Gee Company accumulates the following adjustment data at December 31. Indicate the type of adjustment (prepaid expense, accrued revenue, and so on), and the status of accounts before adjust (overstated or understated). (Enter answers in alphabetical order.) 1. Supplies of $150 are on hand. Services performed but not recorded total $900. 2. 3. Interest of $200 has accumulated on a note payable. 4. Rent collected in advance totaling $850 has been earned. Item Type of Adjustment Account Balances before Adjustment 2. 4. > 3.

Gee Company accumulates the following adjustment data at December 31. Indicate the type of adjustment (prepaid expense, accrued revenue, and so on), and the status of accounts before adjust (overstated or understated). (Enter answers in alphabetical order.) 1. Supplies of $150 are on hand. Services performed but not recorded total $900. 2. 3. Interest of $200 has accumulated on a note payable. 4. Rent collected in advance totaling $850 has been earned. Item Type of Adjustment Account Balances before Adjustment 2. 4. > 3.

Algebra and Trigonometry (6th Edition)

6th Edition

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:Robert F. Blitzer

ChapterP: Prerequisites: Fundamental Concepts Of Algebra

Section: Chapter Questions

Problem 1MCCP: In Exercises 1-25, simplify the given expression or perform the indicated operation (and simplify,...

Related questions

Question

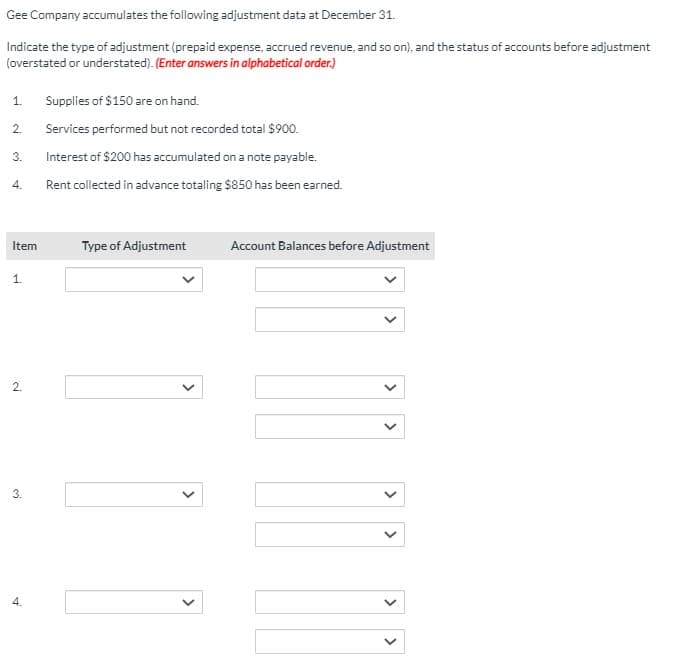

Transcribed Image Text:Gee Company accumulates the following adjustment data at December 31.

Indicate the type of adjustment (prepaid expense, accrued revenue, and so on), and the status of accounts before adjustment

(overstated or understated). (Enter answers in alphabetical order.)

1.

Supplies of $150 are on hand.

Services performed but not recorded total $900.

2.

3.

Interest of $200 has accumulated on a note payable.

4.

Rent collected in advance totaling $850 has been earned.

Item

Type of Adjustment

Account Balances before Adjustment

2.

4.

>

3.

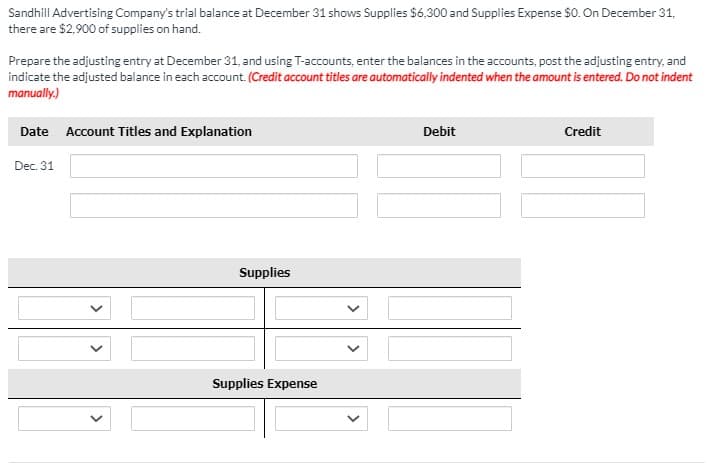

Transcribed Image Text:Sandhill Advertising Company's trial balance at December 31 shows Supplies $6,300 and Supplies Expense $0. On December 31,

there are $2,900 of supplies on hand.

Prepare the adjusting entry at December 31, and using T-accounts, enter the balances in the accounts, post the adjusting entry, and

indicate the adjusted balance in each account. (Credit account titles are automatically indented when the amount is entered. Do not indent

manually.)

Date Account Titles and Explanation

Debit

Credit

Dec. 31

Supplies

Supplies Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:

9780135163078

Author:

Michael Sullivan

Publisher:

PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:

9780980232776

Author:

Gilbert Strang

Publisher:

Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:

9780077836344

Author:

Julie Miller, Donna Gerken

Publisher:

McGraw-Hill Education