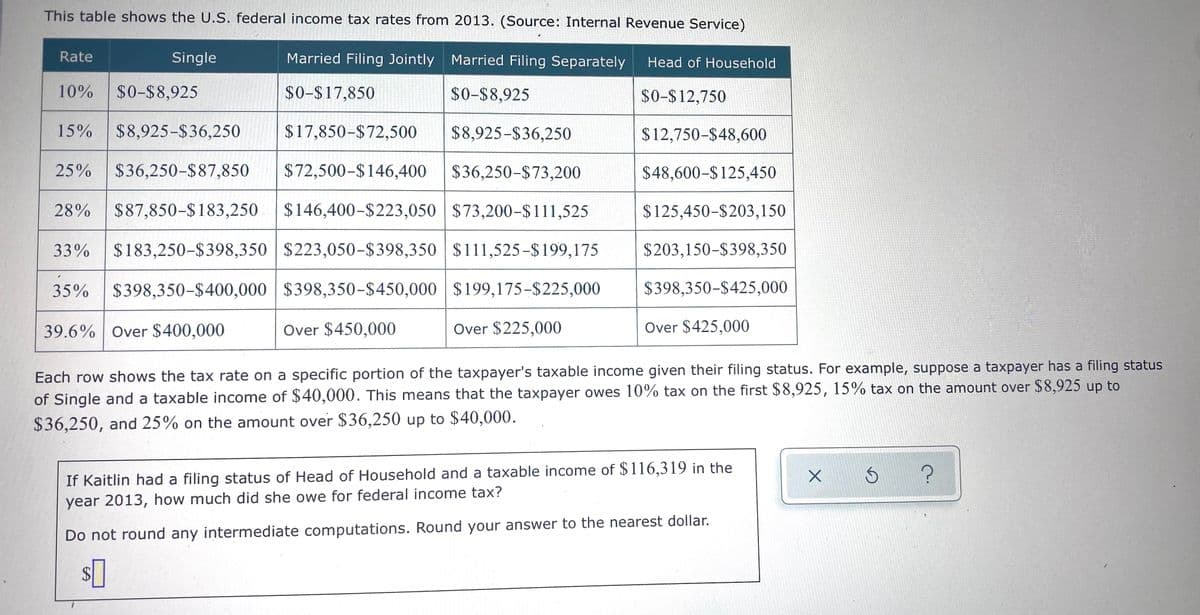

This table shows the U.S. federal income tax rates from 2013. (Source: Internal Revenue Service) Rate Single Married Filing Jointly Married Filing Separately Head of Household 10% $0-$8,925 $0-$17,850 $0-$8,925 $0-$12,750 15% $8,925-$36,250 $17,850-$72,500 $8,925-$36,250 $12,750-$48,600 25% $36,250-$87,850 $72,500-$146,400 $36,250-$73,200 $48,600-$125,450 28% $87,850-$183,250 $146,400-$223,050 $73,200-$111,525 $125,450-$203,150 33% $183,250-$398,350 $223,050-$398,350 $111,525-$ 199,175 $203,150-$398,350 35% $398,350-$400,000 $398,350-$450,000 $199,175-$225,000 $398,350-$425,000 39.6% Over $400,000 Over $450,000 Over $225,000 Over $425,000 Each row shows the tax rate on a specific portion of the taxpayer's taxable income given their filing status. For example, suppose a taxpayer has a filing status of Single and a taxable income of $40,000. This means that the taxpayer owes 10% tax on the first $8,925, 15% tax on the amount over $8,925 up to $36,250, and 25% on the amount over $36,250 up to $40,000. If Kaitlin had a filing status of Head of Household and a taxable income of $116,319 in the year 2013, how much did she owe for federal income tax? Do not round any intermediate computations. Round your answer to the nearest dollar.

Inverse Normal Distribution

The method used for finding the corresponding z-critical value in a normal distribution using the known probability is said to be an inverse normal distribution. The inverse normal distribution is a continuous probability distribution with a family of two parameters.

Mean, Median, Mode

It is a descriptive summary of a data set. It can be defined by using some of the measures. The central tendencies do not provide information regarding individual data from the dataset. However, they give a summary of the data set. The central tendency or measure of central tendency is a central or typical value for a probability distribution.

Z-Scores

A z-score is a unit of measurement used in statistics to describe the position of a raw score in terms of its distance from the mean, measured with reference to standard deviation from the mean. Z-scores are useful in statistics because they allow comparison between two scores that belong to different normal distributions.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images