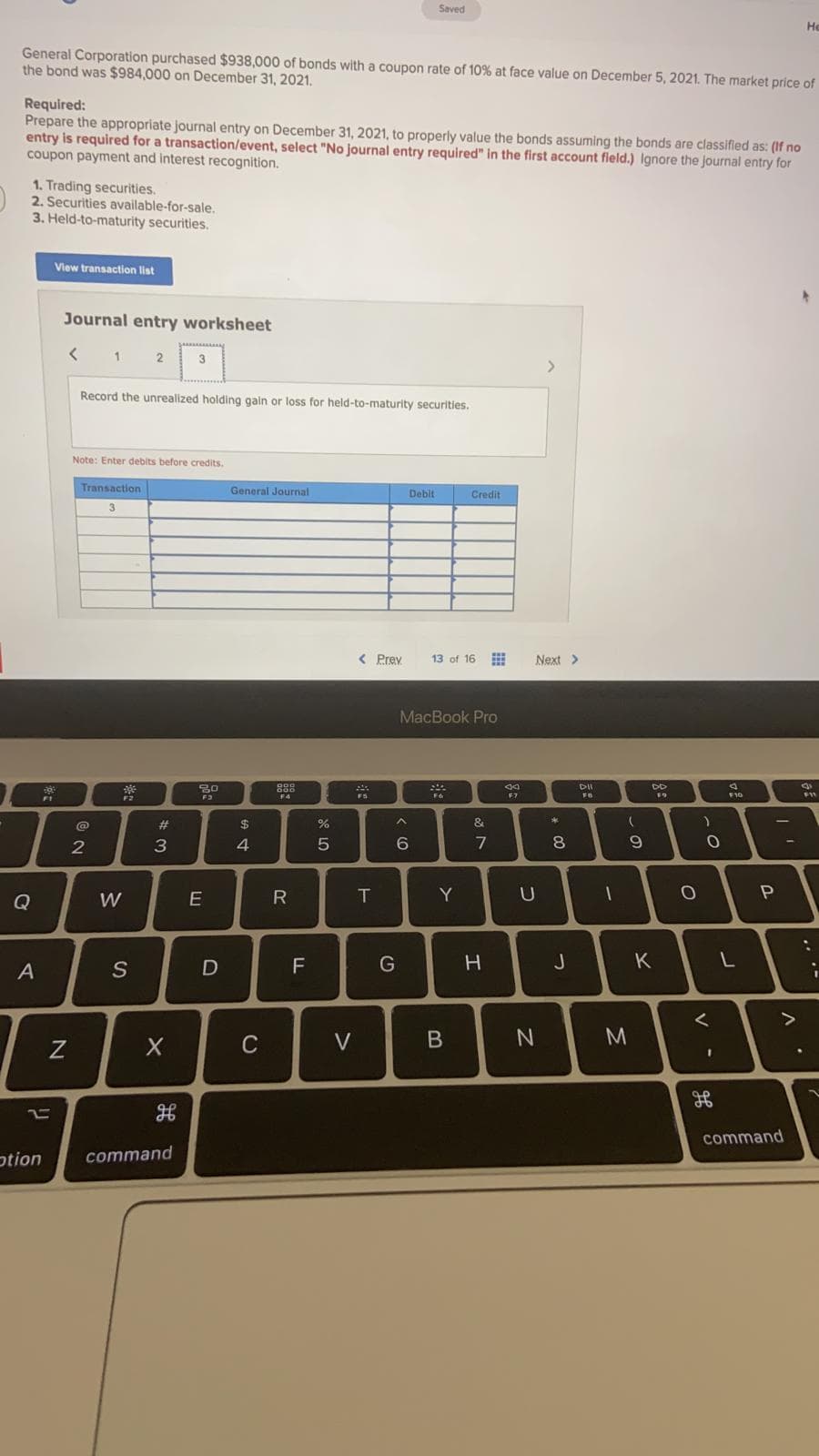

General Corporation purchased $938,000 of bonds with a coupon rate of 10% at face value on December 5, 2021. The market price of the bond was $984,000 on December 31, 2021. Required: Prepare the appropriate journal entry on December 31, 2021, to properly value the bonds assuming the bonds are classified as: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Ignore the journal entry for coupon payment and interest recognition. 1. Trading securities. 2. Securities available-for-sale. 3. Held-to-maturity securities.

General Corporation purchased $938,000 of bonds with a coupon rate of 10% at face value on December 5, 2021. The market price of the bond was $984,000 on December 31, 2021. Required: Prepare the appropriate journal entry on December 31, 2021, to properly value the bonds assuming the bonds are classified as: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Ignore the journal entry for coupon payment and interest recognition. 1. Trading securities. 2. Securities available-for-sale. 3. Held-to-maturity securities.

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 5PA: Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July...

Related questions

Question

Transcribed Image Text:Saved

He

General Corporation purchased $938,000 of bonds with a coupon rate of 10% at face value on December 5, 2021. The market price of

the bond was $984,000 on December 31, 2021.

Required:

Prepare the appropriate journal entry on December 31, 2021, to properly value the bonds assuming the bonds are classified as: (1f no

entry is required for a transaction/event, select "No journal entry required" in the first account field.) Ignore the journal entry for

coupon payment and interest recognition.

1. Trading securities.

2. Securities available-for-sale.

3. Held-to-maturity securities.

View transaction list

Journal entry worksheet

く

3

>

Record the unrealized holding gain or loss for held-to-maturity securities.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

< Prey

13 of 16

Next >

MacBook Pro

888

DII

DD

F3

FS

F7

F10

F11

#

2$

&

2

3

4.

8

Q

E

R

Y

U

S

F

つ

K

く

C

V

command

otion

command

エ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning