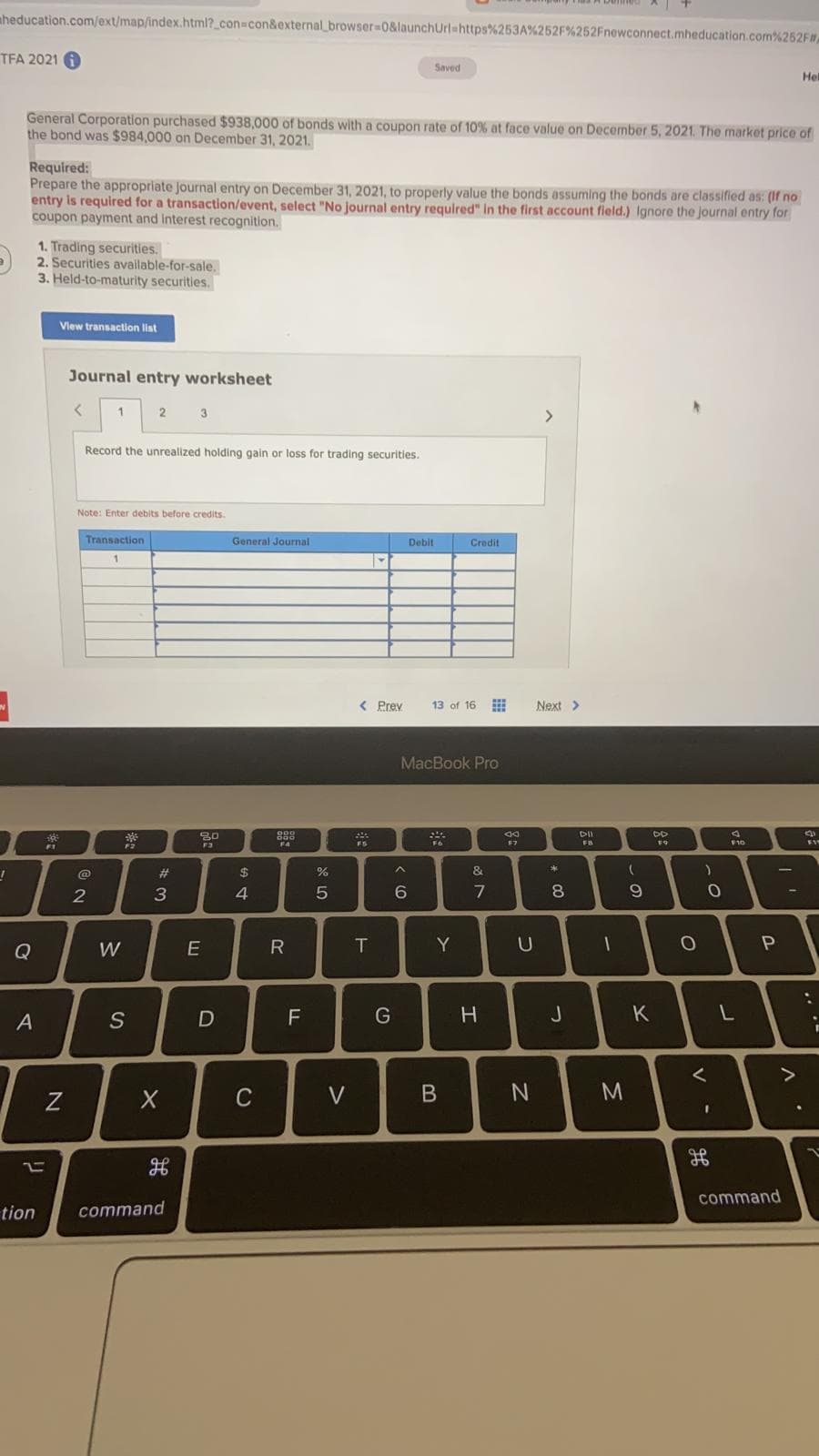

General Corporation purchased $938,000 of bonds with a coupon rate of 10% at face value on December 5, 2021. The market price of the bond was $984,000 on December 31, 2021. Required: Prepare the appropriate Journal entry on December 31, 2021, to properly value the bonds assuming the bonds are classified as: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Ignore the journal entry for coupon payment and Interest recognition. 1. Trading securities. 2. Securities available-for-sale. 3. Held-to-maturity securities. View transaction list Journal entry worksheet 1 2 3 <> Record the unrealized holding gain or loss for trading securitles. Note: Enter debits before credits. Transaction General Journal Debit Credit

General Corporation purchased $938,000 of bonds with a coupon rate of 10% at face value on December 5, 2021. The market price of the bond was $984,000 on December 31, 2021. Required: Prepare the appropriate Journal entry on December 31, 2021, to properly value the bonds assuming the bonds are classified as: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Ignore the journal entry for coupon payment and Interest recognition. 1. Trading securities. 2. Securities available-for-sale. 3. Held-to-maturity securities. View transaction list Journal entry worksheet 1 2 3 <> Record the unrealized holding gain or loss for trading securitles. Note: Enter debits before credits. Transaction General Journal Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 21E: On July 2, 2018, McGraw Corporation issued 500,000 of convertible bonds. Each 1,000 bond could be...

Related questions

Question

Transcribed Image Text:nheducation.com/ext/map/index.html?_con3con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#

TFA 2021 A

Saved

Hel

General Corporation purchased $938,000 of bonds with a coupon rate of 10% at face value on December 5, 2021. The market price of

the bond was $984,000 on December 31, 2021.

Required:

Prepare the appropriate Journal entry on December 31, 2021, to properly value the bonds assuming the bonds are classified as: (If no

entry is required for a transaction/event, select "No journal entry required" In the first account field.) Ignore the Journal entry for

coupon payment and interest recognition.

1. Trading securities.

2. Securities available-for-sale.

3. Held-to-maturity securities.

Vlew transaction list

Journal entry worksheet

2

3

>

Record the unrealized holding gain or loss for trading securities.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

< Prev

13 of 16

Next >

MacBook Pro

FS

F7

F9

F10

%23

$

2

3

4

7

8

Q

W

T

Y

U

S

D

G

H

J

K

C

V

command

tion

command

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT