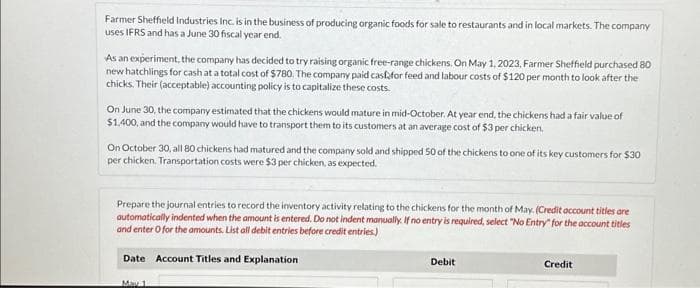

Farmer Sheffield Industries Inc. is in the business of producing organic foods for sale to restaurants and in local markets. The company uses IFRS and has a June 30 fiscal year end. As an experiment, the company has decided to try raising organic free-range chickens. On May 1, 2023, Farmer Sheffield purchased 80 new hatchlings for cash at a total cost of $780. The company paid cast for feed and labour costs of $120 per month to look after the chicks. Their (acceptable) accounting policy is to capitalize these costs. On June 30, the company estimated that the chickens would mature in mid-October. At year end, the chickens had a fair value of $1,400, and the company would have to transport them to its customers at an average cost of $3 per chicken. On October 30, all 80 chickens had matured and the company sold and shipped 50 of the chickens to one of its key customers for $30 per chicken. Transportation costs were $3 per chicken, as expected. Prepare the journal entries to record the inventory activity relating to the chickens for the month of May. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Credit

Farmer Sheffield Industries Inc. is in the business of producing organic foods for sale to restaurants and in local markets. The company uses IFRS and has a June 30 fiscal year end. As an experiment, the company has decided to try raising organic free-range chickens. On May 1, 2023, Farmer Sheffield purchased 80 new hatchlings for cash at a total cost of $780. The company paid cast for feed and labour costs of $120 per month to look after the chicks. Their (acceptable) accounting policy is to capitalize these costs. On June 30, the company estimated that the chickens would mature in mid-October. At year end, the chickens had a fair value of $1,400, and the company would have to transport them to its customers at an average cost of $3 per chicken. On October 30, all 80 chickens had matured and the company sold and shipped 50 of the chickens to one of its key customers for $30 per chicken. Transportation costs were $3 per chicken, as expected. Prepare the journal entries to record the inventory activity relating to the chickens for the month of May. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Credit

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 26E: Ingles Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other...

Related questions

Question

Transcribed Image Text:Farmer Sheffield Industries Inc. is in the business of producing organic foods for sale to restaurants and in local markets. The company

uses IFRS and has a June 30 fiscal year end.

As an experiment, the company has decided to try raising organic free-range chickens. On May 1, 2023, Farmer Sheffield purchased 80

new hatchlings for cash at a total cost of $780. The company paid cast for feed and labour costs of $120 per month to look after the

chicks. Their (acceptable) accounting policy is to capitalize these costs.

On June 30, the company estimated that the chickens would mature in mid-October. At year end, the chickens had a fair value of

$1,400, and the company would have to transport them to its customers at an average cost of $3 per chicken.

On October 30, all 80 chickens had matured and the company sold and shipped 50 of the chickens to one of its key customers for $30

per chicken. Transportation costs were $3 per chicken, as expected.

Prepare the journal entries to record the inventory activity relating to the chickens for the month of May. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter o for the amounts. List all debit entries before credit entries.)

Date Account Titles and Explanation

May 1

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning