George, an ophthalmologist, owns a separate business (not real estate) in which he participates. He has one employee who works part-time in the business. Which of the following statements is correct? a. If George participates for 500 hours and the employee participates for 520 hours during the year, George qualifies as a material participant. b. If George participates for 600 hours and the employee participates for 1,000 hours during the year, George qualifies as a material participant. c. If George participates for 95 hours and the employee participates for 5 hours during the year, George probably does not qualify as a material participant. Od. If George participates for 120 hours and the employee participates for 120 hours during the year, George does not qualify as a material participant.

George, an ophthalmologist, owns a separate business (not real estate) in which he participates. He has one employee who works part-time in the business. Which of the following statements is correct? a. If George participates for 500 hours and the employee participates for 520 hours during the year, George qualifies as a material participant. b. If George participates for 600 hours and the employee participates for 1,000 hours during the year, George qualifies as a material participant. c. If George participates for 95 hours and the employee participates for 5 hours during the year, George probably does not qualify as a material participant. Od. If George participates for 120 hours and the employee participates for 120 hours during the year, George does not qualify as a material participant.

Chapter3: Business Income And Expenses

Section: Chapter Questions

Problem 25P: Lew is a practicing CPA who decides to raise bonsai as a business. Lew engages in the activity and...

Related questions

Question

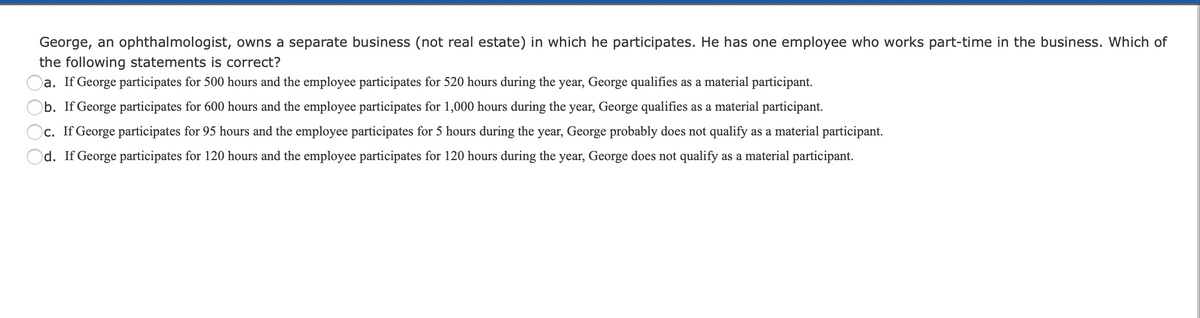

Transcribed Image Text:George, an ophthalmologist, owns a separate business (not real estate) in which he participates. He has one employee who works part-time in the business. Which of

the following statements is correct?

a. If George participates for 500 hours and the employee participates for 520 hours during the year, George qualifies as a material participant.

b. If George participates for 600 hours and the employee participates for 1,000 hours during the year, George qualifies as a material participant.

c. If George participates for 95 hours and the employee participates for 5 hours during the year, George probably does not qualify as a material participant.

d. If George participates for 120 hours and the employee participates for 120 hours during the year, George does not qualify as a material participant.

O O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you