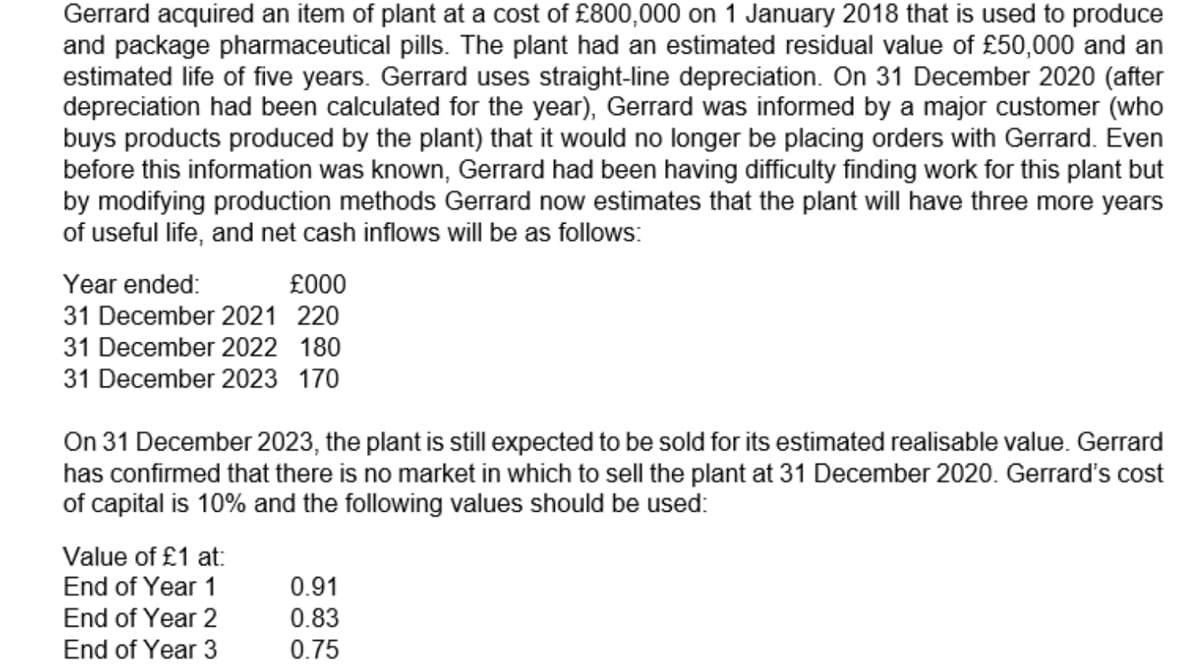

Gerrard acquired an item of plant at a cost of £800,000 on 1 January 2018 that is used to produce and package pharmaceutical pills. The plant had an estimated residual value of £50,000 and an estimated life of five years. Gerrard uses straight-line depreciation. On 31 December 2020 (after depreciation had been calculated for the year), Gerrard was informed by a major customer (who buys products produced by the plant) that it would no longer be placing orders with Gerrard. Even before this information was known, Gerrard had been having difficulty finding work for this plant but by modifying production methods Gerrard now estimates that the plant will have three more years of useful life, and net cash inflows will be as follows: Year ended: £000 31 December 2021 220 31 December 2022 180 31 December 2023 170 On 31 December 2023, the plant is still expected to be sold for its estimated realisable value. Gerrard has confirmed that there is no market in which to sell the plant at 31 December 2020. Gerrard's cost of capital is 10% and the following values should be used: Value of £1 at: End of Year 1 End of Year 2 End of Year 3 0.91 0.83 0.75

Gerrard acquired an item of plant at a cost of £800,000 on 1 January 2018 that is used to produce and package pharmaceutical pills. The plant had an estimated residual value of £50,000 and an estimated life of five years. Gerrard uses straight-line depreciation. On 31 December 2020 (after depreciation had been calculated for the year), Gerrard was informed by a major customer (who buys products produced by the plant) that it would no longer be placing orders with Gerrard. Even before this information was known, Gerrard had been having difficulty finding work for this plant but by modifying production methods Gerrard now estimates that the plant will have three more years of useful life, and net cash inflows will be as follows: Year ended: £000 31 December 2021 220 31 December 2022 180 31 December 2023 170 On 31 December 2023, the plant is still expected to be sold for its estimated realisable value. Gerrard has confirmed that there is no market in which to sell the plant at 31 December 2020. Gerrard's cost of capital is 10% and the following values should be used: Value of £1 at: End of Year 1 End of Year 2 End of Year 3 0.91 0.83 0.75

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

The following issue relate to clients of the firm of accountants you work for. Each

company has a year-end of 31 December 2022.

You are required to prepare detailed notes for your manager explaining the appropriate

accounting treatments in each case along with supporting calculations as necessary.

You should cite relevant accounting regulations in your answer.

Transcribed Image Text:Gerrard acquired an item of plant at a cost of £800,000 on 1 January 2018 that is used to produce

and package pharmaceutical pills. The plant had an estimated residual value of £50,000 and an

estimated life of five years. Gerrard uses straight-line depreciation. On 31 December 2020 (after

depreciation had been calculated for the year), Gerrard was informed by a major customer (who

buys products produced by the plant) that it would no longer be placing orders with Gerrard. Even

before this information was known, Gerrard had been having difficulty finding work for this plant but

by modifying production methods Gerrard now estimates that the plant will have three more years

of useful life, and net cash inflows will be as follows:

Year ended:

£000

31 December 2021 220

31 December 2022 180

31 December 2023 170

On 31 December 2023, the plant is still expected to be sold for its estimated realisable value. Gerrard

has confirmed that there is no market in which to sell the plant at 31 December 2020. Gerrard's cost

of capital is 10% and the following values should be used:

Value of £1 at:

End of Year 1

End of Year 2

End of Year 3

0.91

0.83

0.75

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT