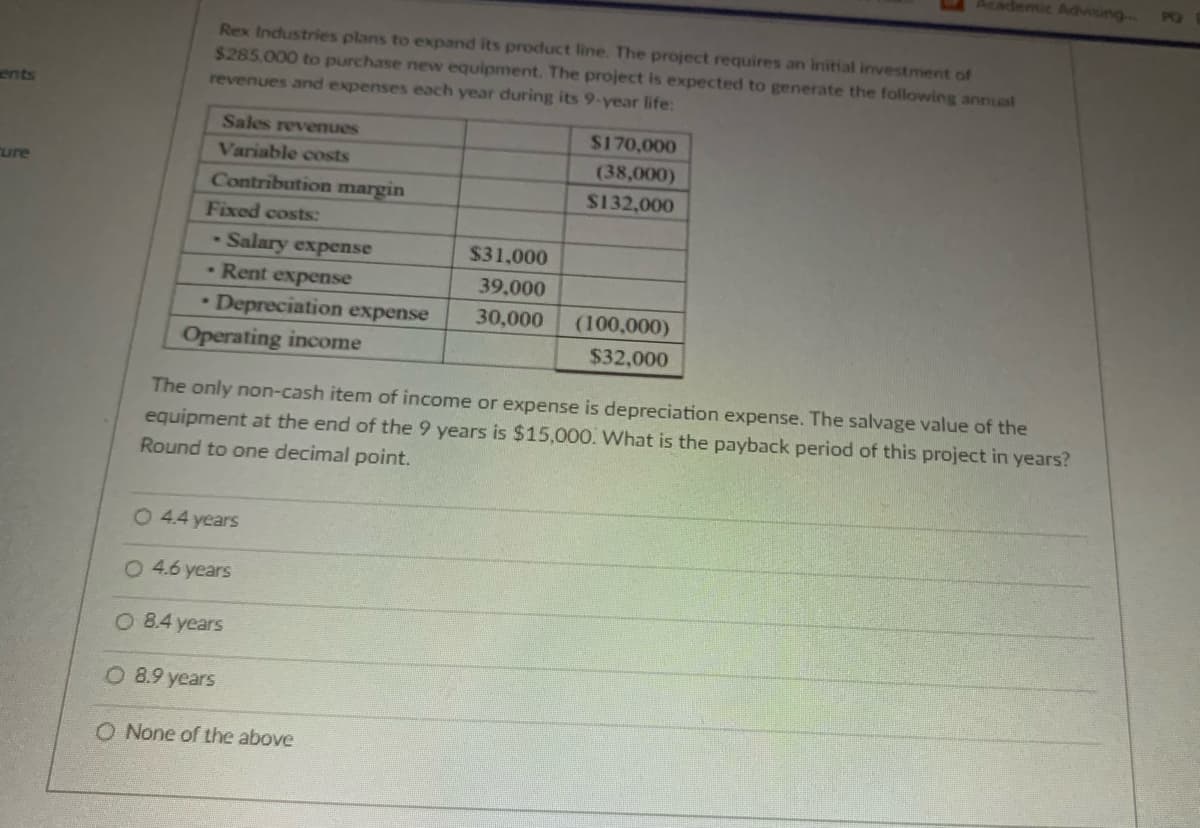

Rex Industries plans to expand its product line. The project requires an initial investment of $285,000 to purchase new equipment. The project is expected to generate the following annual revenues and expenses each year during its 9-year life: . Sales revenues Variable costs Contribution margin Fixed costs: - Salary expense - Rent expense $31,000 39,000 Depreciation expense 30,000 O 4.4 years O 4.6 years O 8.4 years O 8.9 years Operating income The only non-cash item of income or expense is depreciation expense. The salvage value of the equipment at the end of the 9 years is $15,000. What is the payback period of this project in years? Round to one decimal point. $170,000 (38,000) $132,000 O None of the above (100,000) $32,000

Rex Industries plans to expand its product line. The project requires an initial investment of $285,000 to purchase new equipment. The project is expected to generate the following annual revenues and expenses each year during its 9-year life: . Sales revenues Variable costs Contribution margin Fixed costs: - Salary expense - Rent expense $31,000 39,000 Depreciation expense 30,000 O 4.4 years O 4.6 years O 8.4 years O 8.9 years Operating income The only non-cash item of income or expense is depreciation expense. The salvage value of the equipment at the end of the 9 years is $15,000. What is the payback period of this project in years? Round to one decimal point. $170,000 (38,000) $132,000 O None of the above (100,000) $32,000

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

100%

Transcribed Image Text:cure

Rex Industries plans to expand its product line. The project requires an initial investment of

$285,000 to purchase new equipment. The project is expected to generate the following annual

revenues and expenses each year during its 9-year life:

.

Sales revenues

Variable costs

Contribution margin

Fixed costs:

- Salary expense

- Rent expense

Depreciation expense

O 4.4 years

O 4.6 years

O 8.4 years

$31,000

39,000

30,000

O 8.9 years

O None of the above

$170,000

(38,000)

$132,000

Operating income

The only non-cash item of income or expense is depreciation expense. The salvage value of the

equipment at the end of the 9 years is $15,000. What is the payback period of this project in years?

Round to one decimal point.

(100,000)

$32,000

PQ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning