Given: The company has set a goal of 25% Rate of Return on any of its investments. For the Existing System, Process A, Investment was equal to P5,600,000.00 and Operation Cost equals P 965,000.00. The company is contemplating on making an alternative Process B, where the Investment equals P7,000,000.00 and with a corresponding Operation Cost of only P325,000.00 Should the proposed alternative be adopted? O"No, since the difference in the relative costing between Process A (which is 965,000/5,600,000 = 17.23 %) and that of the costing for Alternative B (equal to 325,000/7,000,000= 4.6%) is only 12.63% and such 12.63 % is very much lower than the company target of 25 % O"Yes, since the ROI for Process B ia 45.50 %- O"No. Since the Revenues are not given, therefore the Net Cash Inflow or Income could not be determined O"Yes, since the ROI for Process B is 45.71 %*

Given: The company has set a goal of 25% Rate of Return on any of its investments. For the Existing System, Process A, Investment was equal to P5,600,000.00 and Operation Cost equals P 965,000.00. The company is contemplating on making an alternative Process B, where the Investment equals P7,000,000.00 and with a corresponding Operation Cost of only P325,000.00 Should the proposed alternative be adopted? O"No, since the difference in the relative costing between Process A (which is 965,000/5,600,000 = 17.23 %) and that of the costing for Alternative B (equal to 325,000/7,000,000= 4.6%) is only 12.63% and such 12.63 % is very much lower than the company target of 25 % O"Yes, since the ROI for Process B ia 45.50 %- O"No. Since the Revenues are not given, therefore the Net Cash Inflow or Income could not be determined O"Yes, since the ROI for Process B is 45.71 %*

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 8P

Related questions

Question

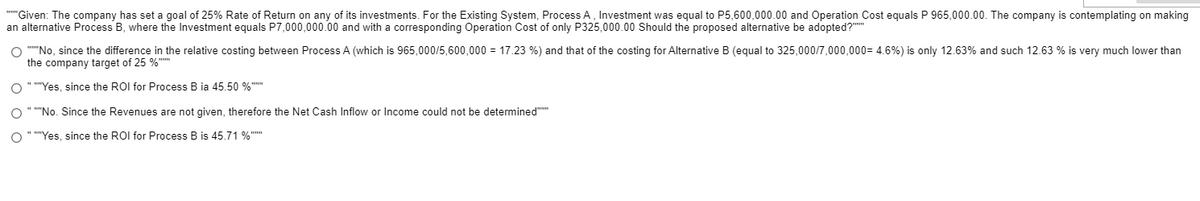

Transcribed Image Text:""Given: The company has set a goal of 25% Rate of Return on any of its investments. For the Existing System, Process A, Investment was equal to P5,600,000.00 and Operation Cost equals P 965,000.00. The company is contemplating on making

an alternative Process B, where the Investment equals P7,000,000.00 and with a corresponding Operation Cost of only P325,000.00 Should the proposed alternative be adopted?""

O ""No, since the difference in the relative costing between Process A (which is 965,000/5,600,000 = 17.23 %) and that of the costing for Alternative B (equal to 325,000/7,000,000= 4.6%) is only 12.63% and such 12.63 % is very much lower than

the company target of 25 %""

O " ""Yes, since the ROI for Process B ia 45.50 %""

O " ""No. Since the Revenues are not given, therefore the Net Cash Inflow or Income could not be determined""

O " ""Yes, since the ROI for Process B is 45.71 %""

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning