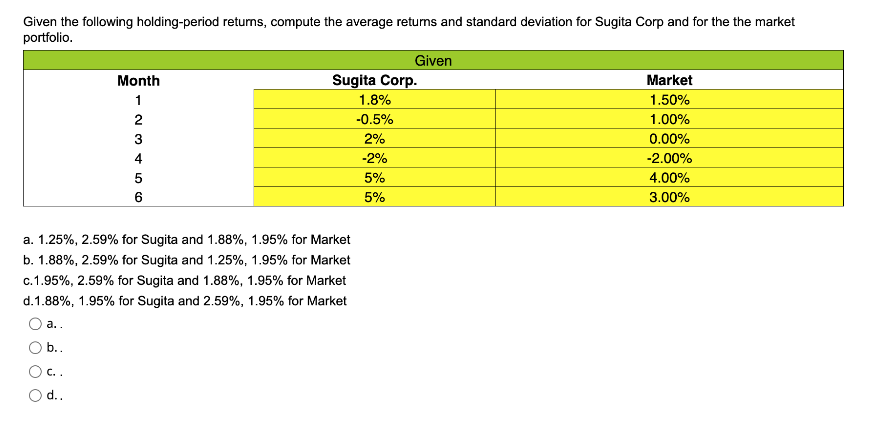

Given the following holding-period returns, compute the average returns and standard deviation for Sugita Corp and for the the market portfolio. a.. b.. Oc.. d.. Month 00 123456 6 a. 1.25%, 2.59% for Sugita and 1.88%, 1.95% for Market b. 1.88%, 2.59% for Sugita and 1.25%, 1.95% for Market c.1.95%, 2.59% for Sugita and 1.88%, 1.95% for Market d.1.88%, 1.95% for Sugita and 2.59%, 1.95% for Market Given Sugita Corp. 1.8% -0.5% 2% -2% 5% 5% Market 1.50% 1.00% 0.00% -2.00% 4.00% 3.00%

Given the following holding-period returns, compute the average returns and standard deviation for Sugita Corp and for the the market portfolio. a.. b.. Oc.. d.. Month 00 123456 6 a. 1.25%, 2.59% for Sugita and 1.88%, 1.95% for Market b. 1.88%, 2.59% for Sugita and 1.25%, 1.95% for Market c.1.95%, 2.59% for Sugita and 1.88%, 1.95% for Market d.1.88%, 1.95% for Sugita and 2.59%, 1.95% for Market Given Sugita Corp. 1.8% -0.5% 2% -2% 5% 5% Market 1.50% 1.00% 0.00% -2.00% 4.00% 3.00%

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 78E: Ratio Analysis Consider the following information. Required: Calculate the stockholder payout...

Related questions

Question

Ef 579.

Transcribed Image Text:Given the following holding-period returns, compute the average returns and standard deviation for Sugita Corp and for the the market

portfolio.

a..

b..

Month

C..

d..

12345

a. 1.25%, 2.59% for Sugita and 1.88 %, 1.95% for Market

b. 1.88%, 2.59% for Sugita and 1.25%, 1.95% for Market

c.1.95%, 2.59% for Sugita and 1.88%, 1.95% for Market

d.1.88%, 1.95% for Sugita and 2.59%, 1.95% for Market

6

Sugita Corp.

1.8%

-0.5%

2%

-2%

Given

5%

5%

Market

1.50%

1.00%

0.00%

-2.00%

4.00%

3.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub