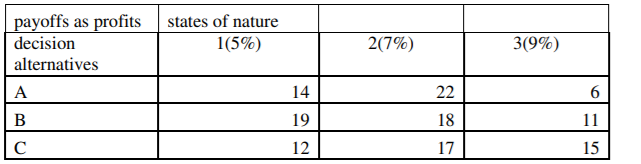

Given the following payoff table with the profits ($m), a firm might expect alternative investments (A, B, C) under different levels of interest rate. (Attached) (a) Which alternative should the firm choose under the maximax criterion? (b) Which option should the firm choose under the maximin criterion? (c) Which option should the firm choose under the LaPlace criterion? (d) Which option should the firm choose with the Hurwicz criterion with α = 0.2? (e) Using a minimax regret approach, what alternative should the firm choose? (f) Economists have assigned probabilities of 0.35, 0.3, and 0.35 to the possible interest levels 1, 2, and 3 respectively. Using expected monetary values, what option should be chosen and what is that optimal expected value? (g) What is the most that the firm should be willing to pay for additional information? Use Expected Regret (h) Use the alternative method to verify EVPI Part 2 Assume now that the pay offs are costs answer the following: (a) Using an optimistic approach (maximax), which option would you choose? (b) Using a pessimistic approach (maximin), which option would you choose? (c) If you are a LaPlace decision maker, which option would you choose? (d) If you are a Hurwicz decision maker, which option would you choose with α = 0.2? (e) Using a minimax regret approach, which option would you choose? (f) Using the same probabilities of 0.35, 0.3, and 0.35 for possible interest levels 1, 2, 3 respectively, which decision alternative will minimise the expected cost? What is the expected annual cost associated with that recommendation? g) What is the most the firm should be willing to pay to obtain further (perfect) information (EVPI)? h) Use the alternative method to verify EVPI

Given the following payoff table with the profits ($m), a firm might expect alternative investments (A, B, C) under different levels of interest rate. (Attached)

(a) Which alternative should the firm choose under the maximax criterion?

(b) Which option should the firm choose under the maximin criterion?

(c) Which option should the firm choose under the LaPlace criterion?

(d) Which option should the firm choose with the Hurwicz criterion with α = 0.2?

(e) Using a minimax regret approach, what alternative should the firm choose?

(f) Economists have assigned probabilities of 0.35, 0.3, and 0.35 to the possible interest levels 1, 2, and 3 respectively. Using expected monetary values, what option should be chosen and what is that optimal expected value?

(g) What is the most that the firm should be willing to pay for additional information? Use Expected Regret

(h) Use the alternative method to verify EVPI

Part 2

Assume now that the pay offs are costs answer the following:

(a) Using an optimistic approach (maximax), which option would you choose?

(b) Using a pessimistic approach (maximin), which option would you choose?

(c) If you are a LaPlace decision maker, which option would you choose?

(d) If you are a Hurwicz decision maker, which option would you choose with α = 0.2?

(e) Using a minimax regret approach, which option would you choose?

(f) Using the same probabilities of 0.35, 0.3, and 0.35 for possible interest levels 1, 2, 3 respectively, which decision alternative will minimise the expected cost? What is the expected annual cost associated with that recommendation?

g) What is the most the firm should be willing to pay to obtain further (perfect) information (EVPI)?

h) Use the alternative method to verify EVPI

Trending now

This is a popular solution!

Step by step

Solved in 2 steps