Strassel Investors buys real estate, develops it, and resells it for a profit. A new property is avalable, and Bud Strassel, the president and owner of Strasel trvestors, belevesif he purchases and develops this property, It can then be soid for $160,000. The current property owner has asked for bids and stated that the property wil be sold for the highest bid in excess of s100.000 Two competitors will be submitting bids for the property. Strassel does nat know what the competitors wil bid, but he ssumes for planning purposes that the amount bid by each competitor will be uniformly distributed between $100,000 and $150,000. (a) Develop a worksheet that can be used to simulate the bids made by the two competitors. Strasel in considering a bid of s130,000 for the property. Using a simulation of 1.000 trias, what is the estimate of the probability Strassel will be able to obtain the property using a bid of s130,000 (Round your answer to the nearest tenth of a pertent.) of: (b) How much does Strassel need to bid to be assured of obtaining the property? O S130,000 O140.000 150,000 (c) Use the simulation model to compute the profit for each trial of the simulation run. With maximzation of proht as Strassels objective, ve simuletion to evaluate Strasial's bid aternatives of s130,000, s140,000, or $150,000. (Round your answers to the nearest dollar) expected profit for a bid of s130,000 expected profit for a bid of $140.000 expected profit for a bid of $150,000 A bid of $140.000 reaults in the largest mean profit of the three alternatives.

Strassel Investors buys real estate, develops it, and resells it for a profit. A new property is avalable, and Bud Strassel, the president and owner of Strasel trvestors, belevesif he purchases and develops this property, It can then be soid for $160,000. The current property owner has asked for bids and stated that the property wil be sold for the highest bid in excess of s100.000 Two competitors will be submitting bids for the property. Strassel does nat know what the competitors wil bid, but he ssumes for planning purposes that the amount bid by each competitor will be uniformly distributed between $100,000 and $150,000. (a) Develop a worksheet that can be used to simulate the bids made by the two competitors. Strasel in considering a bid of s130,000 for the property. Using a simulation of 1.000 trias, what is the estimate of the probability Strassel will be able to obtain the property using a bid of s130,000 (Round your answer to the nearest tenth of a pertent.) of: (b) How much does Strassel need to bid to be assured of obtaining the property? O S130,000 O140.000 150,000 (c) Use the simulation model to compute the profit for each trial of the simulation run. With maximzation of proht as Strassels objective, ve simuletion to evaluate Strasial's bid aternatives of s130,000, s140,000, or $150,000. (Round your answers to the nearest dollar) expected profit for a bid of s130,000 expected profit for a bid of $140.000 expected profit for a bid of $150,000 A bid of $140.000 reaults in the largest mean profit of the three alternatives.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter11: Simulation Models

Section11.3: Financial Models

Problem 28P

Related questions

Concept explainers

Breakeven Analysis

Break Even Analysis is a term used in business, cost accounting and economics. It refers to a point where the total cost incurred becomes equal to the total revenue earned. Break Even Analysis determines the number of units to be sold to earn the revenue required to cover the total costs. Total cost is a sum total of fixed and variable costs.

Process analysis

The term process analysis can be defined as breakdown of production process into different phases that converts inputs into output. A series of routine activities are incorporated using organizational resources with a view to achieve operational excellence.

Question

R2

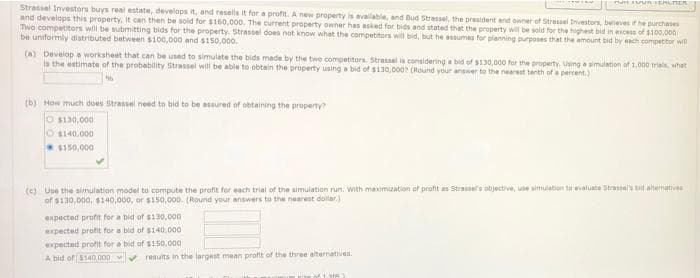

Transcribed Image Text:Strassel Investors buys real estate, develops it, and resells it for a profit. A new property is available, and Bud Strassel, the president and owner of Strasel tnvestors, bellevesf he purchases

and develops this property, It can then be sold for $160,000. The current property owner has asked for bids and stated that the property wil be sold for the highest bid in excess of s100,000

Two competitors will be submitting bids for the property. Strassel does not know what the competitors wil bid, but he asumes for planning purposes that the amount bid by each compettor will

be uniformly distributed between $100,000 and S150,000.

(a) Develop a worksheet that can be used to simulate the bids made by the two competitors. Strasel in considering a bid of s130,000 for the property. Using a simulation of 1,000 trials, what

is the estimate of the probability Strassel will be able to obtain the property using a bid of $130,000 (Round your answer to the nearest tenth of a percent.)

(b) How much does Strassel need to bid to be assured of obtaining the property?

O s130,000

Os140.000

150,000

(c) Use the simulation model to compute the profit for each trial of the simulation run. With maximzation of proht as Strael's objective, se simulation to evaluate Strassels bid ahernatives

of s130,000, s140,000, or $150,000. (Round your answers to the nearest dollar.)

expected profit for a bid of $130,000

expected profit for a bid of $140,000

expected profit for a bid of $150,000

A bid of $140.000

results in the largest mean profit of the three alternatives.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,