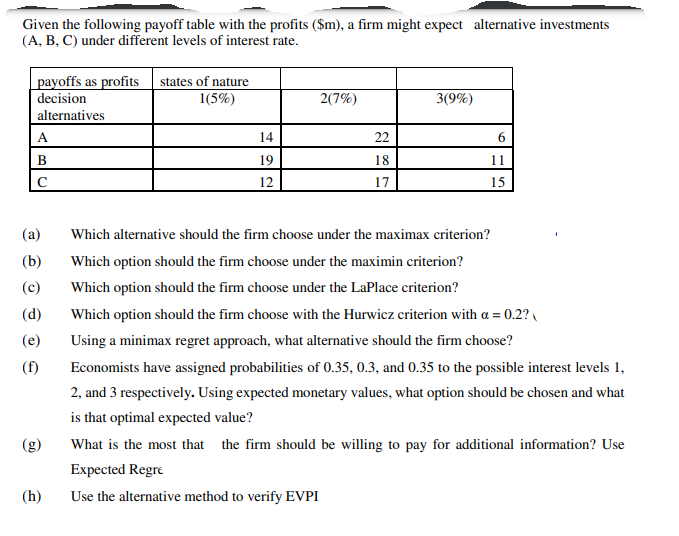

Given the following payoff table with the profits ($m), a firm might expect alternative investments (A, B, C) under different levels of interest rate. payoffs as profits states of nature decision 1(5%) 2(7%) 3(9%) alternatives A 14 22 6 B 19 18 11 12 17 15 (a) Which alternative should the firm choose under the maximax criterion? (b) Which option should the firm choose under the maximin criterion? (c) Which option should the firm choose under the LaPlace criterion?

Q: Happy Company is going to introduce one of the three new products (alternative) to the market: A, B…

A: The given data is

Q: The cash flow details of a public project is as follows Initial cost = BD 210000 Annual operating…

A: Please find the attached answer in step 2

Q: business owner is planning to strategies his company's growth, he can either buy , rent, or lease a…

A: Given information- The probability of business doing good = 0.7 The probability of a slow business…

Q: Consider the payoff matrix below with actions, states of nature, and prior probabilities. 0.20 0.30…

A: This question is related to the topic-decision making and this topic falls under the operations…

Q: A decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy…

A: Below is the solution:-

Q: probabilities

A: probabilities: $10 0.9, $50 0.1

Q: Mr. Albert Richardson, a financial advisor at NNW Investments identified two companies that are…

A: Linear Programming: Linear programming (LP, also called linear optimization) could be a method to…

Q: The following payoff table provides profits based on various possible decision alternatives adn…

A:

Q: 1. Mutual funds for ABC Company have Php500,000 available for one of the three investment…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: 2. Consider the following cost matrix: 20 15 10 12 13 a2 15 6. 10 14 15 az 13 17 15 32 10 18 20 12…

A: Find the given details below: Given details: Ө1 Ө2 Ө3 Ө4 Ө5 a1 20 15 10 12 13 a2 15 6 10…

Q: Using the Maximax criterion, what is the best decision and the expected payoff? Best decision Payoff

A: Below is the solution:-

Q: 2. Consider a bidding problem similar to that presented in class. You can still either bid high or…

A: Find the Given details below:

Q: A decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy…

A: Decision Table Alternatives High Low Buy 85 5 Rent 70 50 Lease 45 55…

Q: The CEO of a company is considering submitting a bid to purchase property that will be sold by…

A:

Q: Table Q5 Machines/Probabilities Low (0.10) 50 Moderate (0.60) 60 High (0.30) 85 Alternatives A в 60…

A: First, we need to compute the expected monetary value (EMV) for each decision alternative, as shown…

Q: 2) If the yield curve is flat for short maturities and then slopes downward for longer maturities,…

A: D) a decline in short-term interest rates in the near future and an even steeper declinefurther out…

Q: You are given a payoff table: Positive market Negative market Probabililty 0.40 0.60 Alternatives Go…

A: NO GO is the best alternative as lo as long as the probability of option as it have higher expected…

Q: Happy Company is going to introduce one of the three new products (alternative) to the market: A, B…

A: Given Information:

Q: Consider the following payoff table for three product decisions (A, B, and C) and three future…

A: Given data is

Q: 1. Rajah Company is going to introduce one of the three new products: A, B, and C or do nothing. As…

A: Find the Given details below: Given details: Product Market Condition, Payoff (RM) Favourable…

Q: A company must decide now which of three products to make next year to plan and order proper…

A: (a) Minimum: This is defined as the decision-making strategy under uncertainty. It is termed as a…

Q: 2. Determine the course of action that has the highest expected payoff for the decision tree below!…

A: The calculation of the highest expected payoff requires multiplying each outcome by the estimate of…

Q: A decision maker's worst option has an expected value of $1,000, and her best option has an expected…

A: A decision producer's most noticeably terrible option has a normal value of $1,000. This implies…

Q: A decision maker has prepared the following payoff table. States of Nature Alternative Low High 80…

A: Decision Table Alternatives High Low Buy 80 -5 Rent 85 45 Lease 60 50

Q: Come up with a decision using each of the different criteria under conditions of uncertainty using…

A: Given data is

Q: i. Showing all the working clearly, prepare the payoff table if the states of demand are high (S.),…

A: THE ANSWER IS AS BELOW:

Q: (a) Which alternative should be chosen under the maximin payoff criterion? (b) Which alternative…

A: The payoff table is given in order along with the prior probability and the decision as per the…

Q: You are entrusted with deciding whether to make or buy software. The make decision has a setup cost…

A: Make decision: Set up cost = $15000 Variable cost (monthly maintenance) = $1200 Purchase decision:…

Q: A decision maker has prepared the following payoff table. States of Nature Alternative Buy High Low…

A: Decision Table Alternatives High Low Buy 85 -10 Rent 70 45 Lease 45 40

Q: What is the interpretation of the coefficient of determination for the investor? If the coefficient…

A: Note: I have answered for 1st question. Kindly post the second question separately with complete…

Q: In the following game, Player 1 makes a low bid or high bid, and Player 2 reacts in an easygoing or…

A: Easy Tough Low 5,1 -10,-10 High 3,3 -1,1

Q: Suppose that you are given a decision situation with three possible states of nature: 5₁, 5₂, and…

A: Find the Given details below: Given details: Prior Probabilities P(s1) 0.5 P(s2) 0.3…

Q: Supposed that a decision-maker faced with four decision alternatives and four states of nature…

A: A scenario with a range of potential outcomes and a range of potential solutions can be represented…

Q: (a) What choice should be made by the optimistic decision maker? (b) What choice should be made by…

A: As per Bartleby guidelines, we can only solve the first three subparts of one question at a…

Q: Come up with a decision using each of the different criteria under conditions of uncertainty using…

A: Given-

Q: A decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy…

A: Decision Table Alternatives High Low Buy 100 0 Rent 60 35 Lease 60 45

Q: of the following terms of the game theory : (i)strategy (ii)Pay off table (iii) value of the game…

A: 1) Methodology (from Greek στρατηγία stratēgia, "craft of troop pioneer; office of general, order,…

Q: Suppose you plan to buy a new car and wish to pick a best one from a list of candidate models, shown…

A: Note- We are authorized to answer one question at a time, since you have not mentioned which…

Q: Suppose Pablo, a salesperson for a sports drink company, acquires 10 lead opportunities per week. Of…

A: Opportunity Win Ratio is the number of closed deals (paying customers) / total number of…

Q: Table 17-19 Consider a small town that has two grocery stores from which residents can choose to buy…

A:

Q: A firm has three investment alternatives. The payoff from each alternative (in thousand Ringgit)…

A: Expected value approach reaches to the optimal solution by multiplying the probability with the…

Q: A decision maker has prepared the following payoff table. States of Nature Alternative High Low Buy…

A: ANSWER : By using Baye's decision rule Buy alternative : 95*0.8+10*.02 = 76+2Expected Payoff = 78…

Q: A business owner is planning to strategize his company's growth. He can either buy, rent, or lease a…

A: Given information- The probability of business doing good = 0.7 The probability of a slow business…

Q: A new minor league baseball team is coming to town and the owners have decided to build a new…

A: Expected value is a proportion of what you ought to hope to get per game over the long haul. The…

Q: Supposed that a decision-maker faced with four decision alternatives and four states of nature…

A: Decision making is a process which helps to choose the optimal decision based on different…

Q: Please use the payoff table (without the given prior probabilities) to answer the following…

A: Note: - Since we can answer only up to three subparts we will answer the first three(a, b, and c)…

Q: The table below shows the net income for several choices (choice 1, choice 2, and choice 3) if…

A: Given data: Choice Outcome 1 Outcome 2 Outcome 3 1 65 83 62 2 69 70 73 3 84 82 63…

Q: Jamie McCullough, owner of Leisure World, Inc., is worried about his business’ future. He has tried…

A: Jamie McCullough is a self-driven, self-motivated, and very inspired individual to make his…

Step by step

Solved in 3 steps with 1 images

- Play Things is developing a new Lady Gaga doll. The company has made the following assumptions: The doll will sell for a random number of years from 1 to 10. Each of these 10 possibilities is equally likely. At the beginning of year 1, the potential market for the doll is two million. The potential market grows by an average of 4% per year. The company is 95% sure that the growth in the potential market during any year will be between 2.5% and 5.5%. It uses a normal distribution to model this. The company believes its share of the potential market during year 1 will be at worst 30%, most likely 50%, and at best 60%. It uses a triangular distribution to model this. The variable cost of producing a doll during year 1 has a triangular distribution with parameters 15, 17, and 20. The current selling price is 45. Each year, the variable cost of producing the doll will increase by an amount that is triangularly distributed with parameters 2.5%, 3%, and 3.5%. You can assume that once this change is generated, it will be the same for each year. You can also assume that the company will change its selling price by the same percentage each year. The fixed cost of developing the doll (which is incurred right away, at time 0) has a triangular distribution with parameters 5 million, 7.5 million, and 12 million. Right now there is one competitor in the market. During each year that begins with four or fewer competitors, there is a 25% chance that a new competitor will enter the market. Year t sales (for t 1) are determined as follows. Suppose that at the end of year t 1, n competitors are present (including Play Things). Then during year t, a fraction 0.9 0.1n of the company's loyal customers (last year's purchasers) will buy a doll from Play Things this year, and a fraction 0.2 0.04n of customers currently in the market ho did not purchase a doll last year will purchase a doll from Play Things this year. Adding these two provides the mean sales for this year. Then the actual sales this year is normally distributed with this mean and standard deviation equal to 7.5% of the mean. a. Use @RISK to estimate the expected NPV of this project. b. Use the percentiles in @ RISKs output to find an interval such that you are 95% certain that the companys actual NPV will be within this interval.In Example 11.1, the possible profits vary from negative to positive for each of the 10 possible bids examined. a. For each of these, use @RISKs RISKTARGET function to find the probability that Millers profit is positive. Do you believe these results should have any bearing on Millers choice of bid? b. Use @RISKs RISKPERCENTILE function to find the 10th percentile for each of these bids. Can you explain why the percentiles have the values you obtain?If you want to invest in a project that cost $3.5 million. As we are unsure about the future demand, there is a 40% probability of high demand with a present value for the project $3 million. There is a 25% probability of moderate demand with a present value of $2.5 million. In addition, there is a 35% probability of low demand with a present value is $1.5 million. Draw a decision tree for this problem. What is the expected net present value of the business? Should you invest? Explain. Assume that you can expand the project by investing another $0.6 million after you learn the true future demand state. This would make the present value of the business $3.9 million in the high‐demand state, $3.5 million in the moderate demand state, and $1.80 million in the low demand state. Draw a decision tree to reflect the option to expand. Evaluate the alternatives. What is the net present value of the business if you consider the option to expand? How valuable is the option to expand?

- Please use the payoff table (without the given prior probabilities) to answer the following questions: (a) Which alternative should be chosen under the maximax criterion? (b) Which alternative should be chosen under the maximin criterion? (c) Which alternative should be chosen under the equally-likely criterion? (d) Which alternative should be chosen under the Hurwicz (realism) criterion for α = 0.55? (e) Develop a regret table for this decision. (f) Which alternative should be chosen under the minimax regret criterion?Given the following payoff table with the profits ($m), a firm might expect alternative investments (A, B, C) under different levels of interest rate. (Attached)(a) Which alternative should the firm choose under the maximax criterion? (b) Which option should the firm choose under the maximin criterion? (c) Which option should the firm choose under the LaPlace criterion? (d) Which option should the firm choose with the Hurwicz criterion with α = 0.2? (e) Using a minimax regret approach, what alternative should the firm choose? (f) Economists have assigned probabilities of 0.35, 0.3, and 0.35 to the possible interest levels 1, 2, and 3 respectively. Using expected monetary values, what option should be chosen and what is that optimal expected value? (g) What is the most that the firm should be willing to pay for additional information? Use Expected Regret (h) Use the alternative method to verify EVPI Part 2 Assume now that the pay offs are costs answer the following: (a) Using an…Many decision problems have the following simplestructure. A decision maker has two possible decisions,1 and 2. If decision 1 is made, a sure cost of c isincurred. If decision 2 is made, there are two possibleoutcomes, with costs c1 and c2 and probabilities p and1 2 p. We assume that c1 , c , c2. The idea is thatdecision 1, the riskless decision, has a moderate cost,whereas decision 2, the risky decision, has a low costc1 or a high cost c2.a. Calculate the expected cost from the riskydecision.b. List as many scenarios as you can think of thathave this structure. (Here’s an example to get youstarted. Think of insurance, where you pay a surepremium to avoid a large possible loss.) For eachof these scenarios, indicate whether you wouldbase your decision on EMV or on expected utility.

- A landlord can either lease for one or two years or sell offices outrightly for K100 million with payoffs as follows: Lease -100 50 150 Sell 100 100 100 The probability of rejecting is 30%, leasing for one year is 50% and for two years 20%. Required: What is the optimal decision strategy if perfect information were available? What is the expected value of perfect information? A decision maker is looking to minimising costs through three alternative decisions a1 , b2 and c3 under two states of nature/events S1 and S2 with S1 having a probability of 30% . For a1 payoffs for s1 K100 million and s2 K540 million For a2 payoff for s1 K150 million and s2 –K50 million For a3 payoff for s1 K350 million and s2 K320 million Required: Find EMV and recommend the course of action Find the…In the environment of increased competition, a fitness club executive is considering the purchase of additional equipment. His alternatives, outcomes, and payoffs (profits) are shown in the following table: (a). If the executive is an optimistic decision maker, which alternative will he likely choose? (b). if the executive is a pessimistic decision maker, which alternative will he likely choose? (c). Market research suggests the chance of a favorable market for fitness clubs is 76%. If the executive uses this analysis, which alternative will he likely choose? I have provided the data table for the problem.In the environment of increased competition, a fitness club executive is considering the purchase of additional equipment. His alternatives, outcomes, and payoffs (profits) are shown in the following table: (a). If the executive is an optimistic decision maker, which alternative will he likely choose? (b). if the executive is a pessimistic decision maker, which alternative will he likely choose? (c). Market research suggests the chance of a favorable market for fitness clubs is 76%. If the executive uses this analysis, which alternative will he likely choose? Please provide an excel sheet with calculations as well

- The following payoff table shows a profit for a decision analysis problem with two decision alternatives and three states of nature. In order to get full credit, show your all work done step by step including cell calculations using excel functions. State of Nature Decion Alternatives s1 s2 s3 d1 250 100 50 d2 100 75 100 a) Construct a decision tree for this problem. b) Suppose that the decision-maker obtains the probabilities P(s1)=0.65, P(s2)=0.15, and P(s3)=0.20. Use the expected value approach to determine the optimal decision.A store owner must decide whether to build a small or a large facility at a new location. Demand at a location can be either small or large, which probabilities estimated to be 0.4 and 0.6, respectively. If small facility is built and demand proves to be high, the manager may choose not to expand (payoff=P235,000) or to expand (payoff=P275,000). If a small facility is built and demand is low, there is no reason to expand and the payoff is P220,000. If a large facility is built and demand proves to be low, the choice is to do nothing (P60,000) or to stimulate demand through local advertising. The response to advertising may be either modest or sizable, with their probabilities estimated to be 0.3 and 0.7, respectively. If it is modest, the payoff grows to P230,000 if the response is sizable. Finally, if a large facility is built and demand turns out to be high, the payoff is P900,000.a.) Draw a decision tree.b.) Determine the expected payoff for each decision and event node.c.)…Which investment should Warren make under each of the following criteria? a. Maximax criterion. b. Maximin criterion. c. Maximum likelihood criterion. d. Bayes’ decision rule. e. The investor decides that Bayes’ decision rule is his most reliable decision criterion. He believes that 0.1 is just about right as the prior probability of an improving economy, but is quite uncertain about how to split the remaining probabilities between a stable economy and a worsening economy. Therefore, he now wishes to do some sort of sensitivity analysis with respect to these latter two prior probabilities. If he still wants to choose the alternative from the Bayes’ decision rule (part d): e1. How much would be the maximum amount of the prior probability of a stable economy? e2. How much would be the minimum amount of the prior probability of a worsening economy?