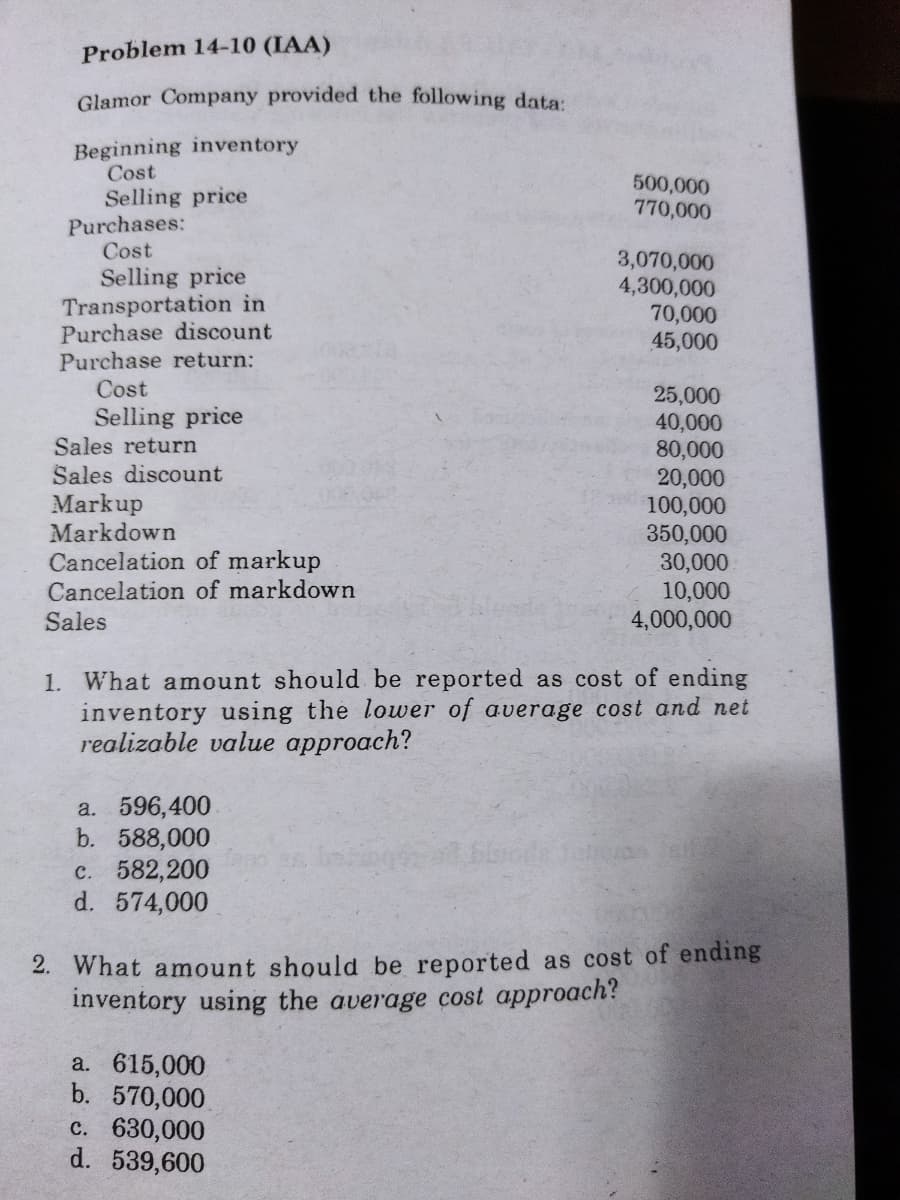

Glamor Company provided the following data: Beginning inventory Cost 500,000 770,000 Selling price Purchases: Cost Selling price Transportation in Purchase discount Purchase return: Cost 3,070,000 4,300,000 70,000 45,000 25,000 40,000 80,000 20,000 100,000 350,000 30,000 10,000 4,000,000 Selling price Sales return Sales discount Markup Markdown Cancelation of markup Cancelation of markdown Sales 1. What amount should be reported as cost of ending inventory using the lower of average cost and net realizable value approach? a. 596,400 b. 588,000 c. 582,200 d. 574,000 2. What amount should be reported as cost of ending inventory using the average cost approach? a. 615,000 b. 570,000 c. 630,000 d. 539,600

Glamor Company provided the following data: Beginning inventory Cost 500,000 770,000 Selling price Purchases: Cost Selling price Transportation in Purchase discount Purchase return: Cost 3,070,000 4,300,000 70,000 45,000 25,000 40,000 80,000 20,000 100,000 350,000 30,000 10,000 4,000,000 Selling price Sales return Sales discount Markup Markdown Cancelation of markup Cancelation of markdown Sales 1. What amount should be reported as cost of ending inventory using the lower of average cost and net realizable value approach? a. 596,400 b. 588,000 c. 582,200 d. 574,000 2. What amount should be reported as cost of ending inventory using the average cost approach? a. 615,000 b. 570,000 c. 630,000 d. 539,600

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.2BE: Perpetual inventory using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as...

Related questions

Topic Video

Question

Transcribed Image Text:Problem 14-10 (IAA)

Glamor Company provided the following data:

Beginning inventory

Cost

500,000

770,000

Selling price

Purchases:

Cost

Selling price

Transportation in

Purchase discount

Purchase return:

Cost

3,070,000

4,300,000

70,000

45,000

25,000

40,000

80,000

20,000

100,000

350,000

30,000

10,000

4,000,000

Selling price

Sales return

Sales discount

Markup

Markdown

Cancelation of markup

Cancelation of markdown

Sales

1. What amount should be reported as cost of ending

inventory using the lower of average cost and net

realizable value approach?

a. 596,400.

b. 588,000

c. 582,200

d. 574,000

2. What amount should be reported as cost of ending

inventory using the average cost approach?

a. 615,000

b. 570,000

c. 630,000

d. 539,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning