$ 42,000 $ 33,000 Cash and cash equivalents. Accounts recelvable.... 84,000 77,000 Inventory. 95,700 131,000 Property, plant, and equipment.. Accumulated depreciation-property, plant, and equipment . Total assets.. Short-term notes payable. Accounts payable..... Long-term notes payable. Bonds payable.. Common stock, $1 par.. Additional paid-in capital.. Retained earnings.... Total liabilities and stockholders' equity. 560,000 500,000 (210,000) 5 531,000 $ 30,000 (231,500) S 550.200 81,000 69,000 110,000 90,000 60,000 120,000 35,000 35,000 165,000 165,000 99,200 22,000 S 550.200 $ 531,000

$ 42,000 $ 33,000 Cash and cash equivalents. Accounts recelvable.... 84,000 77,000 Inventory. 95,700 131,000 Property, plant, and equipment.. Accumulated depreciation-property, plant, and equipment . Total assets.. Short-term notes payable. Accounts payable..... Long-term notes payable. Bonds payable.. Common stock, $1 par.. Additional paid-in capital.. Retained earnings.... Total liabilities and stockholders' equity. 560,000 500,000 (210,000) 5 531,000 $ 30,000 (231,500) S 550.200 81,000 69,000 110,000 90,000 60,000 120,000 35,000 35,000 165,000 165,000 99,200 22,000 S 550.200 $ 531,000

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter14: Statement Of Cash Flows (cashflow)

Section: Chapter Questions

Problem 1R: The comparative balance sheet of Prime Sports Gear, Inc., at December 31, the end of the fiscal...

Related questions

Question

Transcribed Image Text:W LT

ene

Acce

Tour

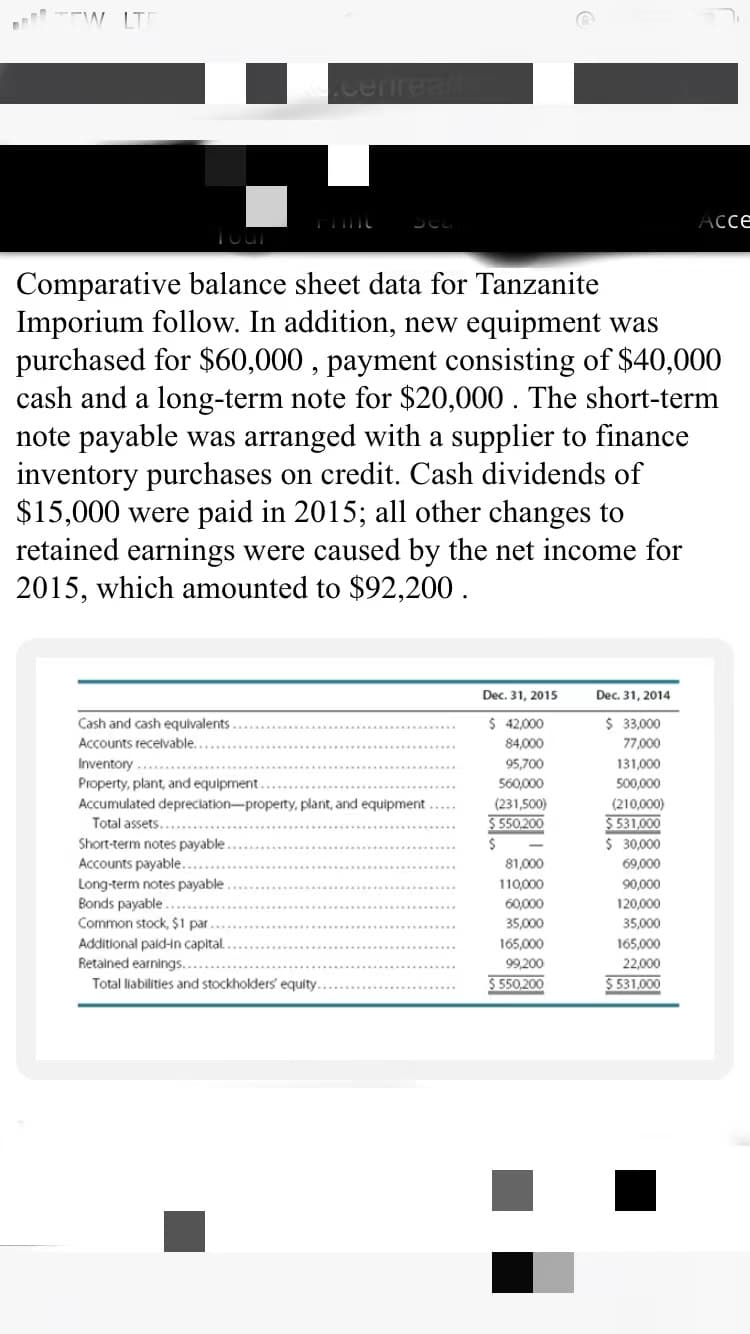

Comparative balance sheet data for Tanzanite

Imporium follow. In addition, new equipment was

purchased for $60,000 , payment consisting of $40,000

cash and a long-term note for $20,000. The short-term

note payable was arranged with a supplier to finance

inventory purchases on credit. Cash dividends of

$15,000 were paid in 2015; all other changes to

retained earnings were caused by the net income for

2015, which amounted to $92,200.

Dec. 31, 2015

Dec. 31, 2014

Cash and cash equivalents

$ 42,000

$ 33,000

Accounts recelvable.

84,000

77,000

Inventory ....

95,700

131,000

Property, plant, and equipment.

Accumulated depreciation-property, plant, and equipment

Total assets.

560,000

500,000

(231,500)

(210,000)

S 550.200

$ 531,000

$ 30,000

Short-term notes payable.

Accounts payable..

Long-term notes payable .

Bonds payable .

Common stock, $1 par.

Additional paid-in capital.

Retained earnings.

Total liabilities and stockholders' equity.

81,000

69,000

110,000

90,000

60,000

35,000

120,000

35,000

165,000

165,000

99,200

22,000

5 550,200

$ 531,000

Transcribed Image Text:TW LTE

се

11

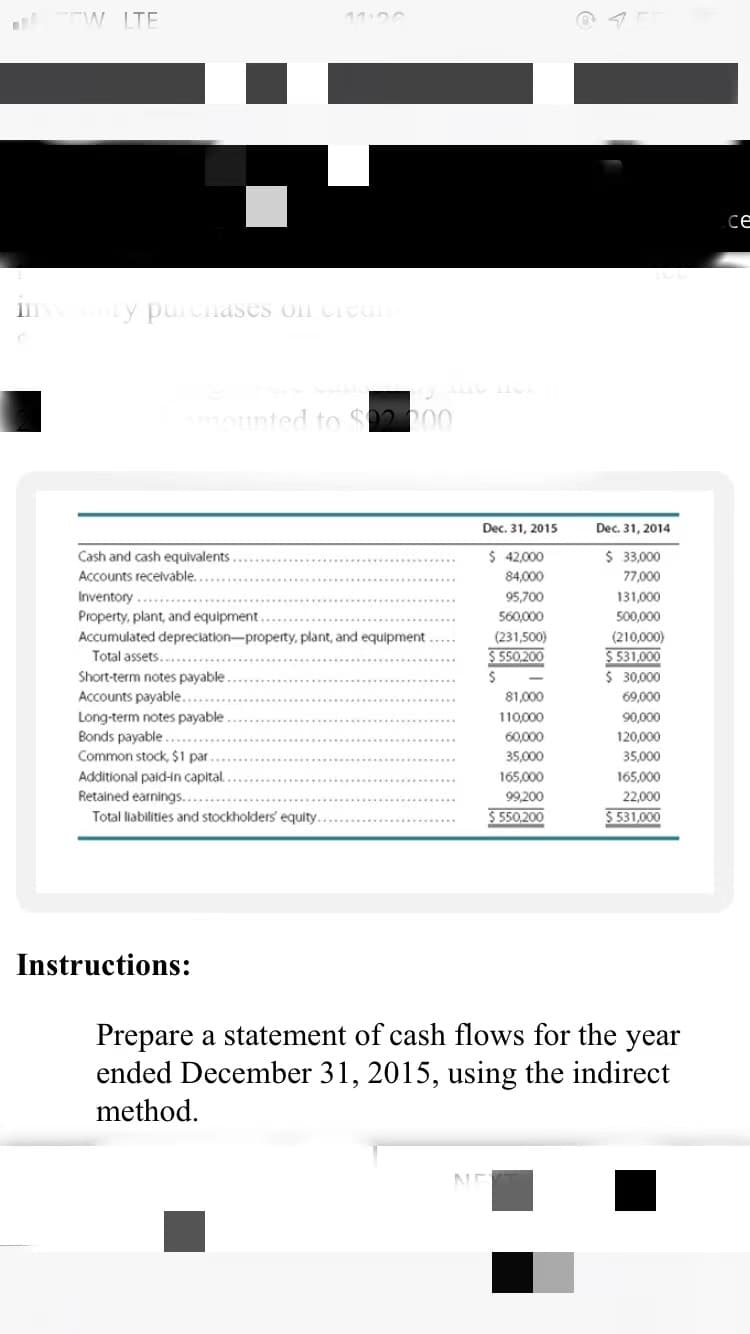

ly puicnases on Creum

mounted to S02 200

Dec. 31, 2015

Dec. 31, 2014

$ 42,000

$ 33,000

Cash and cash equivalents.

Accounts recelvable.

84,000

77,000

Inventory

95,700

131,000

Property, plant, and equipment.

Accumulated depreciation-property, plant, and equipment

Total assets...

Short-term notes payable.

Accounts payable.

Long-term notes payable .

Bonds payable .

Common stock, $1 par

560,000

500.000

(231,500)

S 550.200

(210,000)

S 531,000

$ 30,000

81,000

69,000

110,000

90,000

60,000

120,000

35,000

35,000

Additional paid-n capital.

Retained earnings..

165,000

165,000

99200

22,000

Total liabilities and stockholders equity.

$ 550,200

$ 531,000

Instructions:

Prepare a statement of cash flows for the year

ended December 31, 2015, using the indirect

method.

NE

Expert Solution

Step 1 Introduction

The cash flow statement is prepared to record the cash flow from various activities during the period including operating activities, financing activities and investing activities.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning