Global Systėms Inc. Plans to open a new product line next year. The after tax cash inflows of the two plans is listed below. The firm's cost of capital is 15 percent. The initial investment for each plan is Rs5,00,00o. PLAN YEAR 1 YEAR2 YEAR3_YEAR4 YÉARS AB Rs300 Rs325 Rs150 "Rs30O Rs225 - Rs100 XY Rs150 Rs200 Rs325 Rs100 a) Construct the NPV profiles for PLAN AB and PLAN XY. Which PLAN has a higher IRR?. b) According to the NPV criterion which PLAN should Global Systems choose? c) Calculate the cost of capitał at which the NPV and the IRR rankings conflict?. d) Which plan should the company choose? Why?

Global Systėms Inc. Plans to open a new product line next year. The after tax cash inflows of the two plans is listed below. The firm's cost of capital is 15 percent. The initial investment for each plan is Rs5,00,00o. PLAN YEAR 1 YEAR2 YEAR3_YEAR4 YÉARS AB Rs300 Rs325 Rs150 "Rs30O Rs225 - Rs100 XY Rs150 Rs200 Rs325 Rs100 a) Construct the NPV profiles for PLAN AB and PLAN XY. Which PLAN has a higher IRR?. b) According to the NPV criterion which PLAN should Global Systems choose? c) Calculate the cost of capitał at which the NPV and the IRR rankings conflict?. d) Which plan should the company choose? Why?

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 21SP: Begin with the partial model in the file Ch02 P21 Build a Model.xlsx on the textbooks Web site. a....

Related questions

Question

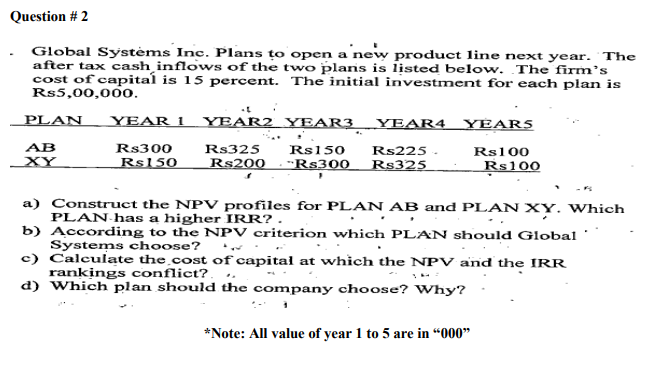

Transcribed Image Text:Question # 2

Global Systėms Inc. Plans to open a new product line next year. The

after tax cash inflows of the two plans is listed below. .The firm’s

cost of capital is 15 percent. The initial investment for each plan is

Rs5,00,000.

PLAN

YEAR 1 YEAR2

YEAR3

YEAR4

YEARS

AB

Rs300

Rs225.

Rs325

Rs325

Rs150

Rs100

XY

Rs150

Rs200

-"Rs300

Rs100

a) Construct the NPV profiles for PLAN AB and PLAN XY. Which

PLAN has a higher IRR?.

b) According to the NPV criterion which PL AN should Global

Systems choose?

c) Calculate the cost of capital at which the NPV and the IRR

rankings conflict?.

d) Which plan should the company choose? Why?

*Note: All value of year 1 to 5 are in "000"

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning