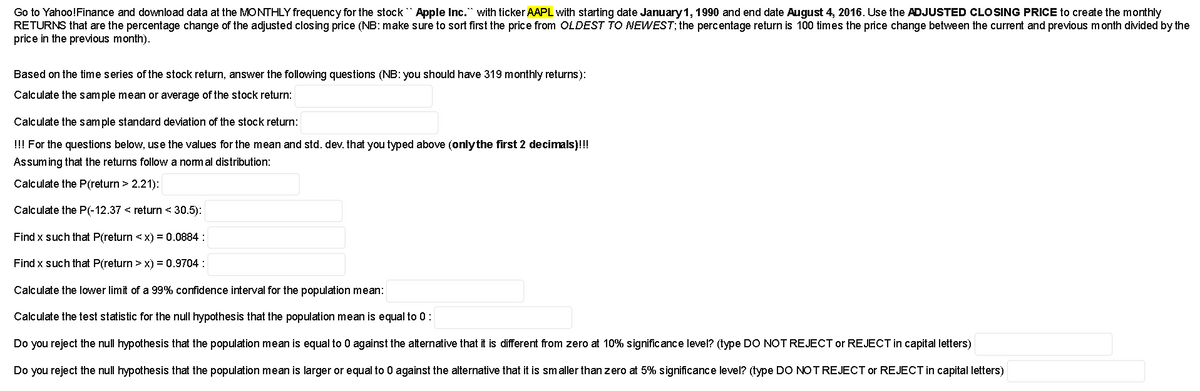

Go to Yahoo!Finance and download data at the MONTHLY frequency for the stock Apple Inc. with ticker AAPL with starting date January 1, 1990 and end date August 4, 2016. Use the ADJUSTED CLOSING PRICE to create the monthly RETURNS that are the percentage change of the adjusted closing price (NB: make sure to sort first the price from OLDEST TO NEWEST; the percentage return is 100 times the price change between the current and previous month divided by the price in the previous month). Based on the time series of the stock return, answer the following questions (NB: you should have 319 monthly returns): Calculate the sample mean or average of the stock return: Calculate the sample standard deviation of the stock return: !!! For the questions below, use the values for the mean and std. dev. that you typed above (only the first 2 decimals)!!! Assuming that the returns follow a normal distribution: Calculate the P(return > 2.21): Calculate the P(-12.37 < return < 30.5): Find x such that P(return x) = 0.9704: Calculate the lower limit of a 99% confidence interval for the population mean: Calculate the test statistic for the null hypothesis that the population mean is equal to 0: Do you reject the null hypothesis that the population mean is equal to 0 against the alternative that it is different from zero at 10% significance level? (type DO NOT REJECT or REJECT in capital letters) Do you reject the null hypothesis that the population mean is larger or equal to 0 against the alternative that it is smaller than zero at 5% significance level? (type DO NOT REJECT or REJECT in capital letters)

Go to Yahoo!Finance and download data at the MONTHLY frequency for the stock Apple Inc. with ticker AAPL with starting date January 1, 1990 and end date August 4, 2016. Use the ADJUSTED CLOSING PRICE to create the monthly RETURNS that are the percentage change of the adjusted closing price (NB: make sure to sort first the price from OLDEST TO NEWEST; the percentage return is 100 times the price change between the current and previous month divided by the price in the previous month). Based on the time series of the stock return, answer the following questions (NB: you should have 319 monthly returns): Calculate the sample mean or average of the stock return: Calculate the sample standard deviation of the stock return: !!! For the questions below, use the values for the mean and std. dev. that you typed above (only the first 2 decimals)!!! Assuming that the returns follow a normal distribution: Calculate the P(return > 2.21): Calculate the P(-12.37 < return < 30.5): Find x such that P(return x) = 0.9704: Calculate the lower limit of a 99% confidence interval for the population mean: Calculate the test statistic for the null hypothesis that the population mean is equal to 0: Do you reject the null hypothesis that the population mean is equal to 0 against the alternative that it is different from zero at 10% significance level? (type DO NOT REJECT or REJECT in capital letters) Do you reject the null hypothesis that the population mean is larger or equal to 0 against the alternative that it is smaller than zero at 5% significance level? (type DO NOT REJECT or REJECT in capital letters)

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter7: Exponents And Exponential Functions

Section: Chapter Questions

Problem 68SGR

Related questions

Question

Transcribed Image Text:Go to Yahoo!Finance and download data at the MONTHLY frequency for the stock Apple Inc. with ticker AAPL with starting date January 1, 1990 and end date August 4, 2016. Use the ADJUSTED CLOSING PRICE to create the monthly

RETURNS that are the percentage change of the adjusted closing price (NB: make sure to sort first the price from OLDEST TO NEWEST; the percentage return is 100 times the price change between the current and previous month divided by the

price in the previous month).

Based on the time series of the stock return, answer the following questions (NB: you should have 319 monthly returns):

Calculate the sample mean or average of the stock return:

Calculate the sample standard deviation of the stock return:

!!! For the questions below, use the values for the mean and std. dev. that you typed above (only the first 2 decimals)!!!

Assuming that the returns follow a normal distribution:

Calculate the P(return > 2.21):

Calculate the P(-12.37 < return < 30.5):

Find x such that P(return <x) = 0.0884:

Find x such that P(return > x) = 0.9704:

Calculate the lower limit of a 99% confidence interval for the population mean:

Calculate the test statistic for the null hypothesis that the population mean is equal to 0:

Do you reject the null hypothesis that the population mean is equal to 0 against the alternative that it is different from zero at 10% significance level? (type DO NOT REJECT or REJECT in capital letters)

Do you reject the null hypothesis that the population mean is larger or equal to 0 against the alternative that it is smaller than zero at 5% significance level? (type DO NOT REJECT or REJECT in capital letters)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill