Golf Trends is an importer of a wide variety of Cleveland golf products. On 1 November 2018 the business set up a new department to market two new golf clubs called the Wedge and the Driver. The following practices are observed by the business: The perpetual recording method is used on the FIFO (first-in-first-out) basis. All purchases and sales are on credit. The business maintains a consistent mark-up of 33%% on cost except during a special sale. The following information relating to the new department of the business was extracted from the trial balance on 1 January 2019: 60 000 75 600 135 600 Inventory: 100 Wedges 90 Drivers During the 2019 financial year the following transactions took place in the new department: 31 Bought 60 Wedges with a marked price of R960 each and 60 Drivers with a marked price of R1 200 each, all are subject to a 25% trade discount. January February 15 Sold 50 Wedges and 30 Drivers for R73 600. March 11 10 Wedges, sold on 15 February, were returned. Nine of these Wedges were accepted back into the business for re-sale and one was taken by the owner of the business to give to his son for his birthday. April 3 Sold 90 Wedges for R76 960. June Bought 20 Wedges for R780 each. Paid customs duty and freight of R600 by cheque. August 4 Sold 30 Wedges after applying the normal mark-up. September 15 A special sale was held for the Drivers which were marked down by 20%. 60 Drivers were sold during the special sale. A physical stock count on 31 December 2019 revealed that 19 Wedges and 58 Drivers were on hand. As Cleveland are going to release a new golf club, it was determined that the Wedges would only realise 75% of their cost. REQUIRED: Prepare entries in general journal form (without narrations) to record the transactions for the year ended 31 December 2019. Closing entries are not required. Note: Show all workings clearly. Work to the nearest R1.

Golf Trends is an importer of a wide variety of Cleveland golf products. On 1 November 2018 the business set up a new department to market two new golf clubs called the Wedge and the Driver. The following practices are observed by the business: The perpetual recording method is used on the FIFO (first-in-first-out) basis. All purchases and sales are on credit. The business maintains a consistent mark-up of 33%% on cost except during a special sale. The following information relating to the new department of the business was extracted from the trial balance on 1 January 2019: 60 000 75 600 135 600 Inventory: 100 Wedges 90 Drivers During the 2019 financial year the following transactions took place in the new department: 31 Bought 60 Wedges with a marked price of R960 each and 60 Drivers with a marked price of R1 200 each, all are subject to a 25% trade discount. January February 15 Sold 50 Wedges and 30 Drivers for R73 600. March 11 10 Wedges, sold on 15 February, were returned. Nine of these Wedges were accepted back into the business for re-sale and one was taken by the owner of the business to give to his son for his birthday. April 3 Sold 90 Wedges for R76 960. June Bought 20 Wedges for R780 each. Paid customs duty and freight of R600 by cheque. August 4 Sold 30 Wedges after applying the normal mark-up. September 15 A special sale was held for the Drivers which were marked down by 20%. 60 Drivers were sold during the special sale. A physical stock count on 31 December 2019 revealed that 19 Wedges and 58 Drivers were on hand. As Cleveland are going to release a new golf club, it was determined that the Wedges would only realise 75% of their cost. REQUIRED: Prepare entries in general journal form (without narrations) to record the transactions for the year ended 31 December 2019. Closing entries are not required. Note: Show all workings clearly. Work to the nearest R1.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter14: Adjustments For A Merchandising Business

Section: Chapter Questions

Problem 1CP: Block Foods, a retail grocery store, has agreed to purchase all of its merchandise from Square...

Related questions

Question

7

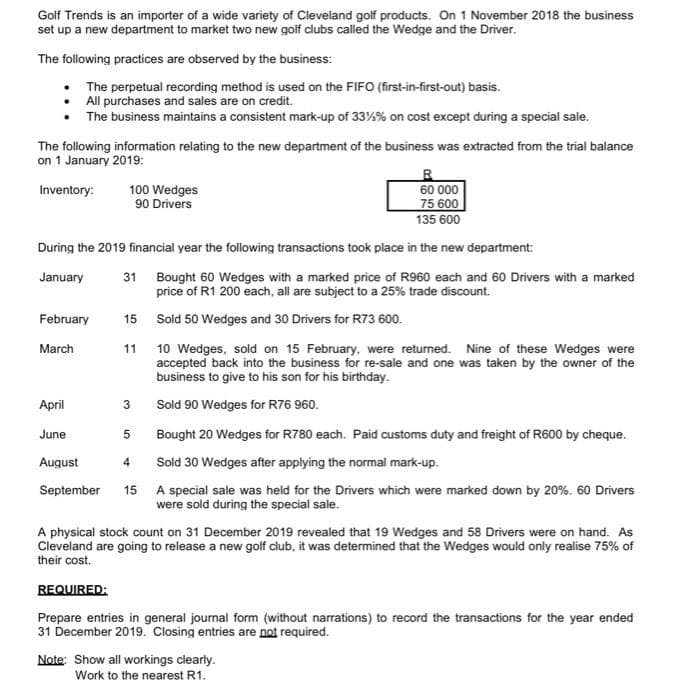

Transcribed Image Text:Golf Trends is an importer of a wide variety of Cleveland golf products. On 1 November 2018 the business

set up a new department to market two new golf clubs called the Wedge and the Driver.

The following practices are observed by the business:

The perpetual recording method is used on the FIFO (first-in-first-out) basis.

All purchases and sales are on credit.

The business maintains a consistent mark-up of 33%% on cost except during a special sale.

The following information relating to the new department of the business was extracted from the trial balance

on 1 January 2019:

60 000

75 600

Inventory:

100 Wedges

90 Drivers

135 600

During the 2019 financial year the following transactions took place in the new department:

January

31

Bought 60 Wedges with a marked price of R960 each and 60 Drivers with a marked

price of R1 200 each, all are subject to a 25% trade discount.

February

15 Sold 50 Wedges and 30 Drivers for R73 600.

March

11

10 Wedges, sold on 15 February, were returned. Nine of these Wedges were

accepted back into the business for re-sale and one was taken by the owner of the

business to give to his son for his birthday.

April

3

Sold 90 Wedges for R76 960.

June

Bought 20 Wedges for R780 each. Paid customs duty and freight of R600 by cheque.

August

4

Sold 30 Wedges after applying the normal mark-up.

September

15 A special sale was held for the Drivers which were marked down by 20%. 60 Drivers

were sold during the special sale.

A physical stock count on 31 December 2019 revealed that 19 Wedges and 58 Drivers were on hand. As

Cleveland are going to release a new golf club, it was determined that the Wedges would only realise 75% of

their cost.

REQUIRED:

Prepare entries in general journal form (without narrations) to record the transactions for the year ended

31 December 2019. Closing entries are not required.

Note: Show all workings clearly.

Work to the nearest R1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,