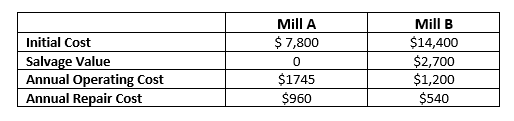

Grinding mills A and B are being considered for a 12-year service in a chemical plant. The minimum attractive rate of return is 10%. What is the Present Worth equivalent of Mill B?

Q: Incomplete Games: Example 2 Nature 2 3 C D Player 1 A 12,9| 3,6 B 6,0 6,9 C D A 0,9 3,6 B 6,0 6,9 1|...

A:

Q: Consider the same Stackelberg game with three firms as described by the previous question. Firm 1 ch...

A: In a Stackelberg competition with n number of firms, one firm acts as the leader with the remainder ...

Q: QUESTION 40 If you had a budget surplus, which of the following choices would most likely increase t...

A: The answer is - c. Save and invest

Q: What is internal and external economics? How many types are there in the internal and external econo...

A:

Q: Table 3-5 Assume that England and Spain can switch between producing cheese and producing bread at ...

A: Answer: Given,

Q: How many years will Colombia grow with a GDP of $323 billion dollars at a growth rate of 4%? 7) Ho...

A: The correct answer is given in the second step.

Q: Question: a) :What is the importance of capital? b): How many types are in the division of labour?

A: Answer is given: The importance of capital is given as:

Q: Assume that Lucky Bank is required to hold a 10% deposits as reserves, and there is a $3000 increase...

A: PLEASE FIND THE ANSWER BELOW.

Q: In this problem we have considered two government schemes: A price floor is established and the gove...

A: In the given table, equilibrium price is achieved when quantity demanded is equal to quantity suppli...

Q: Classical economists believe that... a. The economy is composed of the real sector and the monetary ...

A: Classical economist' primary premise is that markets function effectively and provide the best macro...

Q: a. What are the ways in which a government policymaker can try to raise the growth in living standa...

A: Hi! Thank you for the question As per the honor code, We’ll answer the first question since the exac...

Q: Explain and Expound in your own Word (150-200 words only) The Impact of Globalization in the Philip...

A: Globalization is described as the integration of nations via international commerce and multinationa...

Q: (Table: Costs for Alina's Apple Pies) Use the table Costs for Alina's Apple Pies. If Alina's Apple P...

A: For a perfectly competitive firm, profit-maximizing quantity is such quantity where the price is equ...

Q: The Code argued that "the law of nations and of nature" had never recognized slavery and knew "no di...

A: If we consider the American economy then there is so much discrimination happened on the basis of co...

Q: c) Please find below Pricing options for firm A and B, along with individual payoffs (Firm A's payof...

A: Given pay off Matrix

Q: Q3. Consider the following two-stage game: Stage 1: Player 1 moves first to choose either L or R. St...

A: Given game

Q: You are Lori Lightfoot. The city needs money. You are contemplating 2 sources of revenue: levying ...

A: PLEASE FIND THE ANSWER BELOW.

Q: From Adam Smith's Wealth of Nation , What are the three key roles that government should fill in soc...

A: The father of economics, Adam Smith published his famous book "An Enquiry into the Nature and Causes...

Q: Consider a monopoly with the following marginal cost and demand curves: MC = 2Q + 200, p = 2,600 – 2...

A: For first price discrimination, the monopoly firm is able to charge prices equals to the consumers w...

Q: TRUE or FALSE. If the statement is correct, write TRUE on your answer sheet. If the statement is inc...

A: Indifference curve refers to the curve which shows different combinations of two goods which provide...

Q: On the following graph, use the black line (cross symbol) to indicate the domestic price of aluminum...

A: Given: The tariff imposed on aluminium=$100 per tonne

Q: Now, imagine that two government employees proposed alternative plans for reducing pollution by 6 un...

A: Given: Number of firms=3 Pollution for each area=4 units

Q: Assume that we have a fixed supply of a depletable resource to allocate between two periods. Assume ...

A: Consumption is done in two periods - Period 1 and Period 2 Fixed supply of a depletable resource to ...

Q: Year BTCF (Marginal cost) 1 %24

A: Substitution/Replacement includes eliminating liquefiable material from the site and supplanting it ...

Q: Sarah, Alicia, and Philip all lost their jobs when the technology start-up they worked for was acqui...

A: Concepts: Labor force: Labor force is consist of employed workers as well as unemployed workers who...

Q: The hysteresis hypothesis believes that. O a. Money is neutral in the long run. O b. An economy adju...

A: Economic growth and business cycles have traditionally been considered independently. The dependency...

Q: Use the following assumptions to solve this assignment: 1. There are three countries - Argentina, Br...

A: Most economic decisions are made on the basis of the idea of an opportunity cost, what needs to be g...

Q: a. Distinguish between legally required reserves and excess reserves. b. Why don’t banks hold a 100...

A: The correct answer is given in the second step.

Q: Which of the following statements are false? (i) If a 12% decrease in an individual’s income increas...

A: (i) If a 12% decrease in an individual’s income increases his quantity demanded for oats by 6%, the ...

Q: states engage in trade, with each state specializing in the good in which it has a comparative advan...

A: The production possibility frontier (PPF) is a curve that is used to discover the mix of products th...

Q: The maximum carrying capacity of a park is 100 animals. Currently, there are 10 animals in the park....

A:

Q: Which is NOT needed for the Fed to design and implement effective monetary policy to reduce the seve...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: why is the supply chain and the macroeconpmic is important in the businesses in the healthcare

A: A supply chain refers to a network that links a company's suppliers to create and distribute a produ...

Q: An electric switch manufacturing company is trying to decide between three different assembly method...

A: The Annual Worth calculation method is usually used for comparing alternatives. This method is also ...

Q: Costs and Profit Maximization: Work It Out 1 Suppose Margie decides to lease a photocopier and open...

A: As we know that fixed cast of the expenditure incurred on fixed factor which is not changeable as in...

Q: As more economic development occurs, A. capital accumulation decreases. B. the population growth rat...

A:

Q: 1. Can you estimate a regression model for Y and X? 2. What are the assumptions of the model in 1? 3...

A: According to the answering guidelines, we can answer only three subparts of a question and the rest ...

Q: Consumer Price Index Year Index 2XXX 66.0 3XXX 64.6 4XXX 64.6 5XXX 65.3 6XXX 66.4 7XXX 6...

A: Given: Consumer Price Index Year Index 2XXX 66.0 3XXX 64.6 4XXX 64.6 5XXX 65.3 ...

Q: You are HR di. ector for a growing law firm in Tampa, Florida, which cu."ently has need of writing 3...

A: We are considering hiring four paralegals to shoulder the load; each pa alegal is a bit slower than ...

Q: the long-run equilibrium, all firms in a perfectly competitive market earn zero economic profit. Exp...

A: In a perfectly competitive market there are large number of firms producing similar and identical pr...

Q: White Oaks Properties builds strip shopping centers and small malls. The company plans to replace it...

A: Given Initial cost or first cost of the equipment P=$750,000 Operating cost =$240,000 per year Salv...

Q: QUESTION 32 Reasonable uses of debt include all the following EXCEPT O a. to purchase a car. O b. to...

A: Debt basically refers to the amount that is taken by an businesse organization for some duration of ...

Q: a change in business investment a determinant of aggregate demand or aggregate supply? What happens ...

A: The entire amount of money or sales profits that the seller expects to receive from the sale of prod...

Q: The incidence of a tax: - refers to who writes the check to the government. - is a measure of the...

A: In Economics, incidence of tax explains which party ultimately bears the burden of tax. It expalins ...

Q: DIRECTION: Enumerate 5 common public goods and services government provided with the taxes we pay. A...

A: Public goods are those that are non-excludable and non-rival in utilization. The public authority/go...

Q: What is called state enterprise and why it is important for the consumers/what are its merits?

A:

Q: What are the advantages and disadvantages of division of labour?

A:

Q: 12. Prove, using Eq. (4-42), that the long-run supply curve of a competitive firm is more elastic th...

A: Introduction Long run supply curve is more elastic because we have enough time for doing adjustments...

Q: Player 2 C R T 8, ? 46, 2 Player 1 M 6, 12 5,? 4, 6 B ? ,6 6,8 8,3 Consider the following two-player...

A:

Q: The population in country C decreases, due to a lower birth rate. At the same time, there is an incr...

A: The question is based on the demand and supply side of the vegetable market. Price and quantity are ...

Grinding mills A and B are being considered for a 12-year service in a chemical plant. The minimum attractive

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Company B is a retailer of mobile phones in Australia that works 250 days in a year. The manager would like you to determine a minimum-cost inventory plan for an upcoming mobile phone to be launched in the market. They have collected the following information: • Annual demand: 700 phones • Phone cost: $1,793 each• Phone RRP: $1,949 each• Net weight: 169 g each • Tare weight: 61 g each• Annual inventory holding cost: 30%• Cost per order to replenish inventory: $82• Annual in-transit holding cost: 10%• Freight rate (per kg): $8.10• Freight rate (per consignment): $301.50 (i.e. handling fee, dangerous good fee, anlithium battery fee)• Time to process order for freight: 1 days • Freight transit time: 4 days Solve this problem using a non-linear programming (NLP) model and your model should generate only integer results for economic order quantity and the number of orders. 1. Economic order quantity for the phone in units and in kg 2. The total cost for purchasing the phones3. The total…Ella Ltd recently started to manufacture and sell productDG. The variable cost of product DG is £4 per unit and the totalweekly fixed costs are £18 000.The company has set the initial selling price of product DG byadding a mark up of 40 per cent to its total unit cost. It has assumedthat production and sales will be 3000 units per week.The company holds no stocks of product DG.Required:(a) Calculate for product DG:(i) the initial selling price per unit; and(ii) the resultant weekly profit. The management accountant has established that alinear relationship between the unit selling price (P in £)and the weekly demand (Q in units) for product DG isgiven by:P = 20 - 0:002QThe marginal revenue (MR in £ per unit) is related to weeklydemand (Q in units) by the equation:MR = 20 - 0:004Q(b) Calculate the selling price per unit for product DG that shouldbe set in order to maximize weekly profit. (c) Distinguish briefly between penetration and skimming pricingpolicies when launching a new…4.1REQUIREDStudy the information given below and calculate the following if the sales manager’s proposal is accepted:4.1.1 Break-even quantity.4.1.2 The number of units that must be sold to achieve the company’s profit objective. INFORMATIONSirloin Enterprises manufactures a product that sells for R9 each. The company presently produces and sells 90 000 units per year. Total variable manufacturing costs and selling costs are R405 000 and R81 000 (10% of sales) respectively. Fixed costs are R226 440 for manufacturing overheads and R97 200 for selling and administrative activities.The sales manager has proposed that the price be increased to R10.80 per unit. The company’s profit objective is 10% of sales. 4.2 ENO Ltd, a pharmaceutical company, is seeking finance for the development of a vaccine aimed at reducing the spread the Corona virus. The company is seeking funding only from the public in the form of equity as well as long-term borrowing.In light of the above, critically discuss…

- Use Excel to solve this problem.Northern Engineering is analyzing a mining project. Annual production, unit costs, andunit revenues are in the table. The first cost of the mine setup is $6 million. If i is 15%,what is the PW?BVM manufactured and sold 25,000 small statues this past year. At that volume, the firm was exactly in a breakeven situation in terms of profitability. BVM’s unit costs are expected to increase by 30% next year. What additional information is needed to determine how much the production volume/sales would have to increase next year to just break even in terms of profitability? (a) Costs per unit (b) Sales price per unit and costs per unit (c) Total fixed costs, sales price per unit, and costs per unit (d) No data is needed, the volume increase is 25, 000 + 25, 000(0.30) = 32, 500 units.“Acme Boards” makes and sells skateboards for $240.00. The costs associated with the business include variable costs of $180 per board and fixed costs of $300,000. Determine: The number of skateboards required to sell to breakeven. The profit if they have been selling about 8,000 pr year. a) Now, they are considering undertaking an advertising program with GBC Promotions that would cost $150,000 (additional fixed cost) and increasing the price by $160 to $400. Find the number of skateboards required to sell at $400 and make the same amount of profit as in part “b”. b) What is the % sales decline that can occur in c, to make the same profit as before?

- The Asian Transmission Co. makes and sell automotive parts. Present sales volume is 50,000 units a year and selling price is P50.00 per unit. Fixed expenses is P180,000.00 per year and variable cost per unit is P35.00. What is the total profit / loss for the year if only 10,000 are sold? a. P30k b. P30k c. P70k d. P570kConsider the following data of a company for the year 1999:Sales = Rs. 1,20,000Fixed cost = Rs. 25,000Variable cost = Rs. 45,000Find the BEP.Investors put up $1040000 to construct a building and purchase all equipment for a new restaurant. The investors expect to earn a minimum return of 10 per cent on thier investment. The restaurant is open 52 weeks per year and serves 900 meals per week. The fixed costs are spread over the 52 weeks. Included in the fixed costs in 10% return to the investors and $2000 in other fixed costs. Variable costs include $2000 in weekly wages, and $600 per week in materials, electricity, etc. The restaurant charges $8 on average per meal. The operating profit per week of the restaurant is A)$0 B)$2900 C)$4600 D)$4900

- Plan A (Depreciation 3422 ; total anual cost 23922) Plan B (Depreciation 4277 ; total anual cost 22857) Plan C (Depreciation 7071; total anual cost 24, 891) Plan D (Depreciation 7413; total anual cost 22533) All I need is a solution for the question. Our subject is engineering economics and the lesson is economic study methodA manufacturer produces a certain item with the following cost : Selling Price per item P 600.00 Labor Cost P 76.00 per items Material Cost P 115.00 per items Other variable cost P 2.32 per items Monthly fixed cost P 428,000 Calculate the Break - Even point and draw the Break Even ChartEngineering Economics 00011 Please provide a step by step solution using ROR