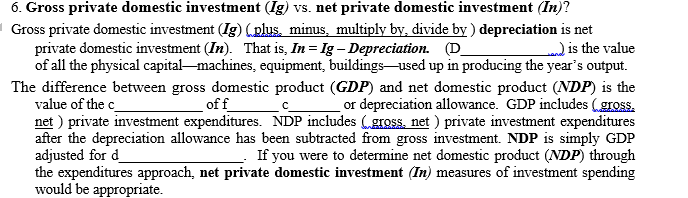

Gross private domestic investment (Ig) (plus, minus, multiply by, divide by ) depreciation is net private domestic investment (In). That is, In = Ig – Depreciation. (D of all the physical capital-machines, equipment, buildingsused up in producing the year's output. )is the value The difference between gross domestic product (GDP) and net domestic product (NDP) is the value of the c net ) private investment expenditures. NDP includes (gross, net ) private investment expenditures after the depreciation allowance has been subtracted from gross investment. NDP is simply GDP adjusted for d the expenditures approach, net private domestic investment (In) measures of investment spending would he annronriate off_ or depreciation allowance. GDP includes (gross. If you were to determine net domestic product (NDP) through

Gross private domestic investment (Ig) (plus, minus, multiply by, divide by ) depreciation is net private domestic investment (In). That is, In = Ig – Depreciation. (D of all the physical capital-machines, equipment, buildingsused up in producing the year's output. )is the value The difference between gross domestic product (GDP) and net domestic product (NDP) is the value of the c net ) private investment expenditures. NDP includes (gross, net ) private investment expenditures after the depreciation allowance has been subtracted from gross investment. NDP is simply GDP adjusted for d the expenditures approach, net private domestic investment (In) measures of investment spending would he annronriate off_ or depreciation allowance. GDP includes (gross. If you were to determine net domestic product (NDP) through

Chapter6: Tracking The U.s. Economy

Section: Chapter Questions

Problem 1.3P

Related questions

Question

Transcribed Image Text:6. Gross private domestic investment (Ig) vs. net private domestic investment (In)?

I Gross private domestic investment (Ig) (plus, minus, multiply by, divide by) depreciation is net

private domestic investment (In). That is, In = Ig – Depreciation. (D_

of all the physical capital-machines, equipment, buildings-used up in producing the year's output.

is the value

The difference between gross domestic product (GDP) and net domestic product (NDP) is the

value of the c_

net ) private investment expenditures. NDP includes (gross, net ) private investment expenditures

after the depreciation allowance has been subtracted from gross investment. NDP is simply GDP

adjusted for d_

the expenditures approach, net private domestic investment (In) measures of investment spending

would be appropriate.

off_

or depreciation allowance. GDP includes (gross.

If you were to determine net domestic product (NDP) through

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co