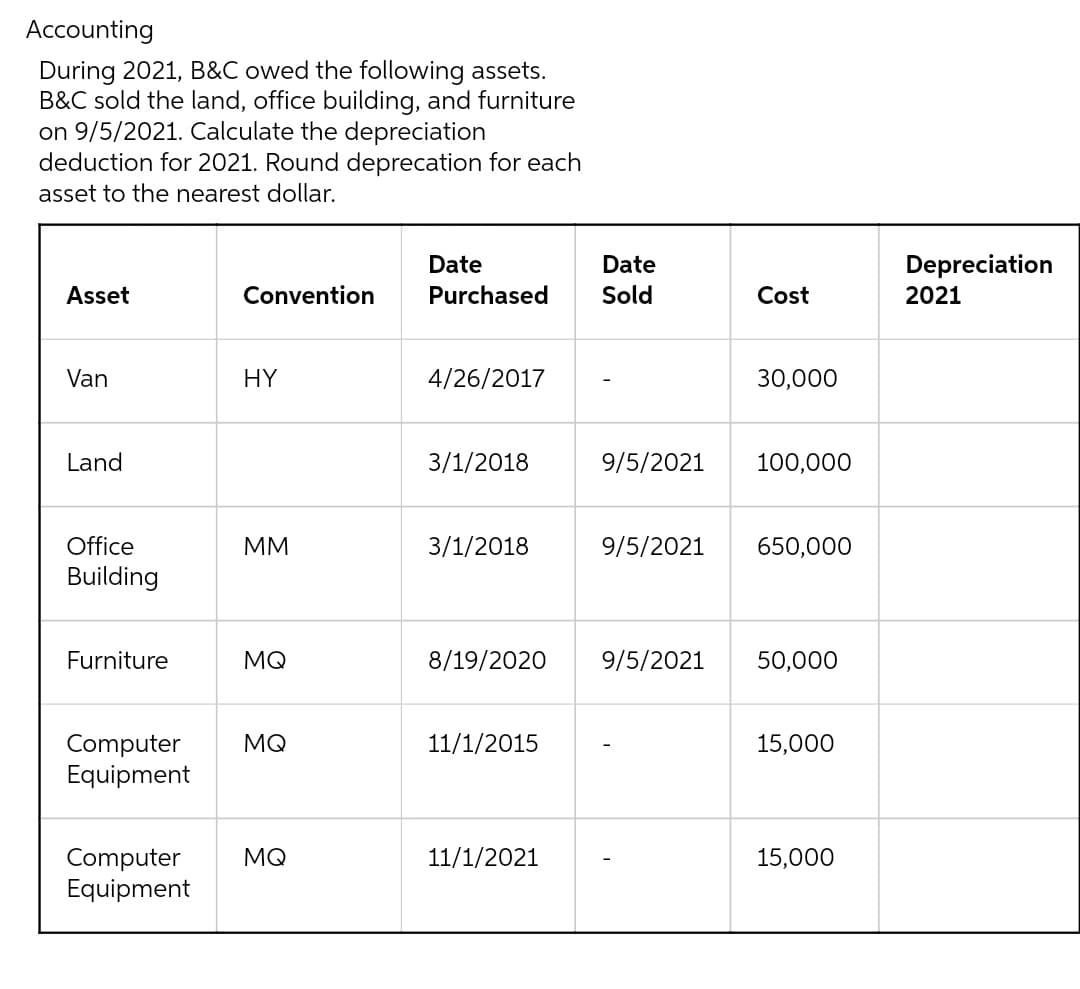

Accounting During 2021, B&C owed the following assets. B&C sold the land, office building, and furniture on 9/5/2021. Calculate the depreciation deduction for 2021. Round deprecation for each asset to the nearest dollar. Asset Van Land Office Building Furniture Convention HY MM MQ Computer MQ Equipment Computer MQ Equipment Date Purchased 4/26/2017 /1/2018 3/1/2018 11/1/2015 Date Sold 11/1/2021 Cost 30,000 9/5/2021 100,000 8/19/2020 9/5/2021 50,000 9/5/2021 650,000 15,000 15,000 Depreciation 2021

Accounting During 2021, B&C owed the following assets. B&C sold the land, office building, and furniture on 9/5/2021. Calculate the depreciation deduction for 2021. Round deprecation for each asset to the nearest dollar. Asset Van Land Office Building Furniture Convention HY MM MQ Computer MQ Equipment Computer MQ Equipment Date Purchased 4/26/2017 /1/2018 3/1/2018 11/1/2015 Date Sold 11/1/2021 Cost 30,000 9/5/2021 100,000 8/19/2020 9/5/2021 50,000 9/5/2021 650,000 15,000 15,000 Depreciation 2021

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 17P: On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and...

Related questions

Question

Transcribed Image Text:Accounting

During 2021, B&C owed the following assets.

B&C sold the land, office building, and furniture

on 9/5/2021. Calculate the depreciation

deduction for 2021. Round deprecation for each

asset to the nearest dollar.

Asset

Van

Land

Office

Building

Furniture

Convention

HY

MM

MQ

Computer MQ

Equipment

Computer MQ

Equipment

Date

Purchased

4/26/2017

/1/2018

3/1/2018

11/1/2015

Date

Sold

11/1/2021

Cost

30,000

9/5/2021 100,000

8/19/2020 9/5/2021 50,000

9/5/2021 650,000

15,000

15,000

Depreciation

2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning