Group and Composite

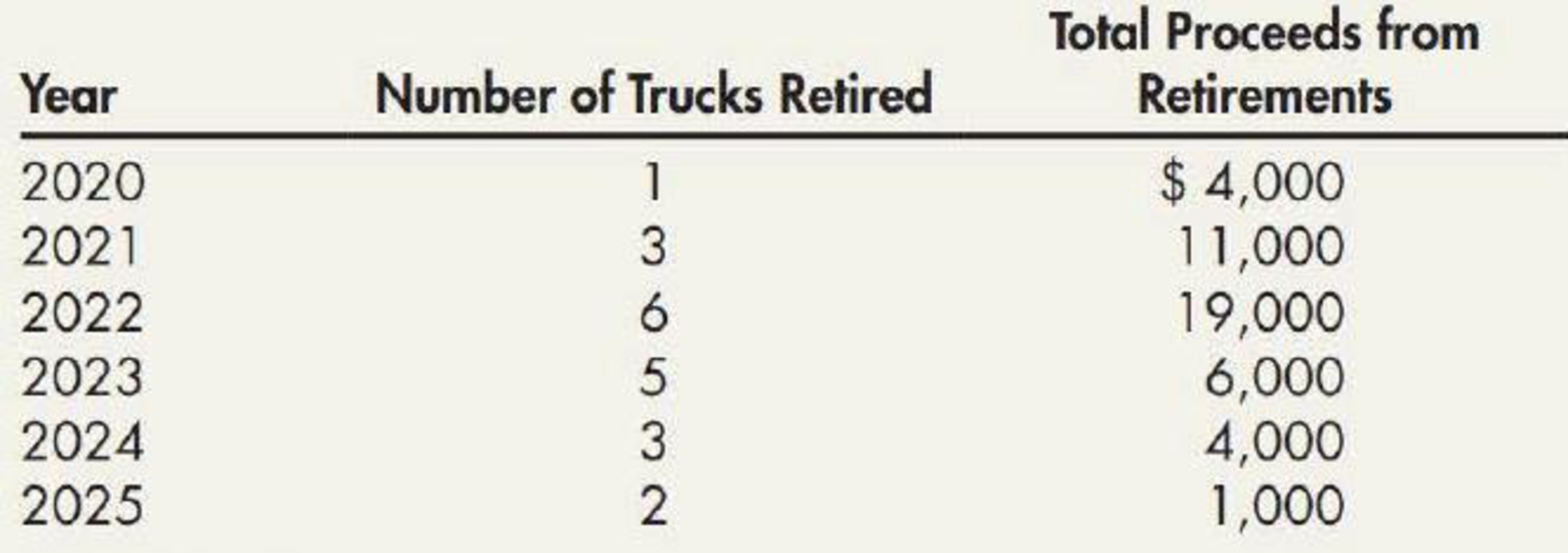

Cheadle actually retired the trucks according to the following schedule (assume each truck was retired at the beginning of the year):

Required:

- 1. Prepare the

journal entries necessary to record the preceding events. - 2. Assume that the company expected all the trucks to last 4 years and be retired for $1,600 each. Using group depreciation, prepare journal entries for all 6 years, assuming the company retired the trucks as shown by the latter schedule.

1.

Prepare the necessary journal entries to record the given transactions.

Explanation of Solution

Depreciation expense: Depreciation expense is a non-cash expense, which is recorded on the income statement reflecting the consumption of economic benefits of long-term asset on account of its wear and tear or obsolesces.

Straight-line depreciation method: The depreciation method which assumes that the consumption of economic benefits of long-term asset could be distributed equally throughout the useful life of the asset is referred to as straight-line method.

Prepare the necessary journal entries to record the given transactions as follows:

| Date | Account Title & Explanation | Debit ($) | Credit($) |

| January 2, 2019 | Trucks (1) | 160,000 | |

| Cash | 160,000 | ||

| (To record the purchase of trucks for cash) | |||

| December 31, 2019 | Depreciation expense (2) | 30,400 | |

| Accumulated depreciation-Trucks | 30,400 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2020 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks | 4,000 | ||

| Trucks | 8,000 | ||

| (To record the retirement of trucks ( truck retired at 2020)) | |||

| December 31, 2020 | Depreciation expense (4) | 28,880 | |

| Accumulated depreciation-Trucks | 28,880 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2021 | Cash | 11,000 | |

|

Accumulated depreciation-Trucks | 13,000 | ||

| Trucks | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2021)) | |||

| December 31, 2021 | Depreciation expense (4) | 24,320 | |

| Accumulated depreciation-Trucks | 24,320 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2022 | Cash | 19,000 | |

|

Accumulated depreciation-Trucks | 29,000 | ||

| Trucks | 48,000 | ||

| (To record the retirement of trucks (6 trucks retired at 2022)) | |||

| December 31, 2022 | Depreciation expense (4) | 15,200 | |

| Accumulated depreciation-Trucks | 15,200 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2023 | Cash | 6,000 | |

|

Accumulated depreciation-Trucks | 34,000 | ||

| Trucks | 40,000 | ||

| (To record the retirement of trucks (5 trucks retired at 2023)) | |||

| December 31, 2023 | Depreciation expense (4) | 7,600 | |

| Accumulated depreciation-Trucks | 7,600 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2024 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks | 20,000 | ||

| Trucks | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2024)) | |||

| December 31, 2024 | Depreciation expense (4) | 3,040 | |

| Accumulated depreciation-Trucks | 3,040 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2025 | Cash | 1,000 | |

|

Accumulated depreciation-Trucks | 15,000 | ||

| Trucks | 16,000 | ||

| (To record the retirement of trucks (2 trucks retired at 2025)) | |||

| December 31, 2025 | Loss on disposal of property, plant and equipment (6) | 5,560 | |

| Accumulated depreciation-Trucks | 5,560 | ||

| (To record the loss on disposal of property, plant and equipment) |

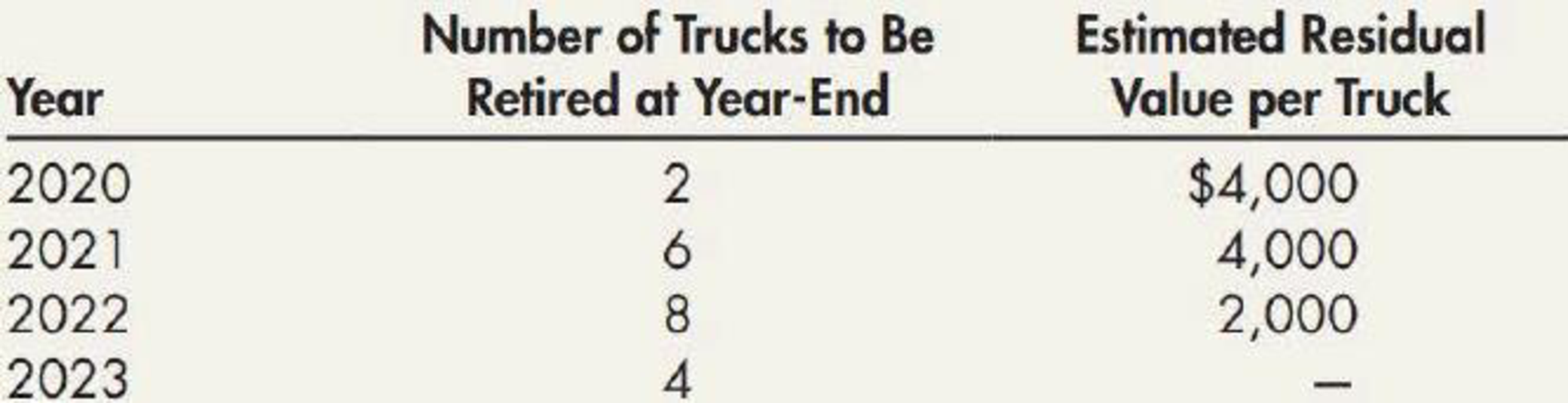

Table (1)

Working note (1):

Calculate the total cost of trucks.

Working note (2):

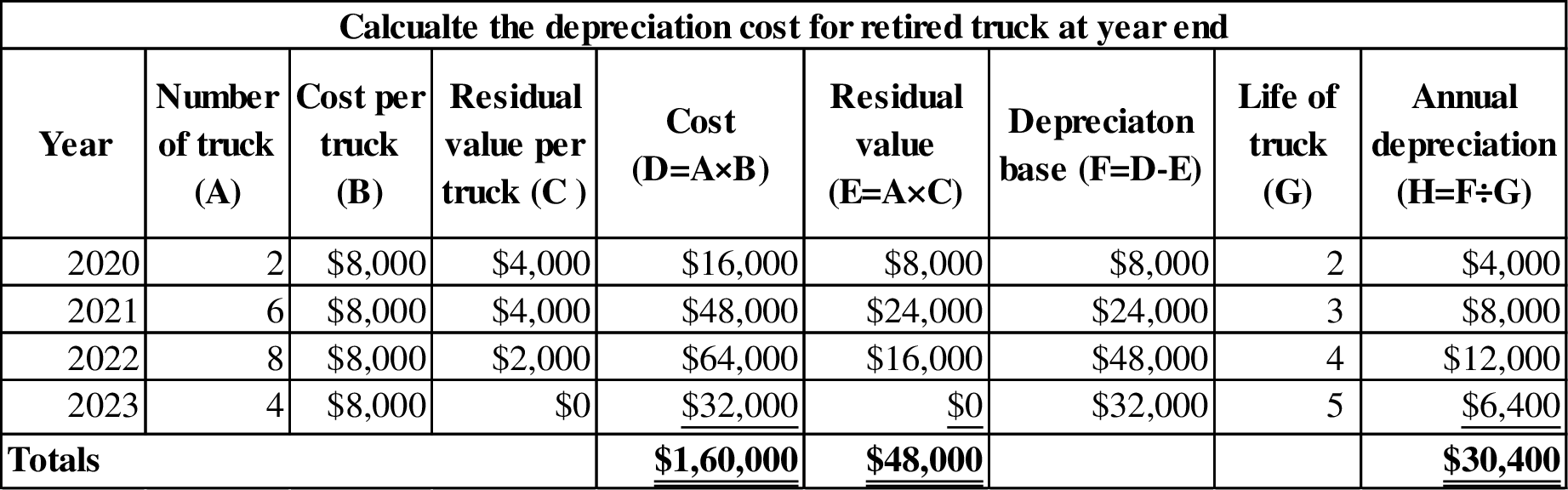

Figure (1)

Working note (3):

Calculate the depreciation rate.

Working note (4):

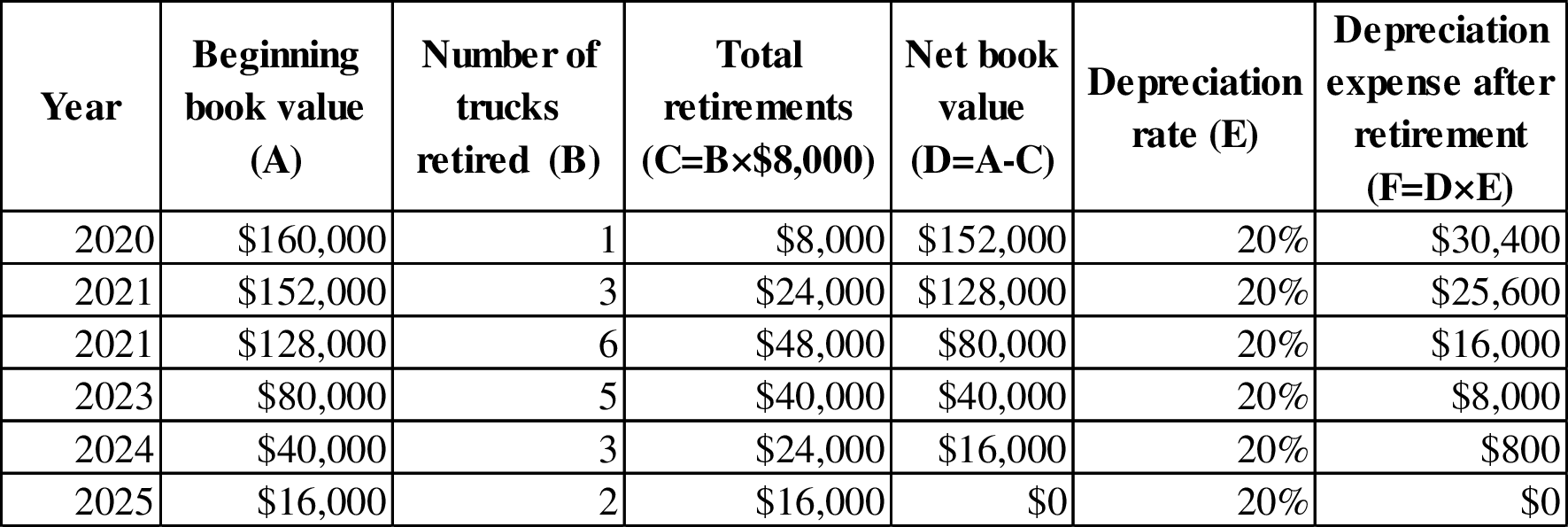

Calculate the depreciation expense after retirement of truck for each year.

Figure (2)

Working note (5):

Calculate the total accumulated depreciation incurred at the time of retirement of truck and total depreciation expense after retirement of truck.

| Year | Accumulated depreciation incurred at the time of retirement of truck ($) | Depreciation expense for each year ($) |

| 2019 | $0 | $30,400 (2) |

| 2020 | $4,000 | $28,880 (4) |

| 2021 | $13,000 | $24,320 (4) |

| 2021 | $29,000 | $15,200 (4) |

| 2023 | $34,000 | $7,600 (4) |

| 2024 | $20,000 | $3,040 (4) |

| 2025 | $15,000 | $0 |

| Total depreciation | $115,000 | $109,440 |

Table (2)

Working note (6):

Calculate the loss on disposal of property, plant and equipment.

2.

Prepare necessary journal entries for all 6 years, if trucks are retired at $1,600 each.

Explanation of Solution

Prepare necessary journal entries for all 6 years, if trucks are retired at $1,600 each as follows:

| Date | Account Title & Explanation | Debit ($) | Credit($) |

| January 2, 2019 | Trucks (1) | 1,60,000 | |

| Cash | 1,60,000 | ||

| (To record the purchase of trucks for cash) | |||

| December 31, 2019 | Depreciation expense (7) | 32,000 | |

| Accumulated depreciation-Trucks | 32,000 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2020 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks | 4,000 | ||

| Trucks | 8,000 | ||

| (To record the retirement of trucks ( truck retired at 2020)) | |||

| December 31, 2020 | Depreciation expense (8) | 30,400 | |

| Accumulated depreciation-Trucks | 30,400 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2021 | Cash | 11,000 | |

|

Accumulated depreciation-Trucks | 13,000 | ||

| Trucks | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2021)) | |||

| December 31, 2021 | Depreciation expense (8) | 25,600 | |

| Accumulated depreciation-Trucks | 25,600 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2022 | Cash | 19,000 | |

|

Accumulated depreciation-Trucks | 29,000 | ||

| Trucks | 48,000 | ||

| (To record the retirement of trucks (6 trucks retired at 2022)) | |||

| December 31, 2022 | Depreciation expense (8) | 16,000 | |

| Accumulated depreciation-Trucks | 16,000 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2023 | Cash | 6,000 | |

|

Accumulated depreciation-Trucks | 34,000 | ||

| Trucks | 40,000 | ||

| (To record the retirement of trucks (5 trucks retired at 2023)) | |||

| December 31, 2023 | Depreciation expense (8) | 8,000 | |

| Accumulated depreciation-Trucks | 8,000 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2024 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks | 20,000 | ||

| Trucks | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2024)) | |||

| December 31, 2024 | Depreciation expense (8) | 800 | |

| Accumulated depreciation-Trucks | 800 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2025 | Cash | 1,000 | |

|

Accumulated depreciation-Trucks | 15,000 | ||

| Trucks | 16,000 | ||

| (To record the retirement of trucks (2 trucks retired at 2025)) | |||

| December 31, 2025 | Loss on disposal of property, plant and equipment (11) | 2,200 | |

| Accumulated depreciation-Trucks | 2,200 | ||

| (To record the loss on disposal of property, plant and equipment) |

Table (3)

Working note (7):

Calculate the group depreciation cost under straight line method:

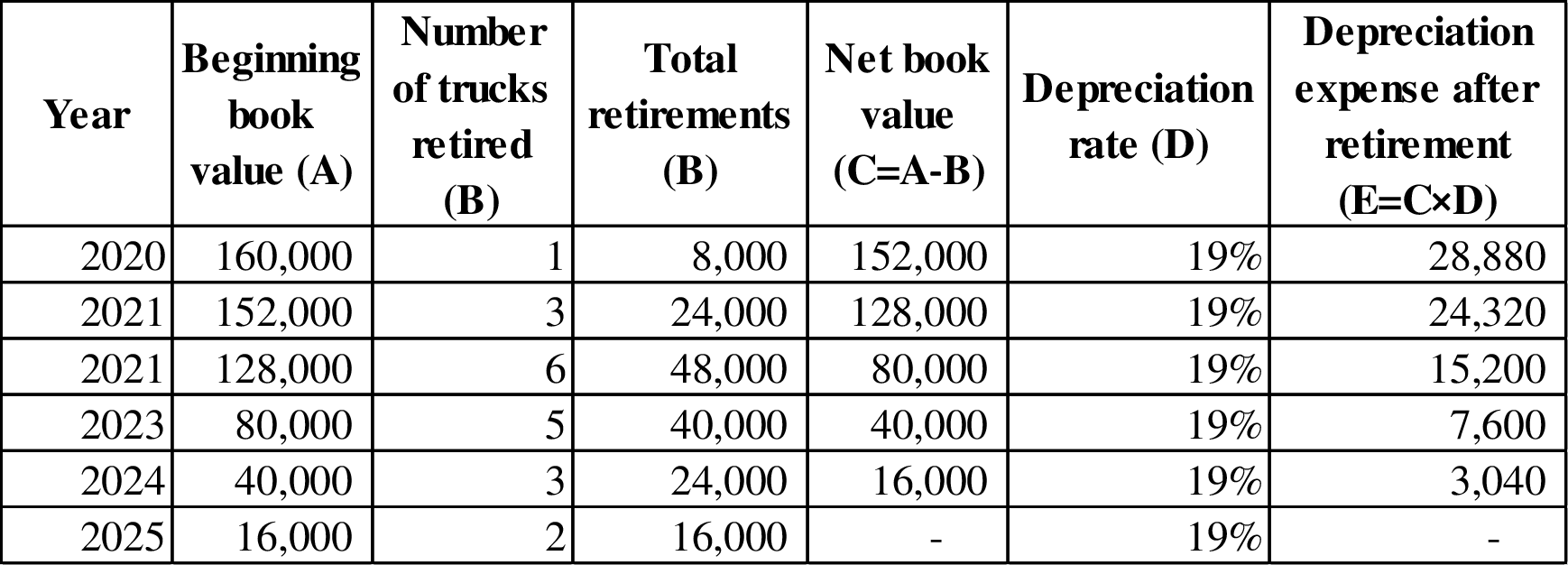

Working note (8):

Calculate the depreciation rate.

Working note (9):

Calculate the depreciation expense after retirement of truck for each year.

Figure (3)

Note: Depreciation expense after retirement for the year 2024 is $800, because the amount of $3,200 would reduce the book value of remaining two trucks (2 trucks) in the year 2025. Hence, the depreciation expense for 2024 is 800

Working note (10):

Calculate the total accumulated depreciation incurred at the time of retirement of truck and total depreciation expense after retirement of truck.

| Year | Accumulated depreciation incurred at the time of retirement of truck ($) | Depreciation expense for each year ($) |

| 2019 | $0 | $32,000 (7) |

| 2020 | $4,000 | $30,400 (9) |

| 2021 | $13,000 | $25,600 (9) |

| 2021 | $29,000 | $16,000 (9) |

| 2023 | $34,000 | $8,000 (9) |

| 2024 | $20,000 | $800 (9) |

| 2025 | $15,000 | $0 |

| Total depreciation | $115,000 | $112,800 |

Table (4)

Working note (11):

Calculate the loss on disposal of property, plant and equipment.

Want to see more full solutions like this?

Chapter 11 Solutions

Intermediate Accounting: Reporting And Analysis

- Comprehensive: Acquisition, Subsequent Expenditures, and Depreciation On January 2, 2019, Lapar Corporation purchased a machine for 50,000. Lapar paid shipping expenses of 500, as well as installation costs of 1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of 3,000. On January 1, 2020, Lapar made additions costing 3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. Required: 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020? 2. Assume Lapar determines the machine has three significant components as shown below. If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?arrow_forwardOn July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000arrow_forwardCost of Asset and Depreciation Method Heist Company purchased a machine on January 2, 2019, and uses the 150%-declining-balance depreciation method. The machine has an expected life of 10 years and an expected residual value of 5,000. The following costs relate to the acquisition and use of the machine during the first year of its operations: Required: 1. Compute the depreciation expense for 2019 and 2020. 2. Next Level What is the effect on the financial statements if the company used the straight-line method instead of the 150%-declining-balance method?arrow_forward

- On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.arrow_forwardKam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.arrow_forwardRevision of Depreciation On January 1, 2017, Blizzards-R-Us purchased a snow-blowing machine for $125,000. The machine was expected to have a residual value of $12,000 at the end of its 5-year useful life. On January 1, 2019, Blizzards-R-Us concluded that the machine would have a remaining useful life of 6 years with a residual value of $3,600. Required: 1. Determine the revised annual depreciation expense for 2019 using the straight-line method. 2. CONCEPTUAL CONNECTION How does the revision in depreciation affect the Blizzards-R-Us financial statements?arrow_forward

- On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.arrow_forwardHunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.arrow_forwardLoban Company purchased four cars for 9,000 each and expects that they will be sold in 3 years for 1,500 each. The company uses group depreciation on a straight-line basis. Required: 1. Prepare journal entries to record the acquisition and the first years depreciation expense. 2. If one of the cars is sold at the beginning of the second year for 7,000, what journal entry is required?arrow_forward

- Depreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The equipment has an estimated service life of 8 years and an estimated residual value of 20,000. Required: Compute the depreciation expense for 2019 under each of the following methods: 1. straight-line 2. sum-of-the-years-digits 3. double-declining-balance 4. Next Level What effect does the depreciation of the equipment have on the analysis of rate of return?arrow_forwardHathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?arrow_forwardAkron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning