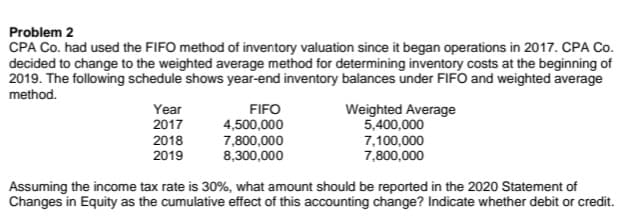

had used the FIFO method of inventory valuation since it began operations in 2017 CPA Co. decided to change to the weighted average method for determining inventory costs at the beginning of 2019. The following schedule shows year-end inventory balances under FIFO and weighted average method. Weighted Average 5,400,000 7,100,000 7,800,000 Year 2017 FIFO 4,500,000 7,800,000 8,300,000 2018 2019 Assuming the income tax rate is 30%, what amount should be reported in the 2020 Statement of Changes in Equity as the cumulative effect of this accounting change? Indicate whether debit or credit

had used the FIFO method of inventory valuation since it began operations in 2017 CPA Co. decided to change to the weighted average method for determining inventory costs at the beginning of 2019. The following schedule shows year-end inventory balances under FIFO and weighted average method. Weighted Average 5,400,000 7,100,000 7,800,000 Year 2017 FIFO 4,500,000 7,800,000 8,300,000 2018 2019 Assuming the income tax rate is 30%, what amount should be reported in the 2020 Statement of Changes in Equity as the cumulative effect of this accounting change? Indicate whether debit or credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 12P: Dollar-Value LIFO Kwestel Company adopted the dollar-value LIFO method for inventory valuation at...

Related questions

Topic Video

Question

Transcribed Image Text:Problem 2

CPA Co. had used the FIFO method of inventory valuation since it began operations in 2017. CPA Co.

decided to change to the weighted average method for determining inventory costs at the beginning of

2019. The following schedule shows year-end inventory balances under FIFO and weighted average

method.

Weighted Average

5,400,000

7,100,000

7,800,000

Year

2017

FIFO

2018

2019

4,500,000

7,800,000

8,300,000

Assuming the income tax rate is 30%, what amount should be reported in the 2020 Statement of

Changes in Equity as the cumulative effect of this accounting change? Indicate whether debit or credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning