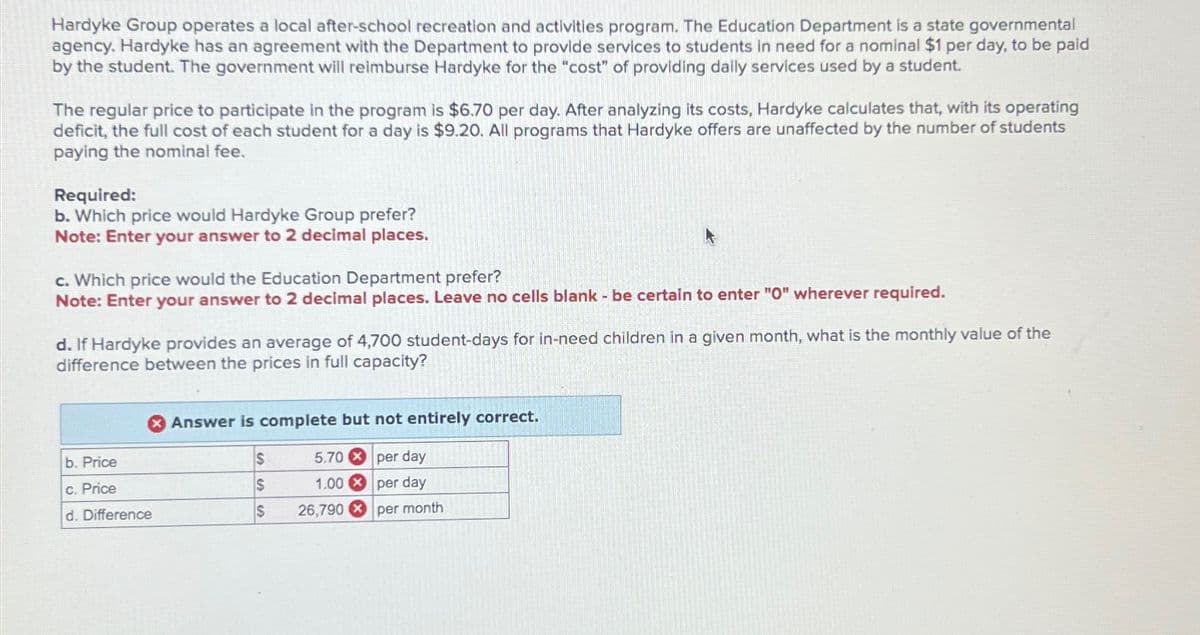

Hardyke Group operates a local after-school recreation and activities program. The Education Department is a state governmental agency. Hardyke has an agreement with the Department to provide services to students in need for a nominal $1 per day, to be paid by the student. The government will reimburse Hardyke for the "cost" of providing daily services used by a student. The regular price to participate in the program is $6.70 per day. After analyzing its costs, Hardyke calculates that, with its operating deficit, the full cost of each student for a day is $9.20. All programs that Hardyke offers are unaffected by the number of students paying the nominal fee. Required: b. Which price would Hardyke Group prefer? Note: Enter your answer to 2 decimal places. c. Which price would the Education Department prefer? Note: Enter your answer to 2 decimal places. Leave no cells blank - be certain to enter "O" wherever required. d. If Hardyke provides an average of 4,700 student-days for in-need children in a given month, what is the monthly value of the difference between the prices in full capacity? Answer is complete but not entirely correct. b. Price $ 5.70 per day c. Price $ 1.00 per day d. Difference $ 26,790 per month

Hardyke Group operates a local after-school recreation and activities program. The Education Department is a state governmental agency. Hardyke has an agreement with the Department to provide services to students in need for a nominal $1 per day, to be paid by the student. The government will reimburse Hardyke for the "cost" of providing daily services used by a student. The regular price to participate in the program is $6.70 per day. After analyzing its costs, Hardyke calculates that, with its operating deficit, the full cost of each student for a day is $9.20. All programs that Hardyke offers are unaffected by the number of students paying the nominal fee. Required: b. Which price would Hardyke Group prefer? Note: Enter your answer to 2 decimal places. c. Which price would the Education Department prefer? Note: Enter your answer to 2 decimal places. Leave no cells blank - be certain to enter "O" wherever required. d. If Hardyke provides an average of 4,700 student-days for in-need children in a given month, what is the monthly value of the difference between the prices in full capacity? Answer is complete but not entirely correct. b. Price $ 5.70 per day c. Price $ 1.00 per day d. Difference $ 26,790 per month

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 18P

Related questions

Question

Transcribed Image Text:Hardyke Group operates a local after-school recreation and activities program. The Education Department is a state governmental

agency. Hardyke has an agreement with the Department to provide services to students in need for a nominal $1 per day, to be paid

by the student. The government will reimburse Hardyke for the "cost" of providing daily services used by a student.

The regular price to participate in the program is $6.70 per day. After analyzing its costs, Hardyke calculates that, with its operating

deficit, the full cost of each student for a day is $9.20. All programs that Hardyke offers are unaffected by the number of students

paying the nominal fee.

Required:

b. Which price would Hardyke Group prefer?

Note: Enter your answer to 2 decimal places.

c. Which price would the Education Department prefer?

Note: Enter your answer to 2 decimal places. Leave no cells blank - be certain to enter "O" wherever required.

d. If Hardyke provides an average of 4,700 student-days for in-need children in a given month, what is the monthly value of the

difference between the prices in full capacity?

Answer is complete but not entirely correct.

b. Price

$

5.70

per day

c. Price

$

1.00

per day

d. Difference

$

26,790

per month

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning