Harmer Inc. is now a successful company. In the early days (before it became profitable), it issued ISOs to its employees. Now Harmer is trying to decide whether to issue NQOs or ISOs to its employees. Initially, Harmer would like to give each employee 20 options (each option allows the employee to acquire one share of Harmer stock). For purposes of this problem, assume that the options are exercised in three years (three years from now) and that the underlying stock is sold in five years (five years from now). Assume that taxes are paid at the same time the income generating the tax is recognized. Also assume the following facts: (Leave no answer blank. Enter zero if applicable.) The after-tax discount rate for both Harmer Inc. and its employees is 10 percent. The corporate tax rate is 21 percent. The personal (employee) ordinary income rate is 37 percent. The personal (employee) long-term capital gains rate is 20 percent. The exercise price of the options is $7. The market price of Harmer at date of grant is $5. The market price of Harmer at date of exercise is $25. The market price of Harmer at date of sale is $35. Q: 1) What is the present value of each employee’s after-tax cash flows from year 1 through year 5 if the employees receive ISOs? Use Exhibit 3.1. (Round your intermediate calculations and final anwser to 2 decimal places.) 2)How many NQOs would Harmer have to grant to keep its employees indifferent between NQOs and 20 ISOs? (Do not round intermediate calculations. Round up your final answer to the next whole number.)

Harmer Inc. is now a successful company. In the early days (before it became profitable), it issued ISOs to its employees. Now Harmer is trying to decide whether to issue NQOs or ISOs to its employees. Initially, Harmer would like to give each employee 20 options (each option allows the employee to acquire one share of Harmer stock). For purposes of this problem, assume that the options are exercised in three years (three years from now) and that the underlying stock is sold in five years (five years from now). Assume that taxes are paid at the same time the income generating the tax is recognized. Also assume the following facts: (Leave no answer blank. Enter zero if applicable.)

- The after-tax discount rate for both Harmer Inc. and its employees is 10 percent.

- The corporate tax rate is 21 percent.

- The personal (employee) ordinary income rate is 37 percent.

- The personal (employee) long-term

capital gains rate is 20 percent. - The exercise price of the options is $7.

- The market price of Harmer at date of grant is $5.

- The market price of Harmer at date of exercise is $25.

- The market price of Harmer at date of sale is $35.

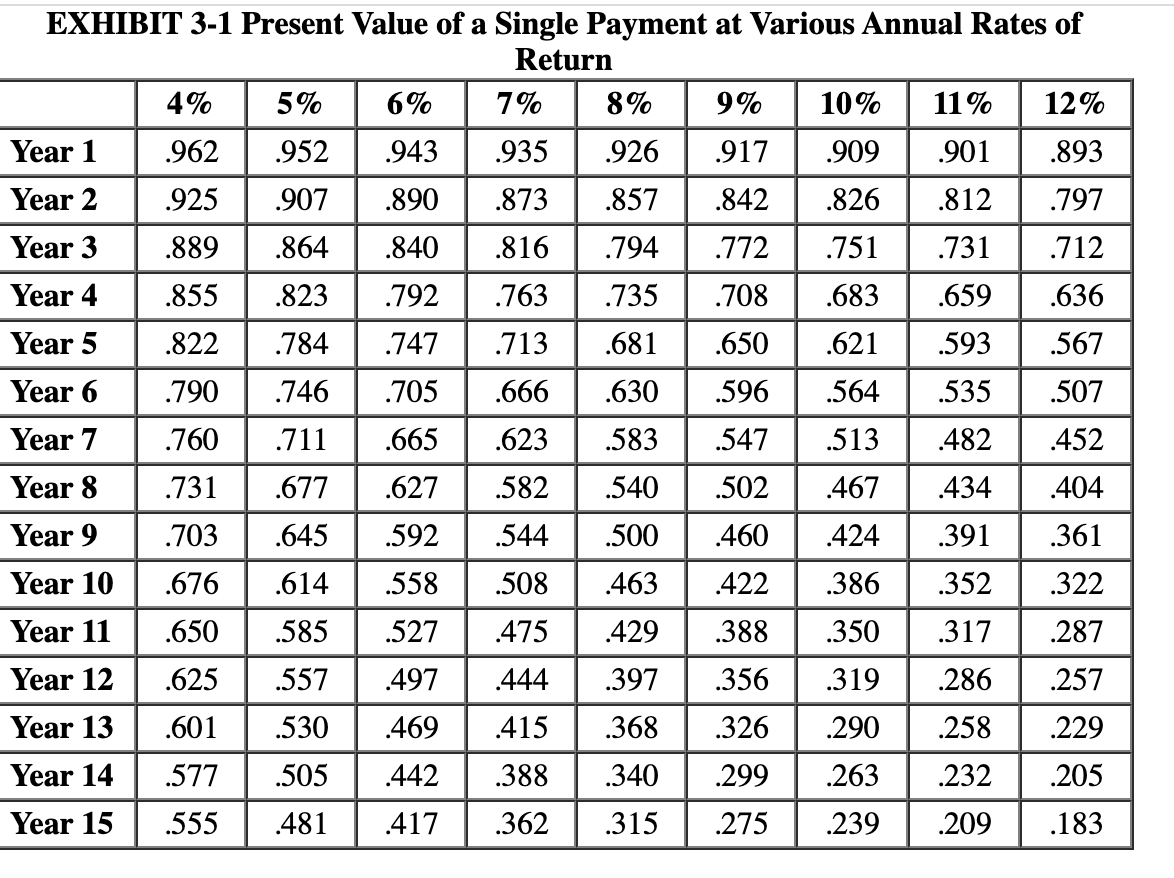

Q: 1) What is the present value of each employee’s after-tax cash flows from year 1 through year 5 if the employees receive ISOs? Use Exhibit 3.1. (Round your intermediate calculations and final anwser to 2 decimal places.)

2)How many NQOs would Harmer have to grant to keep its employees indifferent between NQOs and 20 ISOs? (Do not round intermediate calculations. Round up your final answer to the next whole number.)

Trending now

This is a popular solution!

Step by step

Solved in 4 steps