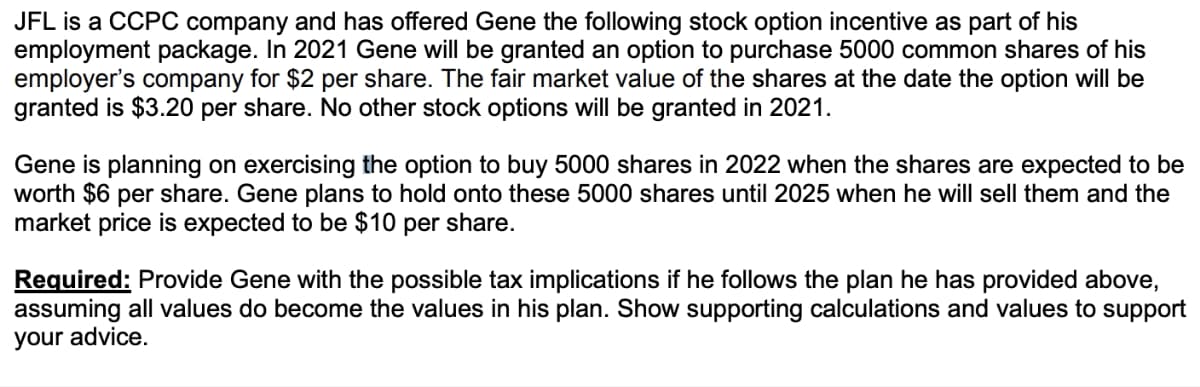

JFL is a CCPC company and has offered Gene the following stock option incentive as part of his employment package. In 2021 Gene will be granted an option to purchase 5000 common shares of his employer's company for $2 per share. The fair market value of the shares at the date the option will be granted is $3.20 per share. No other stock options will be granted in 2021. Gene is planning on exercising the option to buy 5000 shares in 2022 when the shares are expected to be worth $6 per share. Gene plans to hold onto these 5000 shares until 2025 when he will sell them and the market price is expected to be $10 per share. Required: Provide Gene with the possible tax implications if he follows the plan he has provided above, assuming all values do become the values in his plan. Show supporting calculations and values to support your advice.

JFL is a CCPC company and has offered Gene the following stock option incentive as part of his employment package. In 2021 Gene will be granted an option to purchase 5000 common shares of his employer's company for $2 per share. The fair market value of the shares at the date the option will be granted is $3.20 per share. No other stock options will be granted in 2021. Gene is planning on exercising the option to buy 5000 shares in 2022 when the shares are expected to be worth $6 per share. Gene plans to hold onto these 5000 shares until 2025 when he will sell them and the market price is expected to be $10 per share. Required: Provide Gene with the possible tax implications if he follows the plan he has provided above, assuming all values do become the values in his plan. Show supporting calculations and values to support your advice.

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 54P

Related questions

Question

Transcribed Image Text:JFL is a CCPC company and has offered Gene the following stock option incentive as part of his

employment package. In 2021 Gene will be granted an option to purchase 5000 common shares of his

employer's company for $2 per share. The fair market value of the shares at the date the option will be

granted is $3.20 per share. No other stock options will be granted in 2021.

Gene is planning on exercising the option to buy 5000 shares in 2022 when the shares are expected to be

worth $6 per share. Gene plans to hold onto these 5000 shares until 2025 when he will sell them and the

market price is expected to be $10 per share.

Required: Provide Gene with the possible tax implications if he follows the plan he has provided above,

assuming all values do become the values in his plan. Show supporting calculations and values to support

your advice.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT