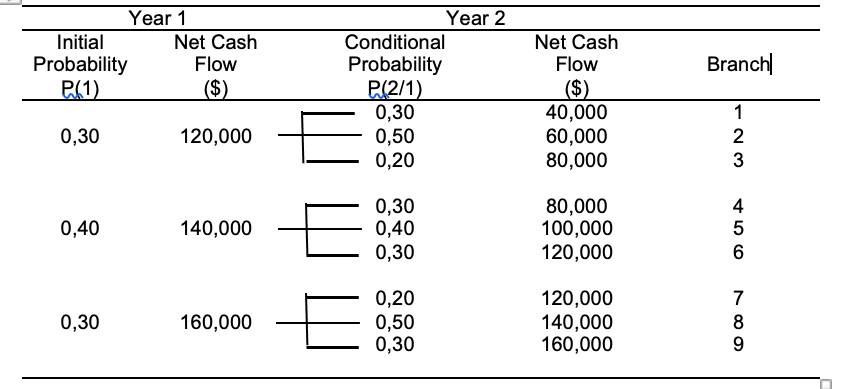

Harrison Company is considering taking on a project that requires an initial cost of $180,000. The project has a lifespan of two (2) years, after which after two years the project has no salvage value. The possible incremental after-tax cash flows and their probabilities can be seen in the following table. The required return by the company for this investment is 8%. Questions : a). The expected net present value of this project b). If it is possible to abandon (abandonment) this project and the abandonment value at the end of the first year is $90,000 after tax. For this project, is abandonment of this project after one year is the right choice? Calculate the expected net present value, assuming that the company would abandon the project if it were useful. Compare with the calculations in the answer to part (a). What are the implications if you are a financial manager?

Harrison Company is considering taking on a project that requires an initial cost of $180,000. The project has a lifespan of two (2) years, after which after two years the project has no salvage value. The possible incremental after-tax cash flows and their probabilities can be seen in the following table.

The required return by the company for this investment is 8%.

Questions :

a). The expected

b). If it is possible to abandon (abandonment) this project and the abandonment value at the end of the first year is $90,000 after tax. For this project, is abandonment of this project after one year is the right choice? Calculate the expected net present value, assuming that the company would abandon the project if it were useful. Compare with the calculations in the answer to part (a). What are the implications if you are a

Step by step

Solved in 6 steps