Harry and Sally own a dog-walking service. Their service includes driving to their customer's homes; taking the customer's dog on a 10-minute walk; 5 minutes of attention/playtime in or just outside the customer's house; refilling water and/or food; waste removal during walk; and one treat per visit. They charge customers $15 per dog-walk. Variable costs total $8.50 per walk - $6.50 for labor/supplies plus $2.00 to reimburse fuel. Their average customer purchases 15 walks per month. Their average customer remains a customer for 7 months. H&S's fixed costs are a low $350 per month. The city Harry and Sally service has 45,000 dog owners, 32% of which have a subscription to "dogster magazine. H&S are considering running an ad in dogster, for a discounted dog-walk promotion where you can purchase your first walk for $5. The cost of running the ad is $1500. Harry and Sally originally charged $20 per dog-walk but decided to reduce the price to $15 shortly after they started their business. At $20 per dog-walk, they averaged 450 walks per month. After reducing their price to $15 per dog-walk, they averaged 780 walks per month. 1. What is the optimal price to maximize profit for H&S dog-walks? 100

Harry and Sally own a dog-walking service. Their service includes driving to their customer's homes; taking the customer's dog on a 10-minute walk; 5 minutes of attention/playtime in or just outside the customer's house; refilling water and/or food; waste removal during walk; and one treat per visit. They charge customers $15 per dog-walk. Variable costs total $8.50 per walk - $6.50 for labor/supplies plus $2.00 to reimburse fuel. Their average customer purchases 15 walks per month. Their average customer remains a customer for 7 months. H&S's fixed costs are a low $350 per month. The city Harry and Sally service has 45,000 dog owners, 32% of which have a subscription to "dogster magazine. H&S are considering running an ad in dogster, for a discounted dog-walk promotion where you can purchase your first walk for $5. The cost of running the ad is $1500. Harry and Sally originally charged $20 per dog-walk but decided to reduce the price to $15 shortly after they started their business. At $20 per dog-walk, they averaged 450 walks per month. After reducing their price to $15 per dog-walk, they averaged 780 walks per month. 1. What is the optimal price to maximize profit for H&S dog-walks? 100

Micro Economics For Today

10th Edition

ISBN:9781337613064

Author:Tucker, Irvin B.

Publisher:Tucker, Irvin B.

Chapter7: Proudction Costs

Section: Chapter Questions

Problem 6SQ

Related questions

Question

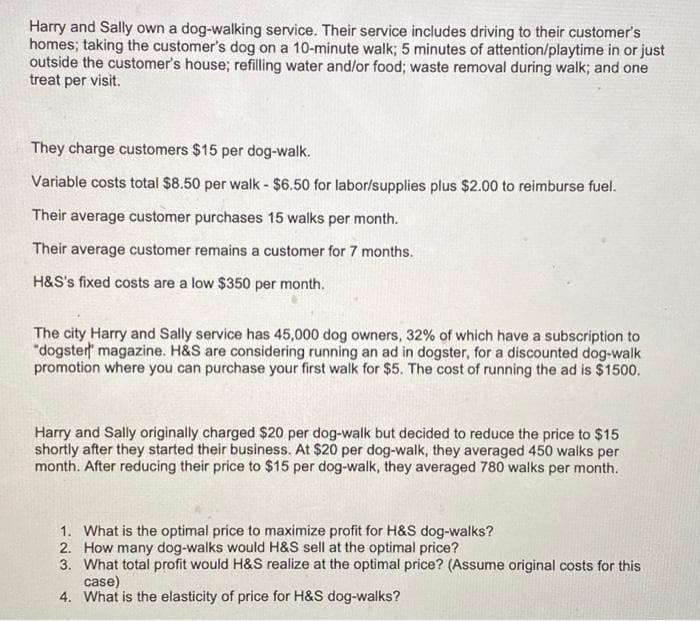

Transcribed Image Text:Harry and Sally own a dog-walking service. Their service includes driving to their customer's

homes; taking the customer's dog on a 10-minute walk; 5 minutes of attention/playtime in or just

outside the customer's house; refilling water and/or food; waste removal during walk; and one

treat per visit.

They charge customers $15 per dog-walk.

Variable costs total $8.50 per walk - $6.50 for labor/supplies plus $2.00 to reimburse fuel.

Their average customer purchases 15 walks per month.

Their average customer remains a customer for 7 months.

H&S's fixed costs are a low $350 per month.

The city Harry and Sally service has 45,000 dog owners, 32% of which have a subscription to

"dogster" magazine. H&S are considering running an ad in dogster, for a discounted dog-walk

promotion where you can purchase your first walk for $5. The cost of running the ad is $1500.

Harry and Sally originally charged $20 per dog-walk but decided to reduce the price to $15

shortly after they started their business. At $20 per dog-walk, they averaged 450 walks per

month. After reducing their price to $15 per dog-walk, they averaged 780 walks per month.

1. What is the optimal price to maximize profit for H&S dog-walks?

2. How many dog-walks would H&S sell at the optimal price?

3. What total profit would H&S realize at the optimal price? (Assume original costs for this.

case)

4. What is the elasticity of price for H&S dog-walks?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning