Harvey quit his job at State University where he earned $45,000 a year. He Figures his entrepreneurial talent or Foregone entrepreneurial income to be Vear To start the b ucinecc be

Harvey quit his job at State University where he earned $45,000 a year. He Figures his entrepreneurial talent or Foregone entrepreneurial income to be Vear To start the b ucinecc be

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 74DC

Related questions

Question

C

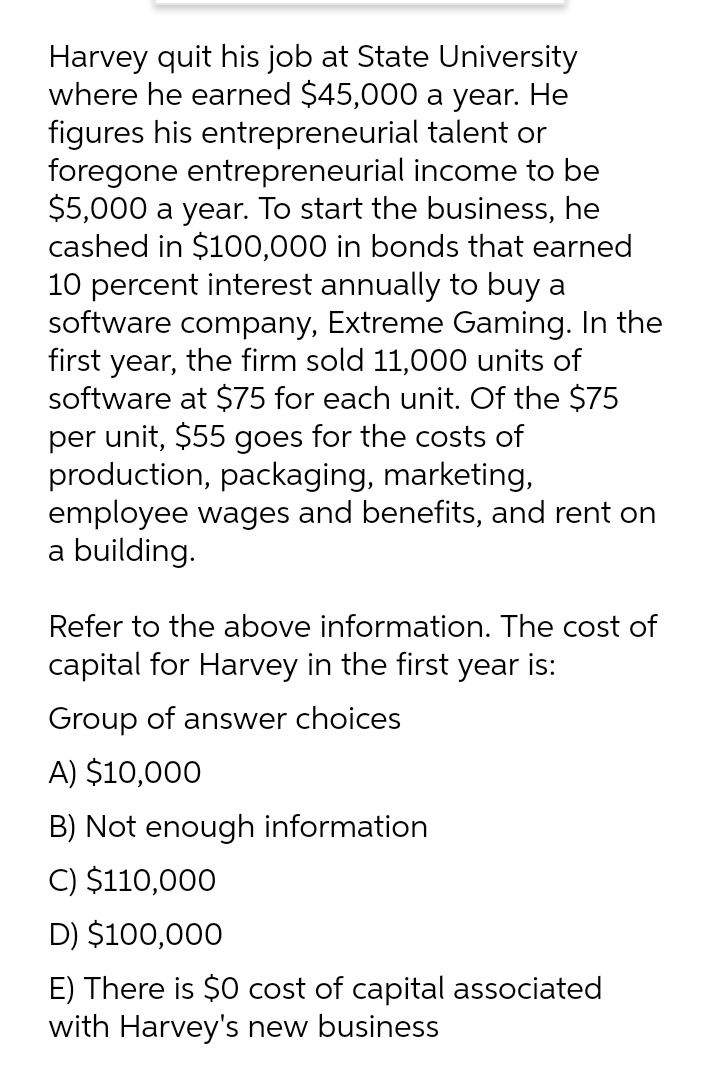

Transcribed Image Text:Harvey quit his job at State University

where he earned $45,000 a year. He

figures his entrepreneurial talent or

foregone entrepreneurial income to be

$5,000 a year. To start the business, he

cashed in $100,000 in bonds that earned

10 percent interest annually to buy a

software company, Extreme Gaming. In the

first year, the firm sold 11,000 units of

software at $75 for each unit. Of the $75

per unit, $55 goes for the costs of

production, packaging, marketing,

employee wages and benefits, and rent on

a building.

Refer to the above information. The cost of

capital for Harvey in the first year is:

Group of answer choices

A) $10,000

B) Not enough information

C) $110,000

D) $100,000

E) There is $0 cost of capital associated

with Harvey's new business

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you