hat is the Tax-deductible contrib w permanent resident: am a new permanent resident ar cently moved to Canada in Augu arted working remotely for the C mpany in June 2021, when I still

hat is the Tax-deductible contrib w permanent resident: am a new permanent resident ar cently moved to Canada in Augu arted working remotely for the C mpany in June 2021, when I still

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 37P

Related questions

Question

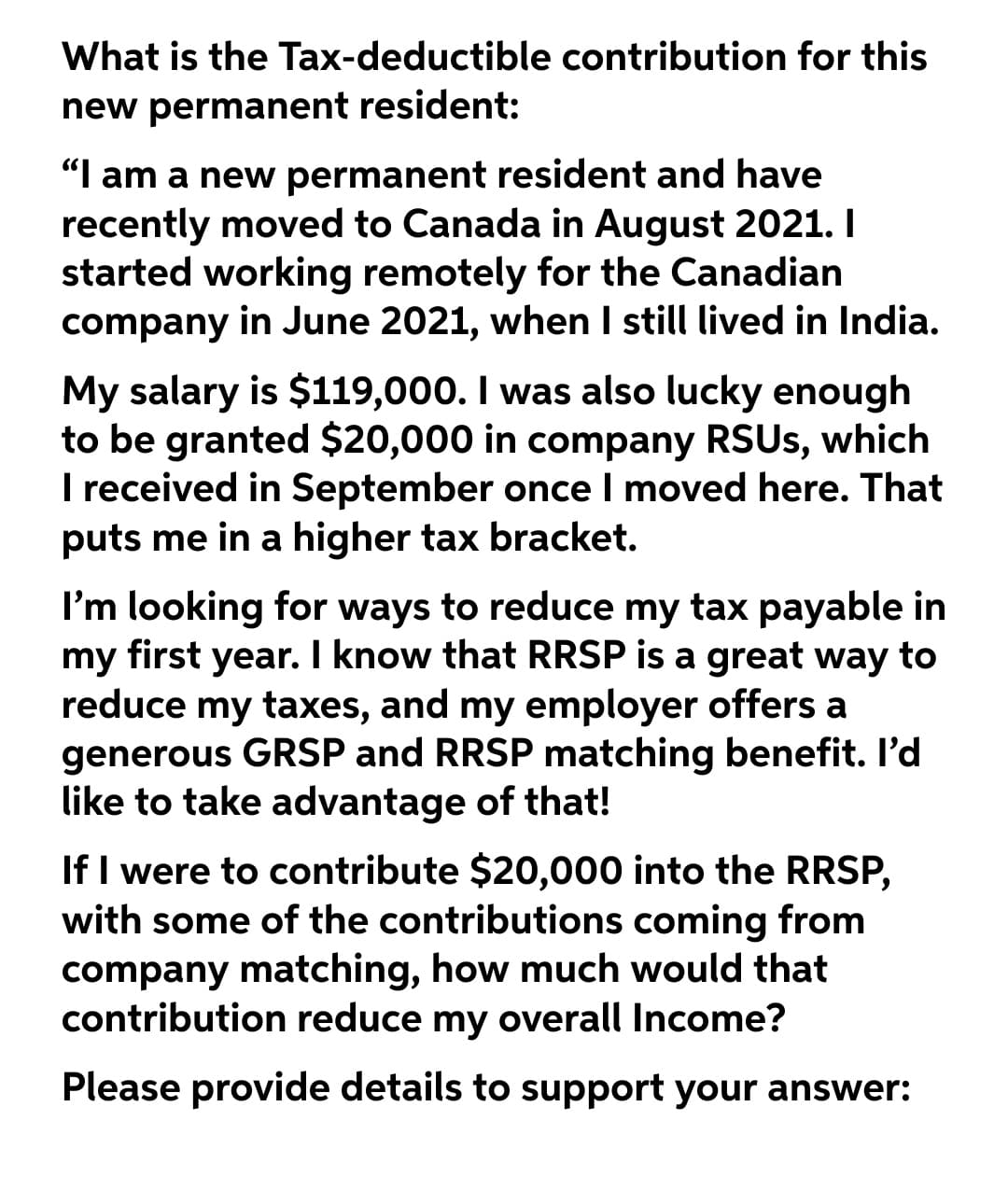

Transcribed Image Text:What is the Tax-deductible contribution for this

new permanent resident:

"I am a new permanent resident and have

recently moved to Canada in August 2021. I

started working remotely for the Canadian

company in June 2021, when I still lived in India.

My salary is $119,000. I was also lucky enough

to be granted $20,000 in company RSUS, which

I received in September once I moved here. That

puts me in a higher tax bracket.

I'm looking for ways to reduce my tax payable in

my first year. I know that RRSP is a great way to

reduce my taxes, and my employer offers a

generous GRSP and RRSP matching benefit. l'd

like to take advantage of that!

If I were to contribute $20,000 into the RRSP,

with some of the contributions coming from

company matching, how much would that

contribution reduce my overall Income?

Please provide details to support your answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT