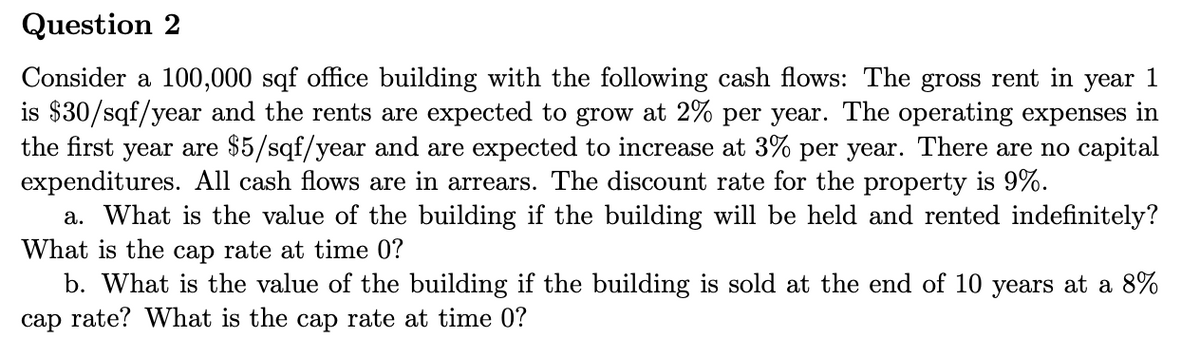

Question 2 Consider a 100,000 sqf office building with the following cash flows: The gross rent in year 1 is $30/sqf/year and the rents are expected to grow at 2% per year. The operating expenses in the first year are $5/sqf/year and are expected to increase at 3% per year. There are no capital expenditures. All cash flows are in arrears. The discount rate for the property is 9%. a. What is the value of the building if the building will be held and rented indefinitely? What is the cap rate at time 0? b. What is the value of the building if the building is sold at the end of 10 years at a 8% cap rate? What is the cap rate at time 0?

Question 2 Consider a 100,000 sqf office building with the following cash flows: The gross rent in year 1 is $30/sqf/year and the rents are expected to grow at 2% per year. The operating expenses in the first year are $5/sqf/year and are expected to increase at 3% per year. There are no capital expenditures. All cash flows are in arrears. The discount rate for the property is 9%. a. What is the value of the building if the building will be held and rented indefinitely? What is the cap rate at time 0? b. What is the value of the building if the building is sold at the end of 10 years at a 8% cap rate? What is the cap rate at time 0?

Chapter4A: Nopat Breakeven: Revenues Needed To Cover Total Operating Costs

Section: Chapter Questions

Problem 1EP

Related questions

Question

Transcribed Image Text:Question 2

Consider a 100,000 sqf office building with the following cash flows: The gross rent in year 1

is $30/sqf/year and the rents are expected to grow at 2% per year. The operating expenses in

the first year are $5/sqf/year and are expected to increase at 3% per year. There are no capital

expenditures. All cash flows are in arrears. The discount rate for the property is 9%.

a. What is the value of the building if the building will be held and rented indefinitely?

What is the cap rate at time 0?

b. What is the value of the building if the building is sold at the end of 10 years at a 8%

cap rate? What is the cap rate at time 0?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning