have competition from the BoT in terms of market share. After doing some basic research on the habits of their customers, they found that if a customer banked at Trust in a given month, the probability of the customer returning to Trust in the following month is 0.75 and the probability that the customer banks at BoT, in the following month is 0.25. However, if a customer banks at BoT in a given month, the probability of the customer returning to BoT in the following month is 0.87 and the customer going to Trust in the following month is 0.13. Suppose that they want to consider the Markov process associated with the monthly banking habits of one customer, but they do not know where the customer banked in the previous month. Thus, they assume a 50% probability that the customer banked at Truist or BoT (that is to say, T:(0) = 0.5 and n:(0) = 0.5). Given these initial state probabilities, answer the following questions: |% (write in percent terms 1. What is the long-run probability (or market share) of Trust Bank? with two decimal places) 2. Trust Bank considers running a promotion to attract BoI customers by offering a $10 gift card for banking with Trust, resulting in the probability of BoJ, customers going to Trust to increase from 0.13 to 3. 0.20 in the next month. What would be the new market share of Trust Bank now? % (write in percent terms with two decimal places).

have competition from the BoT in terms of market share. After doing some basic research on the habits of their customers, they found that if a customer banked at Trust in a given month, the probability of the customer returning to Trust in the following month is 0.75 and the probability that the customer banks at BoT, in the following month is 0.25. However, if a customer banks at BoT in a given month, the probability of the customer returning to BoT in the following month is 0.87 and the customer going to Trust in the following month is 0.13. Suppose that they want to consider the Markov process associated with the monthly banking habits of one customer, but they do not know where the customer banked in the previous month. Thus, they assume a 50% probability that the customer banked at Truist or BoT (that is to say, T:(0) = 0.5 and n:(0) = 0.5). Given these initial state probabilities, answer the following questions: |% (write in percent terms 1. What is the long-run probability (or market share) of Trust Bank? with two decimal places) 2. Trust Bank considers running a promotion to attract BoI customers by offering a $10 gift card for banking with Trust, resulting in the probability of BoJ, customers going to Trust to increase from 0.13 to 3. 0.20 in the next month. What would be the new market share of Trust Bank now? % (write in percent terms with two decimal places).

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter11: Data Analysis And Probability

Section11.8: Probabilities Of Disjoint And Overlapping Events

Problem 2C

Related questions

Question

Hi,

Needs answers pls.

Thank you.

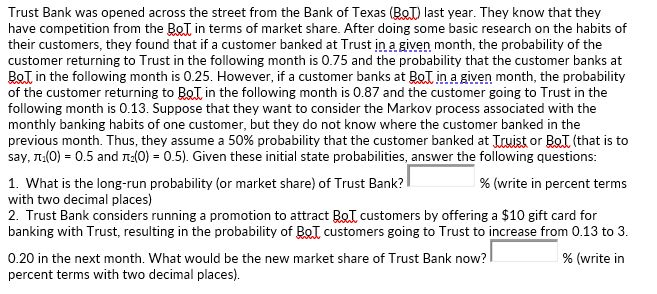

Transcribed Image Text:Trust Bank was opened across the street from the Bank of Texas (BoT) last year. They know that they

have competition from the BoT in terms of market share. After doing some basic research on the habits of

their customers, they found that if a customer banked at Trust in a given month, the probability of the

customer returning to Trust in the following month is 0.75 and the probability that the customer banks at

BoT in the following month is 0.25. However, if a customer banks at BoT in a given month, the probability

of the customer returning to BoT in the following month is 0.87 and the customer going to Trust in the

following month is 0.13. Suppose that they want to consider the Markov process associated with the

monthly banking habits of one customer, but they do not know where the customer banked in the

previous month. Thus, they assume a 50% probability that the customer banked at Truist or BeT (that is to

say, T:(0) = 0.5 and n:(0) = 0.5). Given these initial state probabilities, answer the following questions:

1. What is the long-run probability (or market share) of Trust Bank?

with two decimal places)

2. Trust Bank considers running a promotion to attract BoI. customers by offering a $10 gift card for

banking with Trust, resulting in the probability of BoT customers going to Trust to increase from 0.13 to 3.

% (write in percent terms

0.20 in the next month. What would be the new market share of Trust Bank now?

% (write in

percent terms with two decimal places).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL