(CFO) of New Age Fashion Lta t received a request from a project manager lo auhonze an expene 145,00 hanager states that this expenditur necessary fo last stage developmer a space navigation system, which s based anguage called Xtor. As a space engineer and financial manager, you know that Xtor is almost obsolete and is being replaced by alternatives that provide better cross-platform compatibility. However, the project manager insists that they should continue with the last tranche of payment because over £1.5 million as already been spent on developing this navigation system. It would be a shame to waste all the time and resources that have been invested. Advise the CFO regarding whether she should authorize the £45,000 proposed expenditure. Use marginal cost-benefit analysis to explain your reasoning. hich of the following statements correctly describes your decision? DA The CFO should authorize the £45,000 expenditure to continue the project because the marginal cost-benefit analysis treats the £1.5 million as part of the project's initial capital outlay that can be recovered only if the project is implemented. OB. The CFO should not authorize the £45,000 expenditure to continue the project even if the project will generate a positive net present value. The marginal cost-benefit analysis treats the £1.5 million as a cost that is extremely unlikely to be recovered and the £45,000 expenditure will also become a cost unlikely to be recovered. OC. The CFO should authorize the £45,000 expenditure to continue the project if the project will generate a positive net present value. The marginal cost-benefit analysis treats the £1.5 million as a cost that is irrelevant to the current decision making. OD. The CFO should not authorize the £45,000 expenditure to continue the project because it is surpassed by the new technology. Though the marginal cost-benefit analysis treats the £1.5 million as a cost that is irrelevant to the current decision making, continuing the project would be inadvisable even if the £45,000 expenditure generates a positive net present value.

(CFO) of New Age Fashion Lta t received a request from a project manager lo auhonze an expene 145,00 hanager states that this expenditur necessary fo last stage developmer a space navigation system, which s based anguage called Xtor. As a space engineer and financial manager, you know that Xtor is almost obsolete and is being replaced by alternatives that provide better cross-platform compatibility. However, the project manager insists that they should continue with the last tranche of payment because over £1.5 million as already been spent on developing this navigation system. It would be a shame to waste all the time and resources that have been invested. Advise the CFO regarding whether she should authorize the £45,000 proposed expenditure. Use marginal cost-benefit analysis to explain your reasoning. hich of the following statements correctly describes your decision? DA The CFO should authorize the £45,000 expenditure to continue the project because the marginal cost-benefit analysis treats the £1.5 million as part of the project's initial capital outlay that can be recovered only if the project is implemented. OB. The CFO should not authorize the £45,000 expenditure to continue the project even if the project will generate a positive net present value. The marginal cost-benefit analysis treats the £1.5 million as a cost that is extremely unlikely to be recovered and the £45,000 expenditure will also become a cost unlikely to be recovered. OC. The CFO should authorize the £45,000 expenditure to continue the project if the project will generate a positive net present value. The marginal cost-benefit analysis treats the £1.5 million as a cost that is irrelevant to the current decision making. OD. The CFO should not authorize the £45,000 expenditure to continue the project because it is surpassed by the new technology. Though the marginal cost-benefit analysis treats the £1.5 million as a cost that is irrelevant to the current decision making, continuing the project would be inadvisable even if the £45,000 expenditure generates a positive net present value.

Pkg Acc Infor Systems MS VISIO CD

10th Edition

ISBN:9781133935940

Author:Ulric J. Gelinas

Publisher:Ulric J. Gelinas

Chapter17: Acquiring And Implementing Accounting Information Systems

Section: Chapter Questions

Problem 1SP

Related questions

Question

Transcribed Image Text:Question 4, Warm-Up 1-4 (static)

>

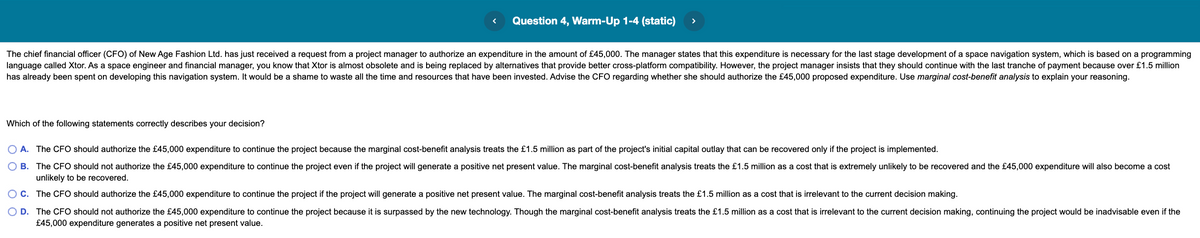

The chief financial officer (CFO) of New Age Fashion Ltd. has just received a request from a project manager to authorize an expenditure in the amount of £45,000. The manager states that this expenditure is necessary for the last stage development of a space navigation system, which is based on a programming

language called Xtor. As a space engineer and financial manager, you know that Xtor is almost obsolete and is being replaced by alternatives that provide better cross-platform compatibility. However, the project manager insists that they should continue with the last tranche of payment because over £1.5 million

has already been spent on developing this navigation system. It would be a shame to waste all the time and resources that have been invested. Advise the CFO regarding whether she should authorize the £45,000 proposed expenditure. Use marginal cost-benefit analysis to explain your reasoning.

Which of the following statements correctly describes your decision?

A. The CFO should authorize the £45,000 expenditure to continue the project because the marginal cost-benefit analysis treats the £1.5 million as part of the project's initial capital outlay that can be recovered only if the project is implemented.

B. The CFO should not authorize the £45,000 expenditure to continue the project even if the project will generate a positive net present value. The marginal cost-benefit analysis treats the £1.5 million as a cost that is extremely unlikely to be recovered and the £45,000 expenditure will also become a cost

unlikely to be recovered.

OC. The CFO should authorize the £45,000 expenditure to continue the project if the project will generate a positive net present value. The marginal cost-benefit analysis treats the £1.5 million as a cost that is irrelevant to the current decision making.

O D. The CFO should not authorize the £45,000 expenditure to continue the project because it is surpassed by the new technology. Though the marginal cost-benefit analysis treats the £1.5 million as a cost that is irrelevant to the current decision making, continuing the project would be inadvisable even if the

£45,000 expenditure generates a positive net present value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub