he following transactions occurred during the month of June 2021 for the Stridewell Corporation. The company owns and operates a etail shoe store. 1. Issued 140,000 shares of common stock in exchange for $700.000 cash. 2. Purchased office equipment at a cost of $113,750. $45,500 was paid in cash and a note payable was signed for the balance owed. 3. Purchased inventory on account at a cost of $280,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $476.000. The cost of the goods sold was $238.000. 5. Paid $6,500 in rent on the store building for the month of June. S. Paid $3.360 to an insurance company for fire and liability insurance for a one-year period beginning June 1, 2021. 7. Paid $202,300 on account for the merchandise purchased in 3. B. Collected $95.200 from customers on account. 9. Paid shareholders a cash dividend of $7.000. D. Recorded depreciation expense of $2.275 for the month on the office equipment. 1. Recorded the amount of prepaid insurance that expired for the month. required: repare journal entries to record each of the transactions and events listed above. (If no entry Is required for a transaction/event,

he following transactions occurred during the month of June 2021 for the Stridewell Corporation. The company owns and operates a etail shoe store. 1. Issued 140,000 shares of common stock in exchange for $700.000 cash. 2. Purchased office equipment at a cost of $113,750. $45,500 was paid in cash and a note payable was signed for the balance owed. 3. Purchased inventory on account at a cost of $280,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $476.000. The cost of the goods sold was $238.000. 5. Paid $6,500 in rent on the store building for the month of June. S. Paid $3.360 to an insurance company for fire and liability insurance for a one-year period beginning June 1, 2021. 7. Paid $202,300 on account for the merchandise purchased in 3. B. Collected $95.200 from customers on account. 9. Paid shareholders a cash dividend of $7.000. D. Recorded depreciation expense of $2.275 for the month on the office equipment. 1. Recorded the amount of prepaid insurance that expired for the month. required: repare journal entries to record each of the transactions and events listed above. (If no entry Is required for a transaction/event,

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 20PC: Analyzing Transactions. Using the analytical framework, indicate the effect of the following related...

Related questions

Question

please journalise all transactions that is needed thnx

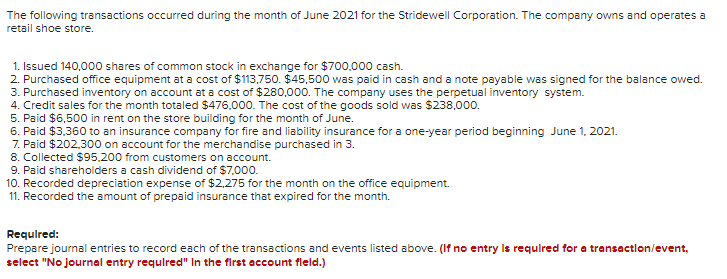

Transcribed Image Text:The following transactions occurred during the month of June 2021 for the Stridewell Corporation. The company owns and operates a

retail shoe store.

1. Issued 140,000 shares of common stock in exchange for $700.000 cash.

2. Purchased office equipment at a cost of $113,750. $45,500 was paid in cash and a note payable was signed for the balance owed.

3. Purchased inventory on account at a cost of $280,000. The company uses the perpetual inventory system.

4. Credit sales for the month totaled $476.000. The cost of the goods sold was $238,000.

5. Paid $6,500 in rent on the store building for the month of June.

6. Paid $3.360 to an insurance company for fire and liability insurance for a one-year period beginning June 1, 2021.

7. Paid $202,300 on account for the merchandise purchased in 3.

8. Collected $95.200 from customers on account.

9. Paid shareholders a cash dividend of $7.000.

10. Recorded depreciation expense of $2,275 for the month on the office equipment.

11. Recorded the amount of prepaid insurance that expired for the month.

Required:

Prepare journal entries to record each of the transactions and events listed above. (If no entry Is requlred for a transactlon/event,

select "No journal entry requlred" In the first account fleld.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning