he management of the Keribels Company wishes to apply hodel to manage its cash investments. They have determir ost of either investing in or selling marketable securities i poking at the Keribels Company's past cash needs, they ha hat the variance of daily cash flow is P 75,000. Keribels Co pportunity cost of cash per day is 0.05%. Based on their ash balance should not fall below P 50,00O. WHAT IS THE OINT?(Use a number, no decimal value, no currency, n sp

he management of the Keribels Company wishes to apply hodel to manage its cash investments. They have determir ost of either investing in or selling marketable securities i poking at the Keribels Company's past cash needs, they ha hat the variance of daily cash flow is P 75,000. Keribels Co pportunity cost of cash per day is 0.05%. Based on their ash balance should not fall below P 50,00O. WHAT IS THE OINT?(Use a number, no decimal value, no currency, n sp

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter23: Other Topics In Working Capital Management

Section: Chapter Questions

Problem 11MC

Related questions

Question

100%

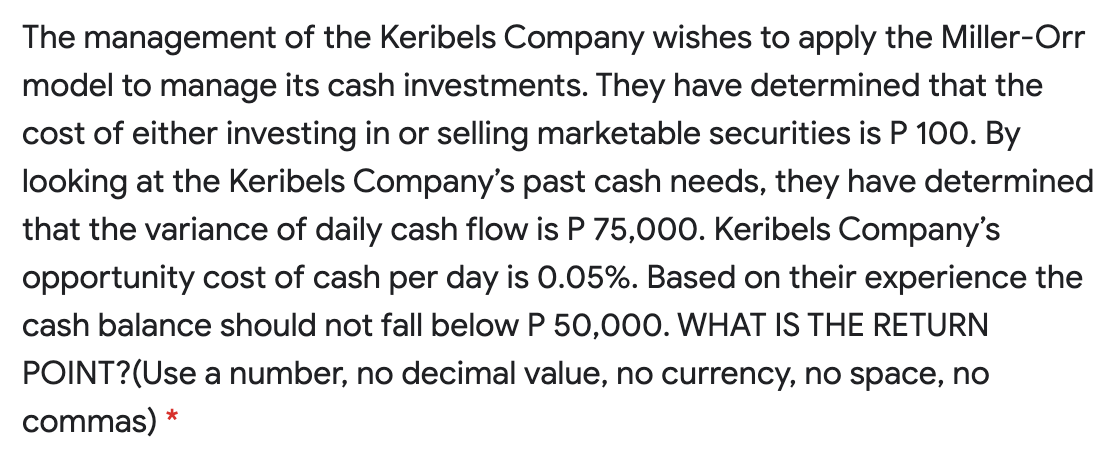

Transcribed Image Text:The management of the Keribels Company wishes to apply the Miller-Orr

model to manage its cash investments. They have determined that the

cost of either investing in or selling marketable securities is P 100. By

looking at the Keribels Company's past cash needs, they have determined

that the variance of daily cash flow is P 75,000. Keribels Company's

opportunity cost of cash per day is 0.05%. Based on their experience the

cash balance should not fall below P 50,000. WHAT IS THE RETURN

POINT?(Use a number, no decimal value, no currency, no space, no

commas) *

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College