he maximum amount a taxpayer may claim for the lifetime learning credit is: O $2,000 per return. $2,000 per qualifying student. $2,500 per return. $2,500 per qualifying student.

he maximum amount a taxpayer may claim for the lifetime learning credit is: O $2,000 per return. $2,000 per qualifying student. $2,500 per return. $2,500 per qualifying student.

Chapter5: Deductions For And From Agi

Section: Chapter Questions

Problem 26MCQ

Related questions

Question

100%

Would you please help me to answer this questions I send in picture?

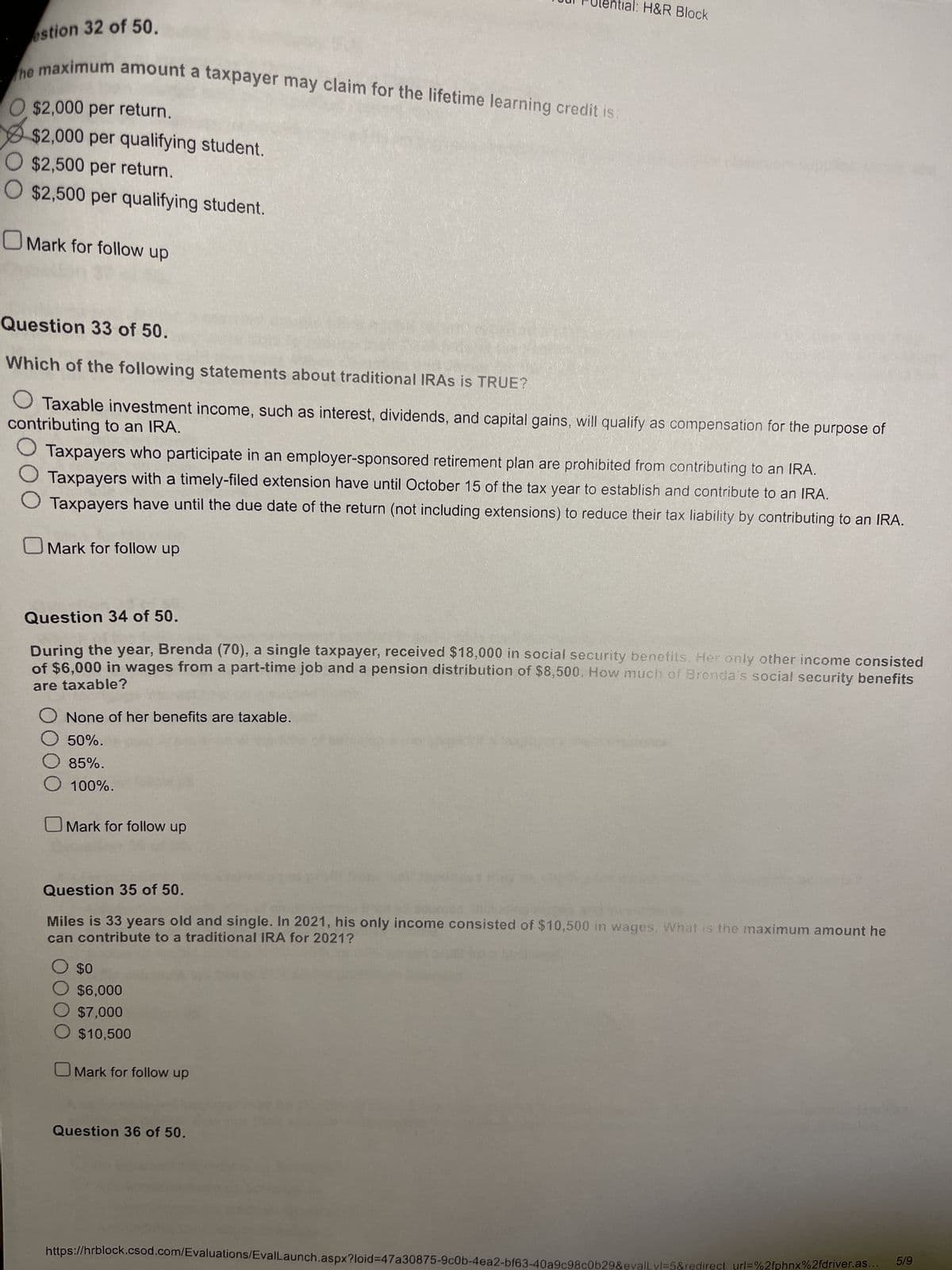

Transcribed Image Text:estion 32 of 50.

$2,000 per return.

$2,000 per qualifying student.

The maximum amount a taxpayer may claim for the lifetime learning credit is:

$2,500 per return.

O $2,500 per qualifying student.

OMark for follow up

Question 33 of 50.

Which of the following statements about traditional IRAs is TRUE?

contributing to an IRA.

Taxable investment income, such as interest, dividends, and capital gains, will qualify as compensation for the purpose of

Taxpayers who participate in an employer-sponsored retirement plan are prohibited from contributing to an IRA.

Taxpayers with a timely-filed extension have until October 15 of the tax year to establish and contribute to an IRA.

Taxpayers have until the due date of the return (not including extensions) to reduce their tax liability by contributing to an IRA.

Mark for follow up

Question 34 of 50.

During the year, Brenda (70), a single taxpayer, received $18,000 in social security benefits. Her only other income consisted

of $6,000 in wages from a part-time job and a pension distribution of $8,500. How much of Brenda's social security benefits

are taxable?

None of her benefits are taxable.

50%.

85%.

O 100%.

ntial: H&R Block

Mark for follow up

Question 35 of 50.

Miles is 33 years old and single. In 2021, his only income consisted of $10,500 in wages. What is the maximum amount he

can contribute to a traditional IRA for 2021?

$0

$6,000

$7,000

$10,500

Mark for follow up

Question 36 of 50.

https://hrblock.csod.com/Evaluations/EvalLaunch.aspx?loid-47a30875-9c0b-4ea2-bf63-40a9c98c0b29&evallvl=5&redirect_url=%2fphnx%2fdriver.as..

5/9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you