Lump-Sum Purchases; Issuance of Stock for Plant Assets 10.32 A package consisting of building and land is bought at a lump-sum price of $70,000. The FMV of the building and land is $60,000 and $20,000, respectively. Allocate the cost to each item and prepare a jour- nal entry.

Lump-Sum Purchases; Issuance of Stock for Plant Assets 10.32 A package consisting of building and land is bought at a lump-sum price of $70,000. The FMV of the building and land is $60,000 and $20,000, respectively. Allocate the cost to each item and prepare a jour- nal entry.

Chapter2: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 14SP

Related questions

Question

10.32 and 10.33 please.

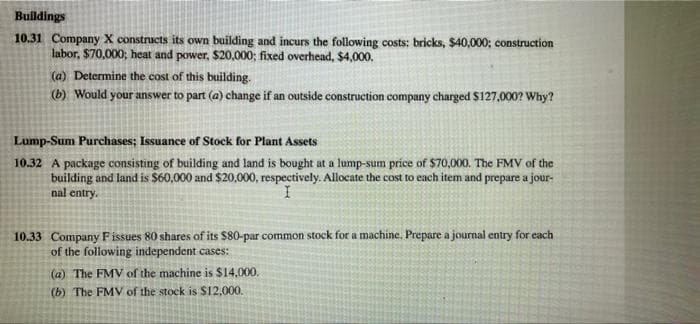

Transcribed Image Text:Buildings

10.31 Company X constructs its own building and incurs the following costs: bricks, $40,000; construction

labor, $70,000; heat and power, $20,000; fixed overhead, $4,000.

(a) Determine the cost of this building.

(b) Would your answer to part (a) change if an outside construction company charged $127,000? Why?

Lump-Sum Purchases; Issuance of Stock for Plant Assets

10.32 A package consisting of building and land is bought at a lump-sum price of $70,000. The FMV of the

building and land is $60,000 and $20,000, respectively. Allocate the cost to each item and prepare a jour-

nal entry.

10.33 Company Fissues 80 shares of its $80-par common stock for a machine. Prepare a journal entry for each

of the following independent cases:

(a) The FMV of the machine is $14,000.

(b) The FMV of the stock is $12,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning