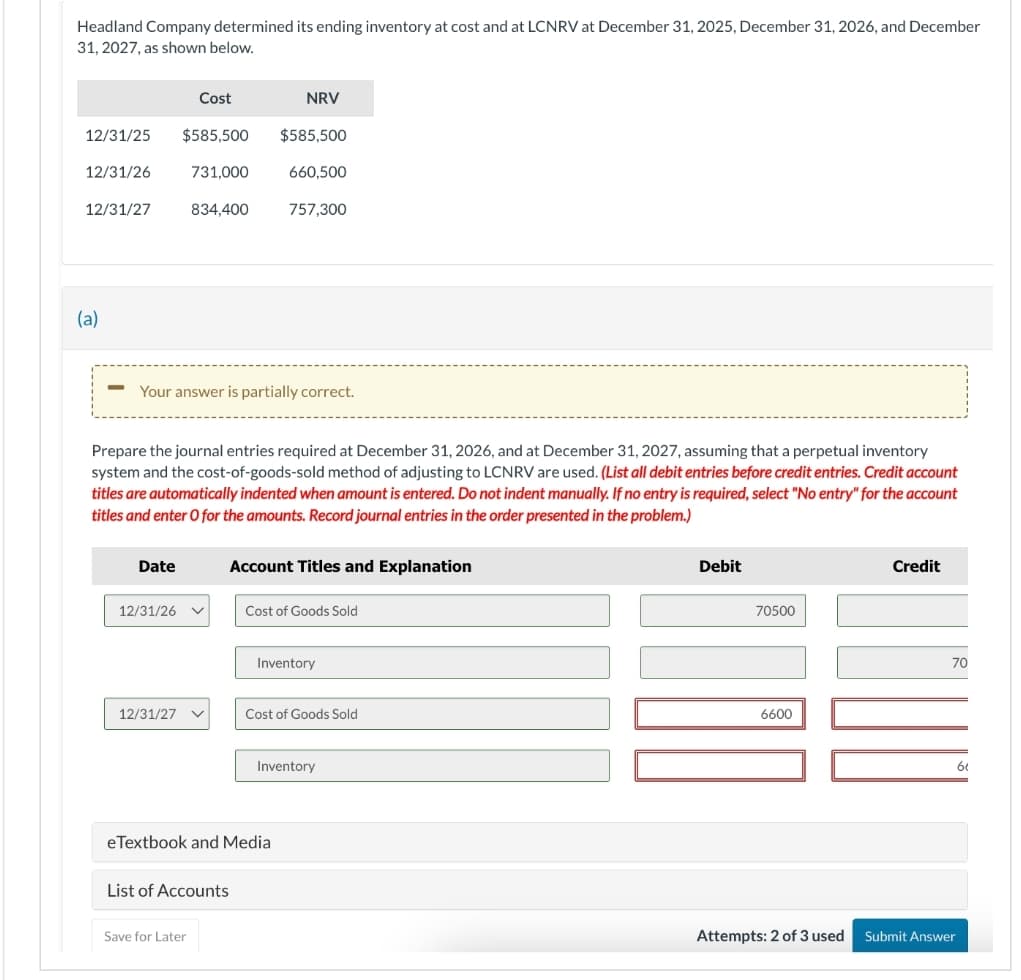

Headland Company determined its ending inventory at cost and at LCNRV at December 31, 2025, December 31, 2026, and December 31, 2027, as shown below. 12/31/25 12/31/26 12/31/27 Cost $585,500 731,000 834,400 NRV $585,500 660,500 757,300

Headland Company determined its ending inventory at cost and at LCNRV at December 31, 2025, December 31, 2026, and December 31, 2027, as shown below. 12/31/25 12/31/26 12/31/27 Cost $585,500 731,000 834,400 NRV $585,500 660,500 757,300

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 9RE: RE7-8 Johnson Company uses a perpetual inventory system. On October 23, Johnson purchased 100,000 of...

Related questions

Topic Video

Question

Subject- accounting

Transcribed Image Text:Headland Company determined its ending inventory at cost and at LCNRV at December 31, 2025, December 31, 2026, and December

31, 2027, as shown below.

12/31/25

12/31/26

12/31/27

(a)

Date

12/31/26

Cost

$585,500

12/31/27

731,000

834,400

Your answer is partially correct.

Save for Later

Prepare the journal entries required at December 31, 2026, and at December 31, 2027, assuming that a perpetual inventory

system and the cost-of-goods-sold method of adjusting to LCNRV are used. (List all debit entries before credit entries. Credit account

titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account

titles and enter O for the amounts. Record journal entries in the order presented in the problem.)

NRV

$585,500

List of Accounts

660,500

757,300

Account Titles and Explanation

eTextbook and Media

Cost of Goods Sold

Inventory

Cost of Goods Sold

Inventory

Debit

70500

6600

Attempts: 2 of 3 used

Credit

70

61

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning