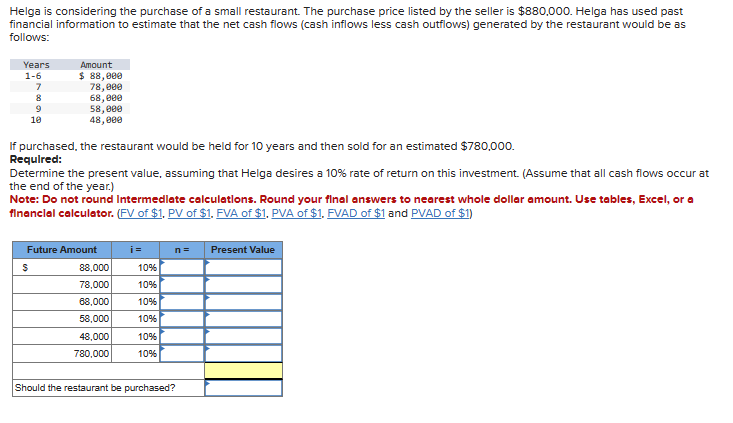

Helga is considering the purchase of a small restaurant. The purchase price listed by the seller is $880,000. Helga has used past financial information to estimate that the net cash flows (cash inflows less cash outflows) generated by the restaurant would be as follows: Years 1-6 7 8 9 10 Amount $ 88,000 78,000 68,000 58,000 48,000 If purchased, the restaurant would be held for 10 years and then sold for an estimated $780,000. Required: Determine the present value, assuming that Helga desires a 10% rate of return on this investment. (Assume that all cash flows occur at the end of the year.) Note: Do not round Intermediate calculations. Round your final answers to nearest whole dollar amount. Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Future Amount S 88,000 78,000 68,000 58,000 48,000 780,000 i= 10% 10% 10% 10% 10% 10% n= Present Value Should the restaurant be purchased?

Helga is considering the purchase of a small restaurant. The purchase price listed by the seller is $880,000. Helga has used past financial information to estimate that the net cash flows (cash inflows less cash outflows) generated by the restaurant would be as follows: Years 1-6 7 8 9 10 Amount $ 88,000 78,000 68,000 58,000 48,000 If purchased, the restaurant would be held for 10 years and then sold for an estimated $780,000. Required: Determine the present value, assuming that Helga desires a 10% rate of return on this investment. (Assume that all cash flows occur at the end of the year.) Note: Do not round Intermediate calculations. Round your final answers to nearest whole dollar amount. Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Future Amount S 88,000 78,000 68,000 58,000 48,000 780,000 i= 10% 10% 10% 10% 10% 10% n= Present Value Should the restaurant be purchased?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 9E: Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required:...

Related questions

Question

Subject: acounting

Transcribed Image Text:Helga is considering the purchase of a small restaurant. The purchase price listed by the seller is $880,000. Helga has used past

financial information to estimate that the net cash flows (cash inflows less cash outflows) generated by the restaurant would be as

follows:

Years

1-6

7

8

9

10

Amount

$ 88,000

78,000

68,000

58,000

48,000

If purchased, the restaurant would be held for 10 years and then sold for an estimated $780,000.

Required:

Determine the present value, assuming that Helga desires a 10% rate of return on this investment. (Assume that all cash flows occur at

the end of the year.)

Note: Do not round Intermediate calculations. Round your final answers to nearest whole dollar amount. Use tables, Excel, or a

financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Future Amount

$

88,000

78,000

68,000

58,000

48,000

780,000

i=

10%

10%

10%

10%

10%

10%

n= Present Value

Should the restaurant be purchased?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning