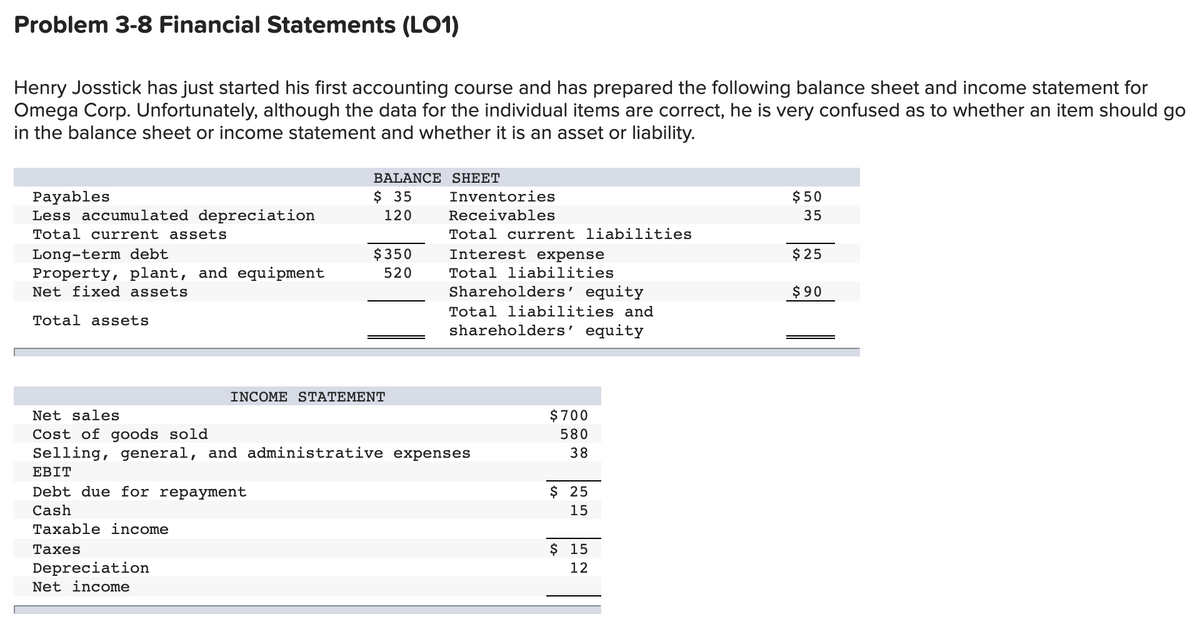

Henry Josstick has just started his first accounting course and has prepared the following balance sheet and income statement for Omega Corp. Unfortunately, although the data for the individual items are correct, he is very confused as to whether an item should go in the balance sheet or income statement and whether it is an asset or liability. BALANCE SHEET $ 35 Payables Less accumulated depreciation Total current assets Inventories $50 120 Receivables 35 Total current liabilities $25 Long-term debt Property, plant, and equipment Net fixed assets Interest expense Total liabilities Shareholders' equity $350 520 $90 Total liabilities and Total assets shareholders' equity INCOME STATEMENT Net sales $700 Cost of goods sold Selling, general, and administrative expenses 580 38 ЕBIT Debt due for repayment $ 25 Cash 15 Taxable income Taxes $ 15 Depreciation Net income 12

Henry Josstick has just started his first accounting course and has prepared the following balance sheet and income statement for Omega Corp. Unfortunately, although the data for the individual items are correct, he is very confused as to whether an item should go in the balance sheet or income statement and whether it is an asset or liability. BALANCE SHEET $ 35 Payables Less accumulated depreciation Total current assets Inventories $50 120 Receivables 35 Total current liabilities $25 Long-term debt Property, plant, and equipment Net fixed assets Interest expense Total liabilities Shareholders' equity $350 520 $90 Total liabilities and Total assets shareholders' equity INCOME STATEMENT Net sales $700 Cost of goods sold Selling, general, and administrative expenses 580 38 ЕBIT Debt due for repayment $ 25 Cash 15 Taxable income Taxes $ 15 Depreciation Net income 12

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 2.3P: P2-3 Financial statements The following amounts were taken from the accounting records of Padget...

Related questions

Question

Transcribed Image Text:Problem 3-8 Financial Statements (LO1)

Henry Josstick has just started his first accounting course and has prepared the following balance sheet and income statement for

Omega Corp. Unfortunately, although the data for the individual items are correct, he is very confused as to whether an item should go

in the balance sheet or income statement and whether it is an asset or liability.

BALANCE SHEET

$ 35

Payables

Less accumulated depreciation

Inventories

$50

120

Receivables

35

Total current assets

Total current liabilities

Interest expense

$ 25

Long-term debt

Property, plant, and equipment

$350

520

Total liabilities

Net fixed assets

Shareholders' equity

$90

Total liabilities and

Total assets

shareholders' equity

INCOME STATEMENT

Net sales

$700

Cost of goods sold

Selling, general, and administrative expenses

580

38

ЕBIT

Debt due for repayment

$ 25

Cash

15

Taxable income

Тахes

$ 15

Depreciation

12

Net income

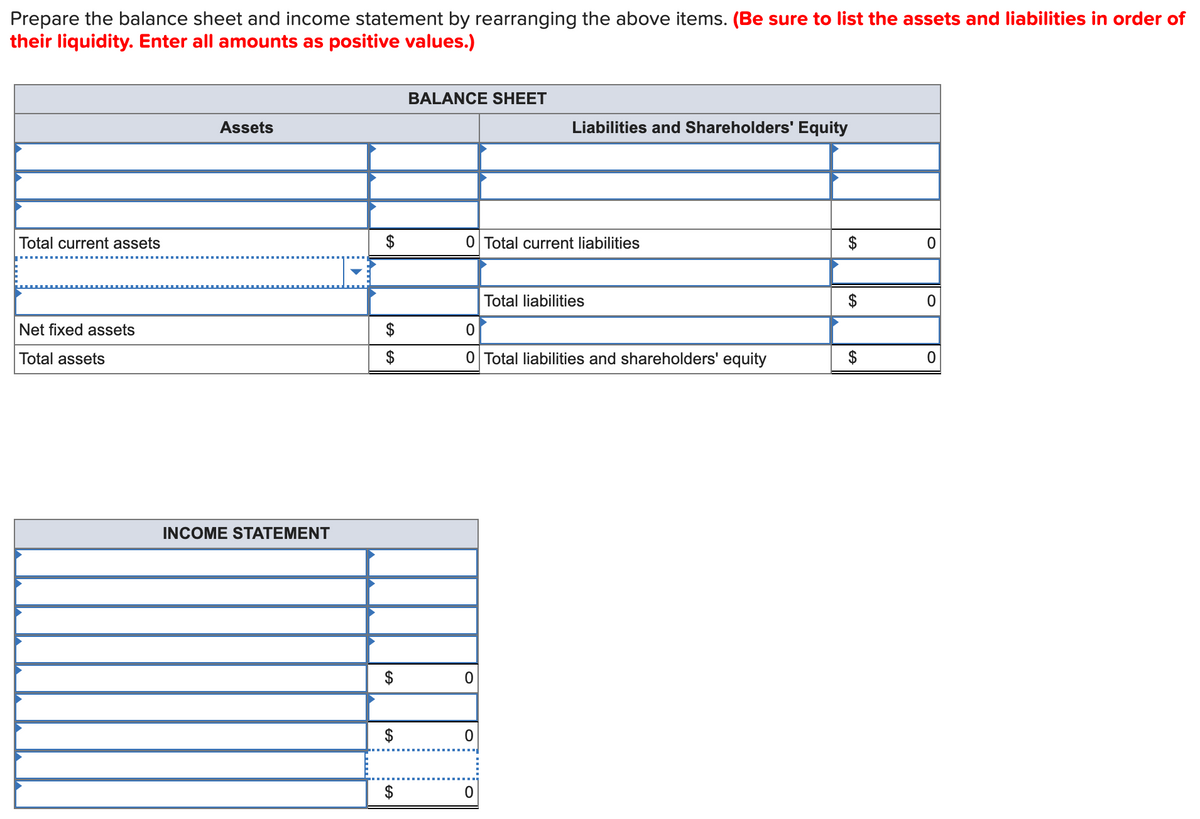

Transcribed Image Text:Prepare the balance sheet and income statement by rearranging the above items. (Be sure to list the assets and liabilities in order of

their liquidity. Enter all amounts as positive values.)

BALANCE SHEET

Assets

Liabilities and Shareholders' Equity

Total current assets

$

0 Total current liabilities

Total liabilities

Net fixed assets

$

Total assets

0 Total liabilities and shareholders' equity

INCOME STATEMENT

$

$

$

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning