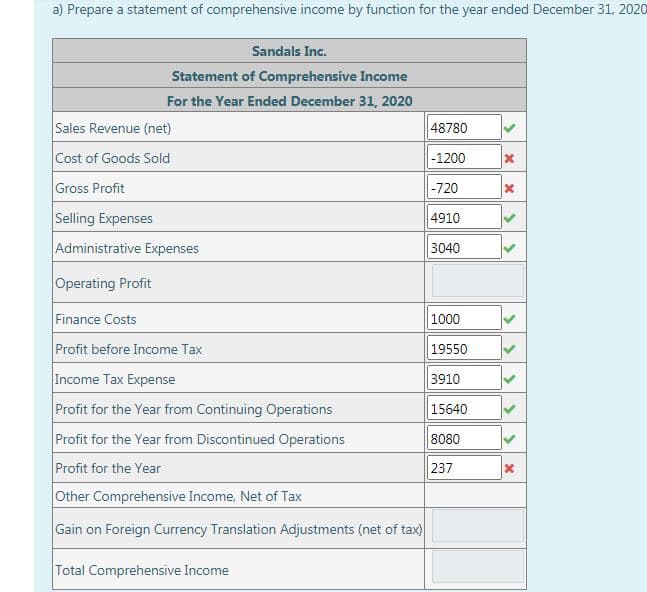

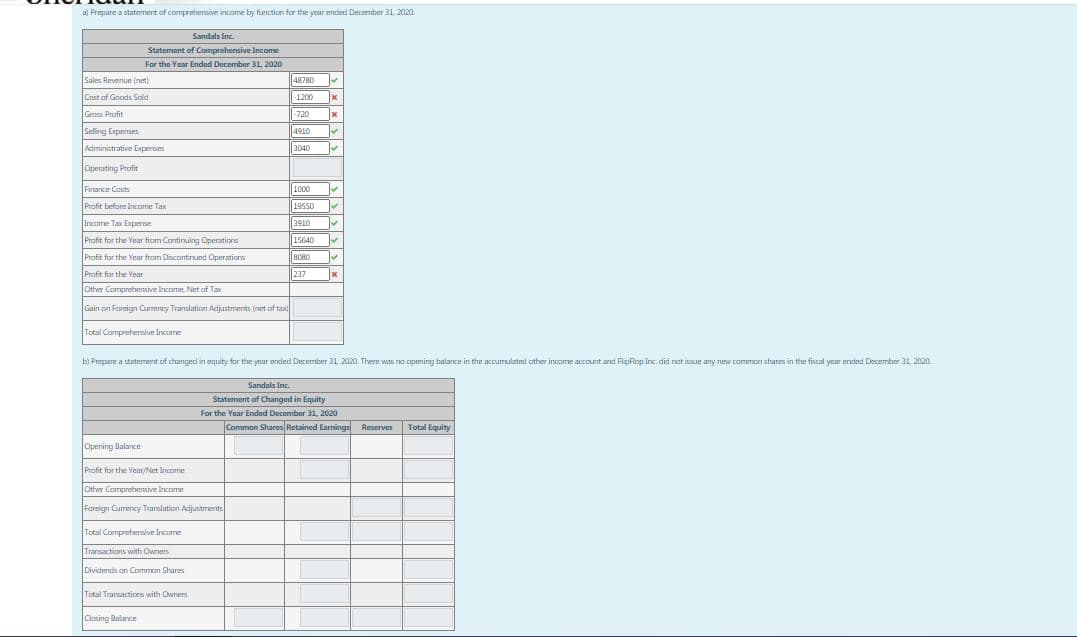

a) Prepare a statement of comprehensive income by function for the year ended December 31, 2020 Sandals Inc. Statement of Comprehensive Income For the Year Ended December 31, 2020 Sales Revenue (net) Cost of Goods Sold Gross Profit 48780 |-1200 -720 Selling Expenses Administrative Expenses 4910 3040 Operating Profit Finance Costs 1000 Profit before Income Tax 19550 Income Tax Expense 3910 Profit for the Year from Continuing Operations 15640 Profit for the Year from Discontinued Operations 8080 Profit for the Year 237 Other Comprehensive Income, Net of Tax Gain on Foreign Currency Translation Adjustments (net of tax) Total Comprehensive Income

Pls show me how to calculate each one. and show me full detail explanations. Dont JUST give me the answers. I need formulas and explanation. Thats more important than the solutions. Please I really need help. I failed both of my tests on accounting. I just dont get it. It's so hard.

List all the advertising, selling, expenses and what is the operating profit. I mainly need help with that.

Below is a list of balances for Sandals Inc. for the year ending December 31, 2020. All balances are in thousands of dollars. Sandals Inc. follows IFRS. Assume a tax rate of 20%. Exclude the presentation of earnings per share for this question.

Unlimited common shares are authorized and 2,700 have been issued and are currently outstanding.

The notes payable is payable over 5 years and $4,000 will be paid by December 31, 2021.

| Account Title | Balance |

| Accounts Payable | $9,800 |

| $12,900 | |

| $1,200 | |

| Advertising Expense | $1,200 |

| Cash | $19,900 |

| Cash Dividends | $3,500 |

| Common Shares | $9,500 |

| Cost of Goods Sold | $20,280 |

| Depreciation Expense-Office Equipment | $110 |

| Depreciation Expense-Store Equipment | $600 |

| Gain on Foreign Currency Translation Adjustments | $110 |

| Gain on Sale of Discontinued Operations | $1,800 |

| Income from Operating Discontinued Operations | $8,300 |

| Interest Expense | $1,000 |

| Merchandise Inventory | $19,600 |

| Miscellaneous Administrative Expenses | $540 |

| Notes Payable | $20,000 |

| Office Salaries Expense | $1,800 |

| Prepaid Insurance | $2,000 |

| Property, Plant and Equipment | $26,700 |

| Rent Expense-Office | $590 |

| Rent Expense-Retail | $1,210 |

| $18,892 | |

| Sales Salaries Expense | $1,900 |

| Sales Discounts | $1,200 |

| Sales Returns and Allowances | $720 |

| Sales Revenue | $50,700 |

| Unearned Revenue | $1,400 |

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images