Here are the changes to the original problem and the revised conditions for this decision-making problem: With a favorable market, John Thompson thinks a large facility would result in a net profit of $190,000 to his firm.

Here are the changes to the original problem and the revised conditions for this decision-making problem: With a favorable market, John Thompson thinks a large facility would result in a net profit of $190,000 to his firm.

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Question

Problem A please

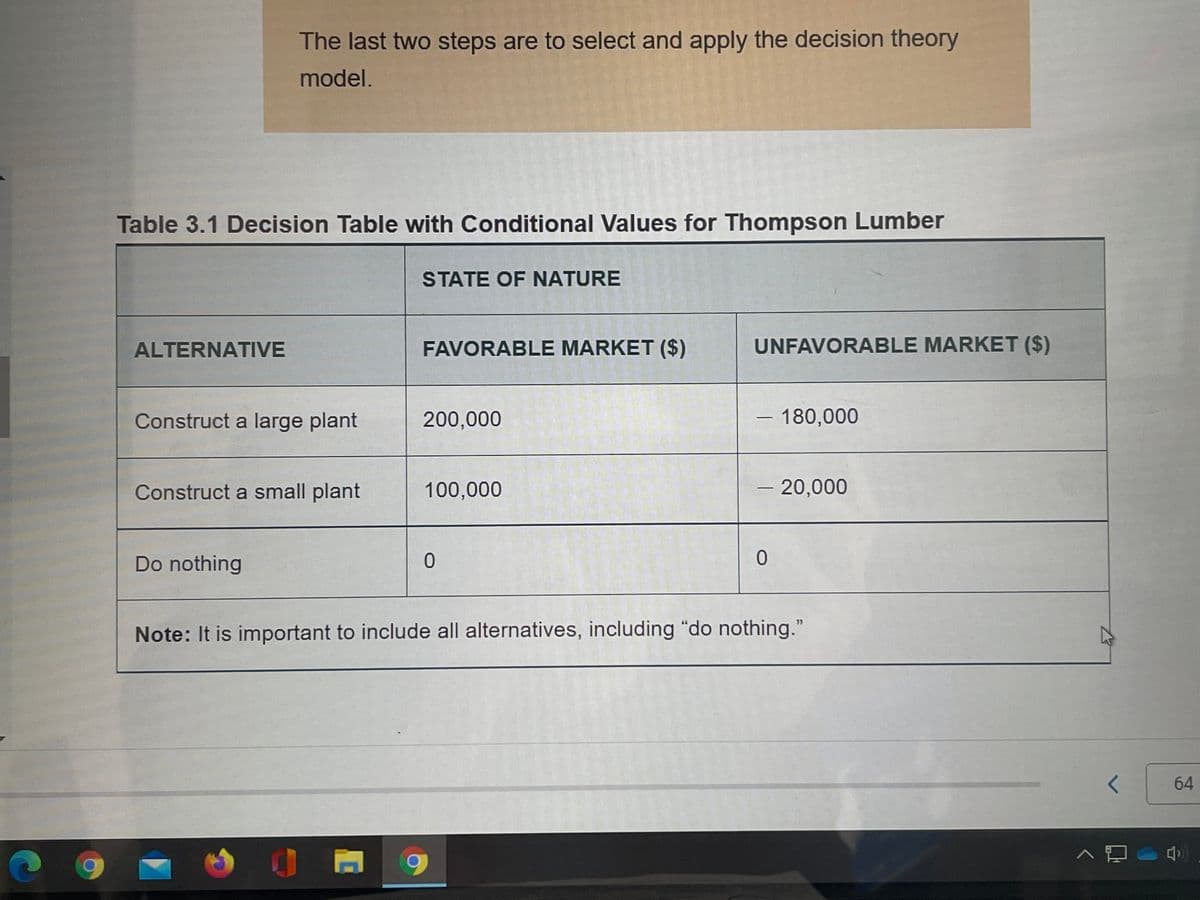

Transcribed Image Text:The last two steps are to select and apply the decision theory

model.

Table 3.1 Decision Table with Conditional Values for Thompson Lumber

STATE OF NATURE

ALTERNATIVE

FAVORABLE MARKET ($)

UNFAVORABLE MARKET ($)

Construct a large plant

200,000

-180,000

Construct a small plant

100,000

-20,000

Do nothing

35

Note: It is important to include all alternatives, including "do nothing."

64

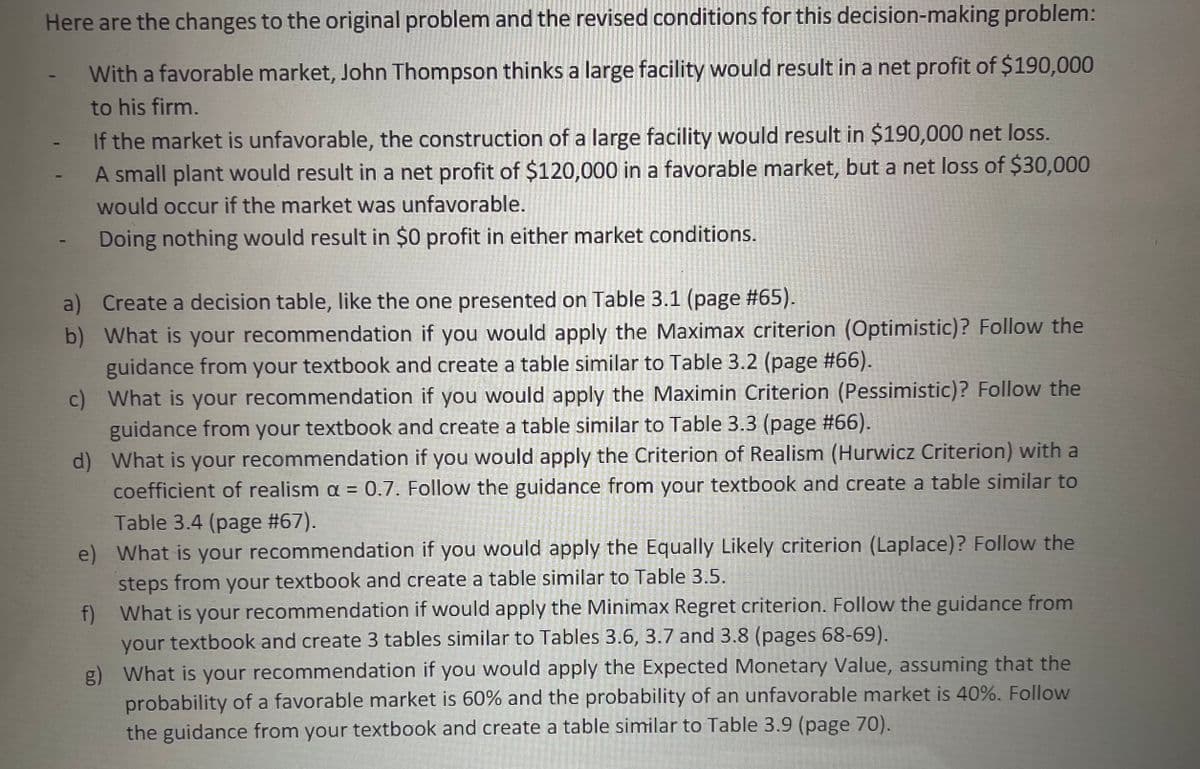

Transcribed Image Text:Here are the changes to the original problem and the revised conditions for this decision-making problem:

With a favorable market, John Thompson thinks a large facility would result in a net profit of $190,000

to his firm.

If the market is unfavorable, the construction of a large facility would result in $190,000 net loss.

A small plant would result in a net profit of $120,000 in a favorable market, but a net loss of $30,000

would occur if the market was unfavorable.

Doing nothing would result in $0 profit in either market conditions.

a) Create a decision table, like the one presented on Table 3.1 (page #65).

b) What is your recommendation if you would apply the Maximax criterion (Optimistic)? Follow the

guidance from your textbook and create a table similar to Table 3.2 (page #66).

c) What is your recommendation if you would apply the Maximin Criterion (Pessimistic)? Follow the

guidance from your textbook and create a table similar to Table 3.3 (page #66).

d) What is your recommendation if you would apply the Criterion of Realism (Hurwicz Criterion) with a

coefficient of realism a = 0.7. Follow the guidance from your textbook and create a table similar to

Table 3.4 (page #67).

e) What is your recommendation if you would apply the Equally Likely criterion (Laplace)? Follow the

steps from your textbook and create a table similar to Table 3.5.

f) What is your recommendation if would apply the Minimax Regret criterion. Follow the guidance from

your textbook and create 3 tables similar to Tables 3.6, 3.7 and 3.8 (pages 68-69).

g) What is your recommendation if you would apply the Expected Monetary Value, assuming that the

probability of a favorable market is 60% and the probability of an unfavorable market is 40%. Follow

the guidance from your textbook and create a table similar to Table 3.9 (page 70).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,