Here is Flounder Company's portfolio of long-term stock investments at December 31, 2021, the end of its first year of operations. 1.260 shares of Batone Inc. common stock 1,080 shares of Mendez Corporation common stock 720 shares of P. Tillman Corporation preferred stock Cost $66.150 On December 31, the total cost of the portfolio equaled the total fair value. Flounder had the following transactions related to the securities during 2022. Feb. 75,600 30,240 Jan. 20 Sold 1.260 shares of Batone Inc. common stock at $55 per share. 28 30 8 Purchased 360 shares of $10 par value common stock of P. Wahl Corporation at $78 per share. Received a cash dividend of $1.25 per share on Mendez Corporation common stock Received cash dividends of $0.40 per share on R. Tillman Corporation preferred stock. Sold all 720 shares of P. Tillman preferred stock at $35 per share. 18 July 30 Received a cash dividend of $1.10 per share on Mendez Corporation common stock Sept 6 Purchased an additional 540 shares of the $10 par value common stock of P. Wahl Corporation at $82 per share. 1 Received a cash dividend of $1,50 per share on P Wahl Corporation common stock. Dec

Here is Flounder Company's portfolio of long-term stock investments at December 31, 2021, the end of its first year of operations. 1.260 shares of Batone Inc. common stock 1,080 shares of Mendez Corporation common stock 720 shares of P. Tillman Corporation preferred stock Cost $66.150 On December 31, the total cost of the portfolio equaled the total fair value. Flounder had the following transactions related to the securities during 2022. Feb. 75,600 30,240 Jan. 20 Sold 1.260 shares of Batone Inc. common stock at $55 per share. 28 30 8 Purchased 360 shares of $10 par value common stock of P. Wahl Corporation at $78 per share. Received a cash dividend of $1.25 per share on Mendez Corporation common stock Received cash dividends of $0.40 per share on R. Tillman Corporation preferred stock. Sold all 720 shares of P. Tillman preferred stock at $35 per share. 18 July 30 Received a cash dividend of $1.10 per share on Mendez Corporation common stock Sept 6 Purchased an additional 540 shares of the $10 par value common stock of P. Wahl Corporation at $82 per share. 1 Received a cash dividend of $1,50 per share on P Wahl Corporation common stock. Dec

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 84PSB: Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following...

Related questions

Question

Please do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.

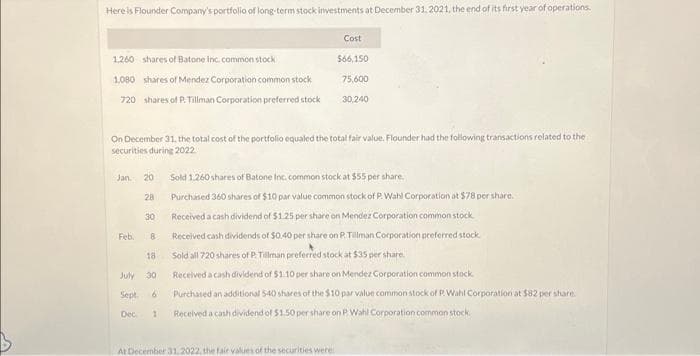

Transcribed Image Text:Here is Flounder Company's portfolio of long-term stock investments at December 31, 2021, the end of its first year of operations.

1,260 shares of Batone Inc. common stock

1,080 shares of Mendez Corporation common stock

720 shares of P. Tillman Corporation preferred stock

On December 31, the total cost of the portfolio equaled the total fair value. Flounder had the following transactions related to the

securities during 2022.

Jan. 201

Feb.

28

30

18

July 30

Sept. 6

Dec 1

Cost

$66,150

75,600

30,240

Sold 1.260 shares of Batone Inc. common stock at $55 per share.

Purchased 360 shares of $10 par value common stock of P. Wahl Corporation at $78 per share.

Received a cash dividend of $1.25 per share on Mendez Corporation common stock.

Received cash dividends of $0.40 per share on P. Tillman Corporation preferred stock.

Sold all 720 shares of P. Tillman preferred stock at $35 per share.

Received a cash dividend of $1.10 per share on Mendez Corporation common stock.

Purchased an additional 540 shares of the $10 par value common stock of P. Wahl Corporation at $82 per share.

Received a cash dividend of $1.50 per share on P Wahl Corporation common stock.

At December 31, 2022, the fair values of the securities were

Transcribed Image Text:"10

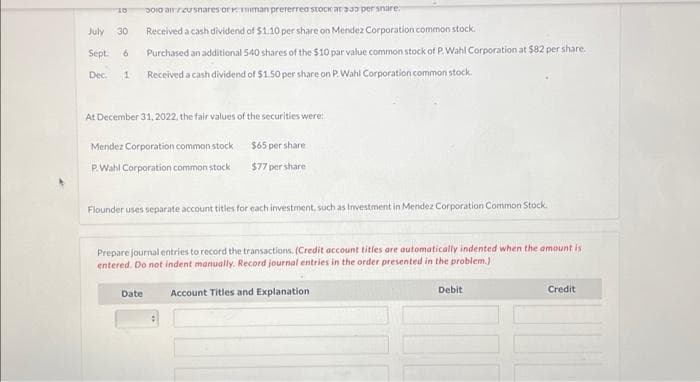

July 30

Sept. 6

Dec. 1

300 air/20shares or man preferred stock ar 330 per snare

Received a cash dividend of $1.10 per share on Mendez Corporation common stock.

Purchased an additional 540 shares of the $10 par value common stock of P.Wahl Corporation at $82 per share.

Received a cash dividend of $1.50 per share on P. Wahl Corporation common stock.

At December 31, 2022, the fair values of the securities were:

Mendez Corporation common stock

P.Wahl Corporation common stock

$65 per share

$77 per share

Flounder uses separate account titles for each investment, such as Investment in Mendez Corporation Common Stock

Date

Prepare journal entries to record the transactions. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually. Record journal entries in the order presented in the problem.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning