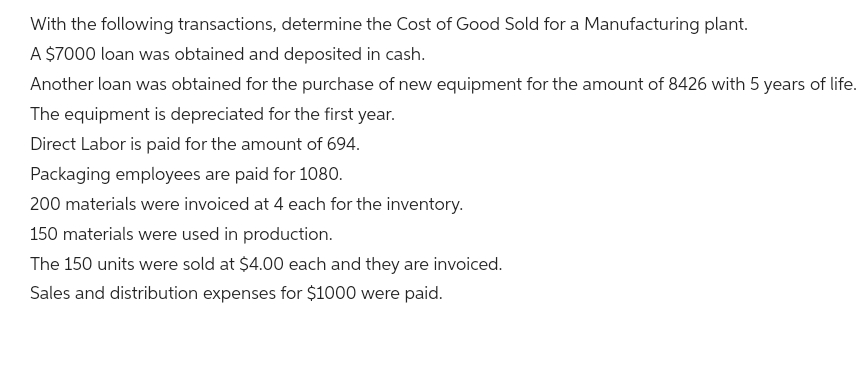

With the following transactions, determine the Cost of Good Sold for a Manufacturing plant. A $7000 loan was obtained and deposited in cash. Another loan was obtained for the purchase of new equipment for the amount of 8426 with 5 years of life. The equipment is depreciated for the first year. Direct Labor is paid for the amount of 694. Packaging employees are paid for 1080. 200 materials were invoiced at 4 each for the inventory. 150 materials were used in production. The 150 units were sold at $4.00 each and they are invoiced. Sales and distribution expenses for $1000 were paid.

With the following transactions, determine the Cost of Good Sold for a Manufacturing plant. A $7000 loan was obtained and deposited in cash. Another loan was obtained for the purchase of new equipment for the amount of 8426 with 5 years of life. The equipment is depreciated for the first year. Direct Labor is paid for the amount of 694. Packaging employees are paid for 1080. 200 materials were invoiced at 4 each for the inventory. 150 materials were used in production. The 150 units were sold at $4.00 each and they are invoiced. Sales and distribution expenses for $1000 were paid.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 2EB: Johnson, Incorporated had the following transactions during the year: Purchased a building for...

Related questions

Question

H2.

Account

Transcribed Image Text:With the following transactions, determine the Cost of Good Sold for a Manufacturing plant.

A $7000 loan was obtained and deposited in cash.

Another loan was obtained for the purchase of new equipment for the amount of 8426 with 5 years of life.

The equipment is depreciated for the first year.

Direct Labor is paid for the amount of 694.

Packaging employees are paid for 1080.

200 materials were invoiced at 4 each for the inventory.

150 materials were used in production.

The 150 units were sold at $4.00 each and they are invoiced.

Sales and distribution expenses for $1000 were paid.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning