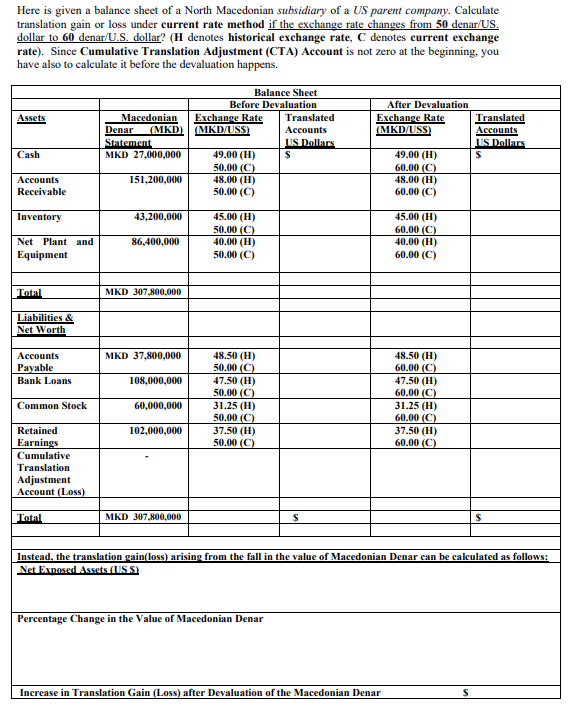

Here is given a balance sheet of a North Macedonian subsidiary of a US parent company. Calculate translation gain or loss under current rate method if the exchange rate changes from 50 denar/US. dollar to 60 denar/U.S. dollar? (H denotes historical exchange rate, C denotes current exchange rate). Since Cumulative Translation Adjustment (CTA) Account is not zero at the beginning. you have also to calculate it before the devaluation happens. Balance Sheet Macedonian (MKD) Before Devaluation Exchange Rate (MKD/USS) After Devaluation Exchange Rate (MKD/USS) Assets Translated Translated Denar Accounts Accounts US Dollars US Dollars Statement MKD 27,000,000 49.00 (H) 50.00 (C) 48.00 (H) 50.00 (C) 49.00 (H) 60.00 (C) 48.00 (H) 60.00 (C) Cash Accounts 151,200,000 Receivable 45.00 (H) 50.00 (C) 40.00 (H) 50.00 (C) Inventory 43,200,000 45.00 (H) 60.00 (C) 40.00 (H) 60.00 (C) Net Plant and 86,400,000 Equipment Total MKD 307,800,000 Liabilities & Net Worth 48.50 (H) 60.00 (C) 47.50 (H) 60.00 (C) Accounts MKD 37,800,000 48.50 (H) 50.00 (C) 47.50 (H) 50.00 (C) 31.25 (H) 50.00 (C) Payable Bank Loans 108,000,000 60,000,000 31.25 (H) 60.00 (C) Common Stock 37.50 (H) 50.00 (C) 37.50 (H) 60.00 (C) Retained 102,000,000 Earnings Cumulative Translation Adjustment Account (Loss) Total MKD 307,800,000 Instead, the translation gain(loss) arising from the fall in the value of Macedonian Denar can be calculated as follows: Net Exposed Assets (US $) Percentage Change in the Value of Macedonian Denar Increase in Translation Gain (Loss) after Devaluation of the Macedonian Denar

Here is given a balance sheet of a North Macedonian subsidiary of a US parent company. Calculate translation gain or loss under current rate method if the exchange rate changes from 50 denar/US. dollar to 60 denar/U.S. dollar? (H denotes historical exchange rate, C denotes current exchange rate). Since Cumulative Translation Adjustment (CTA) Account is not zero at the beginning. you have also to calculate it before the devaluation happens. Balance Sheet Macedonian (MKD) Before Devaluation Exchange Rate (MKD/USS) After Devaluation Exchange Rate (MKD/USS) Assets Translated Translated Denar Accounts Accounts US Dollars US Dollars Statement MKD 27,000,000 49.00 (H) 50.00 (C) 48.00 (H) 50.00 (C) 49.00 (H) 60.00 (C) 48.00 (H) 60.00 (C) Cash Accounts 151,200,000 Receivable 45.00 (H) 50.00 (C) 40.00 (H) 50.00 (C) Inventory 43,200,000 45.00 (H) 60.00 (C) 40.00 (H) 60.00 (C) Net Plant and 86,400,000 Equipment Total MKD 307,800,000 Liabilities & Net Worth 48.50 (H) 60.00 (C) 47.50 (H) 60.00 (C) Accounts MKD 37,800,000 48.50 (H) 50.00 (C) 47.50 (H) 50.00 (C) 31.25 (H) 50.00 (C) Payable Bank Loans 108,000,000 60,000,000 31.25 (H) 60.00 (C) Common Stock 37.50 (H) 50.00 (C) 37.50 (H) 60.00 (C) Retained 102,000,000 Earnings Cumulative Translation Adjustment Account (Loss) Total MKD 307,800,000 Instead, the translation gain(loss) arising from the fall in the value of Macedonian Denar can be calculated as follows: Net Exposed Assets (US $) Percentage Change in the Value of Macedonian Denar Increase in Translation Gain (Loss) after Devaluation of the Macedonian Denar

ChapterP2: Part 2: Exchange Rate Behavior

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Here is given a balance sheet of a North Macedonian subsidiary of a US parent company. Calculate

translation gain or loss under current rate method if the exchange rate changes from 50 denar/US.

dollar to 60 denar/U.S. dollar? (H denotes historical exchange rate, C denotes current exchange

rate). Since Cumulative Translation Adjustment (CTA) Account is not zero at the beginning, you

have also to calculate it before the devaluation happens.

Balance Sheet

Before Devaluation

Exchange Rate

(MKD) (MKD/USS)

After Devaluation

Exchange Rate

(MKD/USS)

Assets

Маccdonian

Denar

Statement

MKD 27,000,000

Translated

Translated

Ассounts

Ассounts

US Dollars

US Dollars

49.00 (H)

50.00 (C)

48.00 (H)

50.00 (C)

49.00 (H)

60.00 (C)

48.00 (H)

60.00 (C)

Cash

Ассounts

151,200,000

Receivable

45.00 (H)

50.00 (C)

40.00 (H)

50.00 (C)

45.00 (H)

60.00 (C)

40.00 (H)

60.00 (C)

Inventory

43,200,000

Net Plant and

86,400,000

Equipment

Tntal

MKD 307,800,000

Liabilities &

Net Worth

Ассounts

48.50 (H)

50.00 (C)

47.50 (H)

48.50 (H)

60.00 (C)

47.50 (H)

60.00 (C)

31.25 (H)

60.00 (C)

37.50 (H)

MKD 37,800,000

Payable

Bank Loans

108,000,000

50.00 (C)

31.25 (H)

50.00 (C)

37.50 (H)

50.00 (C)

Common Stock

60,000,000

Retained

102,000,000

Earnings

60.00 (C)

Cumulative

Translation

Adjustment

Account (Loss)

Tntal

MKD 307,800,000

Instead, the translation gain(loss) arising from the fall in the value of Macedonian Denar can be calculated as follows:

Net Exnosed Assets (US S)

Percentage Change in the Value of Macedonian Denar

Increase in Translation Gain (Loss) after Devaluation of the Macedonian Denar

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning