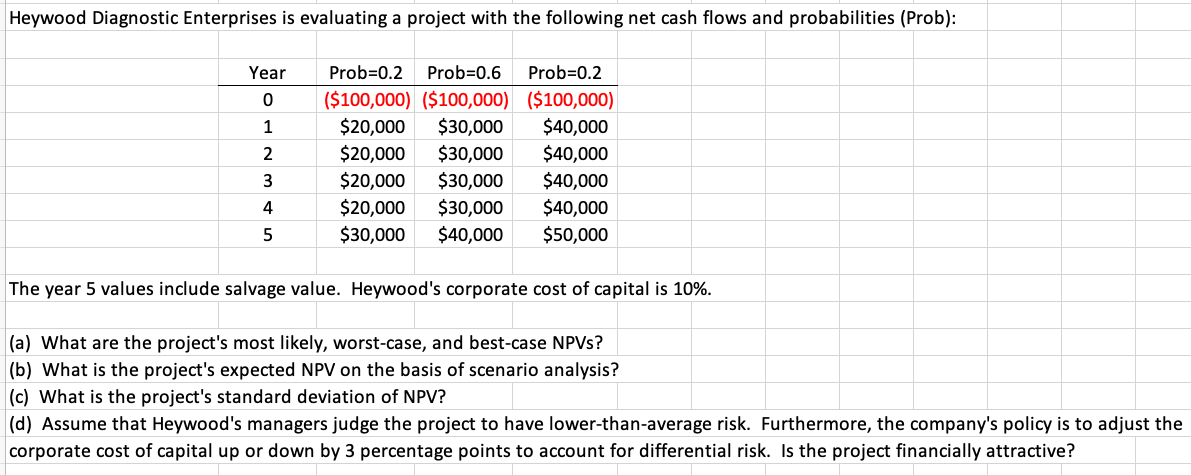

Heywood Diagnostic Enterprises is evaluating a project with the following net cash flows and probabilities (Prob): Year Prob=0.2 Prob=0.6 Prob=0.2 ($100,000) ($100,000) ($100,000) $40,000 $40,000 $40,000 $40,000 $50,000 $30,000 $20,000 $20,000 $20,000 1 $30,000 $30,000 $30,000 $40,000 2 3 $20,000 $30,000 4 The year 5 values include salvage value. Heywood's corporate cost of capital is 10%. (a) What are the project's most likely, worst-case, and best-case NPVS? (b) What is the project's expected NPV on the basis of scenario analysis?

Heywood Diagnostic Enterprises is evaluating a project with the following net cash flows and probabilities (Prob): Year Prob=0.2 Prob=0.6 Prob=0.2 ($100,000) ($100,000) ($100,000) $40,000 $40,000 $40,000 $40,000 $50,000 $30,000 $20,000 $20,000 $20,000 1 $30,000 $30,000 $30,000 $40,000 2 3 $20,000 $30,000 4 The year 5 values include salvage value. Heywood's corporate cost of capital is 10%. (a) What are the project's most likely, worst-case, and best-case NPVS? (b) What is the project's expected NPV on the basis of scenario analysis?

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 2STP

Related questions

Question

Please see attached

Transcribed Image Text:Heywood Diagnostic Enterprises is evaluating a project with the following net cash flows and probabilities (Prob):

Year

Prob=0.2

Prob=0.6

Prob=0.2

($100,000) ($100,000) ($100,000)

$30,000

$30,000

$30,000

$30,000

$40,000

$20,000

$20,000

$20,000

$20,000

$30,000

$40,000

$40,000

$40,000

$40,000

$50,000

1

2

3

4

5

The year 5 values include salvage value. Heywood's corporate cost of capital is 10%.

(a) What are the project's most likely, worst-case, and best-case NPVS?

(b) What is the project's expected NPV on the basis of scenario analysis?

(c) What is the project's standard deviation of NPV?

(d) Assume that Heywood's managers judge the project to have lower-than-average risk. Furthermore, the company's policy is to adjust the

corporate cost of capital up or down by 3 percentage points to account for differential risk. Is the project financially attractive?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College