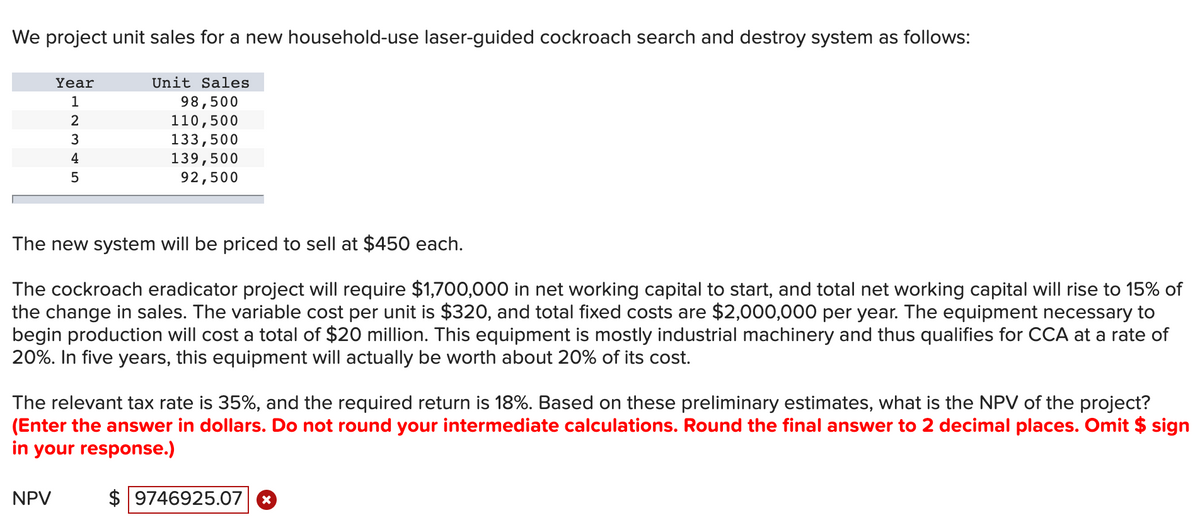

We project unit sales for a new household-use laser-guided cockroach search and destroy system as follows: Year Unit Sales 1 98,500 110,500 133,500 139,500 92,500 2 3 4 The new system will be priced to sell at $450 each. The cockroach eradicator project will require $1,700,000 in net working capital to start, and total net working capital will rise to 15% of the change in sales. The variable cost per unit is $320, and total fixed costs are $2,000,000 per year. The equipment necessary to begin production will cost a total of $20 million. This equipment is mostly industrial machinery and thus qualifies for CCA at a rate of 20%. In five years, this equipment will actually be worth about 20% of its cost. The relevant tax rate is 35%, and the required return is 18%. Based on these preliminary estimates, what is the NPV of the project?

We project unit sales for a new household-use laser-guided cockroach search and destroy system as follows: Year Unit Sales 1 98,500 110,500 133,500 139,500 92,500 2 3 4 The new system will be priced to sell at $450 each. The cockroach eradicator project will require $1,700,000 in net working capital to start, and total net working capital will rise to 15% of the change in sales. The variable cost per unit is $320, and total fixed costs are $2,000,000 per year. The equipment necessary to begin production will cost a total of $20 million. This equipment is mostly industrial machinery and thus qualifies for CCA at a rate of 20%. In five years, this equipment will actually be worth about 20% of its cost. The relevant tax rate is 35%, and the required return is 18%. Based on these preliminary estimates, what is the NPV of the project?

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1P: Talbot Industries is considering launching a new product. The new manufacturing equipment will cost...

Related questions

Question

Transcribed Image Text:We project unit sales for a new household-use laser-guided cockroach search and destroy system as follows:

Year

Unit Sales

1

98,500

110,500

133,500

139,500

92,500

2

3

4

5

The new system will be priced to sell at $450 each.

The cockroach eradicator project will require $1,700,000 in net working capital to start, and total net working capital will rise to 15% of

the change in sales. The variable cost per unit is $320, and total fixed costs are $2,000,000 per year. The equipment necessary to

begin production will cost a total of $20 million. This equipment is mostly industrial machinery and thus qualifies for CCA at a rate of

20%. In five years, this equipment will actually be worth about 20% of its cost.

The relevant tax rate is 35%, and the required return is 18%. Based on these preliminary estimates, what is the NPV of the project?

(Enter the answer in dollars. Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign

in your response.)

NPV

$ 9746925.07

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning