The following are the balance sheets of Jamaica Limited, Barbados Limited and Trinidad Limited, as at the 31 December 2019. The three companies are major players in the retail food industry. Jamaica Limited acquired 70% of the shares in Barbados Limited on January 1 2017 when the reserve balances were as follows: General reserves: $10,000 and retained earnings $12 000. The acquisition of Barbados Limited consisted of a cash payment of $600,000 to be settled in four years' time (cost of capital 8%) and a share exchange of 4 shares in Jamaica Limited for every 5 shares acquired in Barbados Limited. The market price for a Jamaica Limited share at that date was $2.80. To date the acquisition of Barbados Limited has not been recorded. On 1 July 2020 Jamaica Limited acquired 40,000 shares in Trinidad Limited for cash at a price of $2.20 per share. For the year ended 31 December 2019 Trinidad Limited reported a profit of $72,000 (assume profit accrued evenly during the year). Non-Current Assets Land Equipment Less Depreciation Me Vehicles Less Depreciation Investments Trinidad Ltd Current Assets Inventory Accounts receivable Prepayments Bank & cash EQUITY & LIABILITES $1 Ordinary shares Reserves General reserves Retained earnings Balance Sheet as at 31 December 2019 Jamaica Ltd $ Non-Current Liabilities 4% Debentures Current Liabilities Trade Payables Taxation 660, 000 24,000 550, 000 50,000 88,000 $ 145,000 173,000 1,200,000 336,000 300,000 1,836 000 445,000 320, 000 12,000 209,000 1,074, 000 2.910.000 1,200,000 170, 000 246, 000 976, 000 318,000 2.910.000 Barbados Ltd S S 100,000 10,000 000 40 000 25,000 40,000 7,000 40,000 8,000 38,000 300,000 90,000 160 000 550 000 112 000 662 000 200,000 30,000 24, 000 362,000 46.000 662.000 Trinidad Ltd S 70,000 10,000 30.000 15,000 8,000 2,000 13.000 15,000 7,000 $ 170,000 60,000 90,000 320,000 38,000 358,000 100,000 0 36,000 200,000 22,000 358.000

The following are the balance sheets of Jamaica Limited, Barbados Limited and Trinidad Limited, as at the 31 December 2019. The three companies are major players in the retail food industry. Jamaica Limited acquired 70% of the shares in Barbados Limited on January 1 2017 when the reserve balances were as follows: General reserves: $10,000 and retained earnings $12 000. The acquisition of Barbados Limited consisted of a cash payment of $600,000 to be settled in four years' time (cost of capital 8%) and a share exchange of 4 shares in Jamaica Limited for every 5 shares acquired in Barbados Limited. The market price for a Jamaica Limited share at that date was $2.80. To date the acquisition of Barbados Limited has not been recorded. On 1 July 2020 Jamaica Limited acquired 40,000 shares in Trinidad Limited for cash at a price of $2.20 per share. For the year ended 31 December 2019 Trinidad Limited reported a profit of $72,000 (assume profit accrued evenly during the year). Non-Current Assets Land Equipment Less Depreciation Me Vehicles Less Depreciation Investments Trinidad Ltd Current Assets Inventory Accounts receivable Prepayments Bank & cash EQUITY & LIABILITES $1 Ordinary shares Reserves General reserves Retained earnings Balance Sheet as at 31 December 2019 Jamaica Ltd $ Non-Current Liabilities 4% Debentures Current Liabilities Trade Payables Taxation 660, 000 24,000 550, 000 50,000 88,000 $ 145,000 173,000 1,200,000 336,000 300,000 1,836 000 445,000 320, 000 12,000 209,000 1,074, 000 2.910.000 1,200,000 170, 000 246, 000 976, 000 318,000 2.910.000 Barbados Ltd S S 100,000 10,000 000 40 000 25,000 40,000 7,000 40,000 8,000 38,000 300,000 90,000 160 000 550 000 112 000 662 000 200,000 30,000 24, 000 362,000 46.000 662.000 Trinidad Ltd S 70,000 10,000 30.000 15,000 8,000 2,000 13.000 15,000 7,000 $ 170,000 60,000 90,000 320,000 38,000 358,000 100,000 0 36,000 200,000 22,000 358.000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

100%

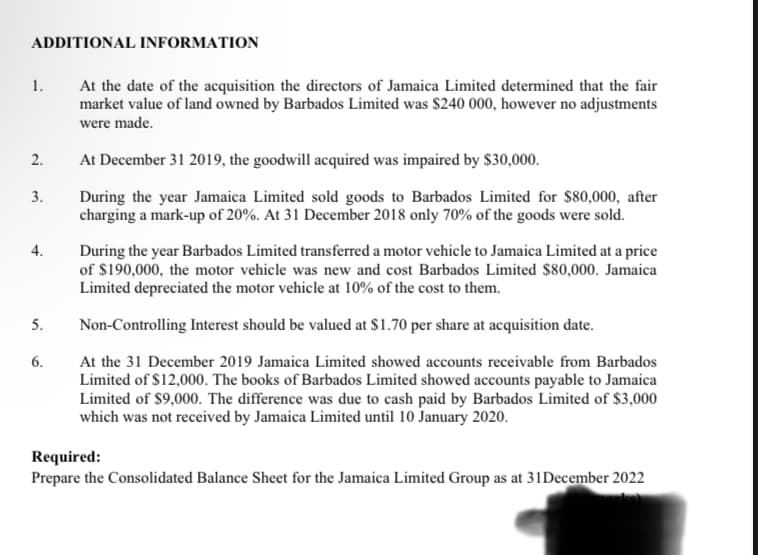

Transcribed Image Text:ADDITIONAL INFORMATION

1.

2.

3.

4.

5.

6.

At the date of the acquisition the directors of Jamaica Limited determined that the fair

market value of land owned by Barbados Limited was $240 000, however no adjustments

were made.

At December 31 2019, the goodwill acquired was impaired by $30,000.

During the year Jamaica Limited sold goods to Barbados Limited for $80,000, after

charging a mark-up of 20%. At 31 December 2018 only 70% of the goods were sold.

During the year Barbados Limited transferred a motor vehicle to Jamaica Limited at a price

of $190,000, the motor vehicle was new and cost Barbados Limited $80,000. Jamaica

Limited depreciated the motor vehicle at 10% of the cost to them.

Non-Controlling Interest should be valued at $1.70 per share at acquisition date.

At the 31 December 2019 Jamaica Limited showed accounts receivable from Barbados

Limited of $12,000. The books of Barbados Limited showed accounts payable to Jamaica

Limited of $9,000. The difference was due to cash paid by Barbados Limited of $3,000

which was not received by Jamaica Limited until 10 January 2020.

Required:

Prepare the Consolidated Balance Sheet for the Jamaica Limited Group as at 31 December 2022

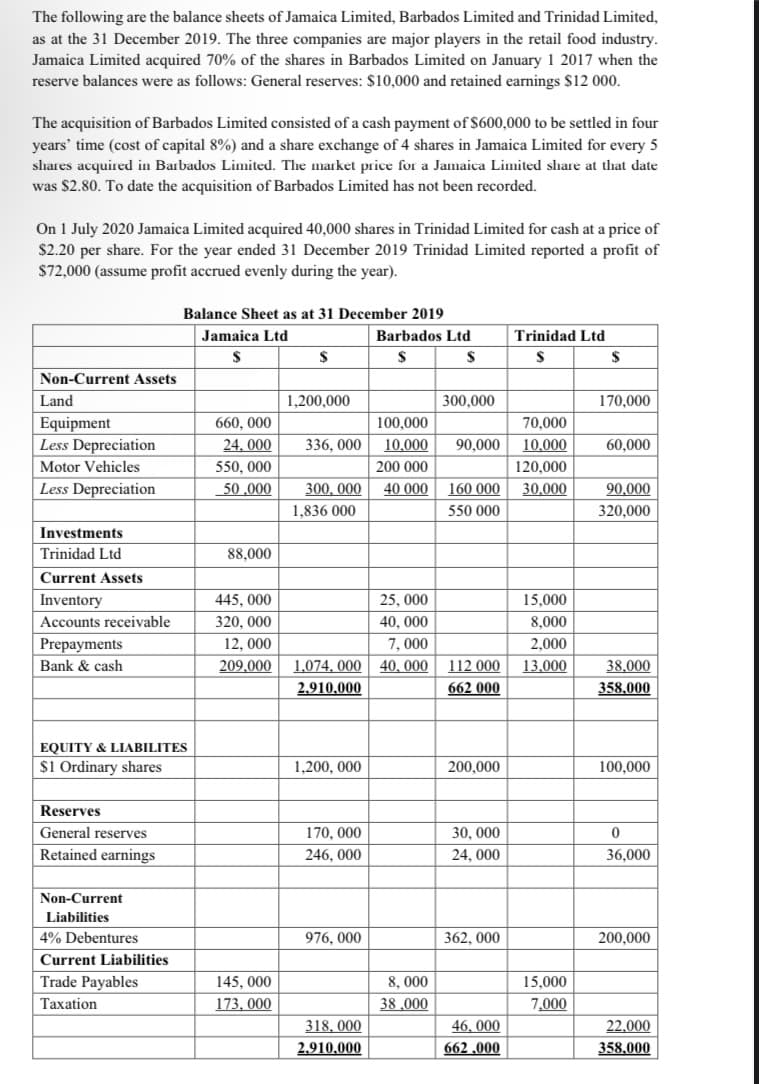

Transcribed Image Text:The following are the balance sheets of Jamaica Limited, Barbados Limited and Trinidad Limited,

as at the 31 December 2019. The three companies are major players in the retail food industry.

Jamaica Limited acquired 70% of the shares in Barbados Limited on January 1 2017 when the

reserve balances were as follows: General reserves: $10,000 and retained earnings $12 000.

The acquisition of Barbados Limited consisted of a cash payment of $600,000 to be settled in four

years' time (cost of capital 8%) and a share exchange of 4 shares in Jamaica Limited for every 5

shares acquired in Barbados Limited. The market price for a Jamaica Limited share at that date

was $2.80. To date the acquisition of Barbados Limited has not been recorded.

On 1 July 2020 Jamaica Limited acquired 40,000 shares in Trinidad Limited for cash at a price of

$2.20 per share. For the year ended 31 December 2019 Trinidad Limited reported a profit of

$72,000 (assume profit accrued evenly during the year).

Non-Current Assets

Land

Equipment

Less Depreciation

Motor Vehicles

Less Depreciation

Investments

Trinidad Ltd

Current Assets

Inventory

Accounts receivable

Prepayments

Bank & cash

EQUITY & LIABILITES

$1 Ordinary shares

Reserves

General reserves

Retained earnings

Non-Current

Liabilities

Balance Sheet as at 31 December 2019

Jamaica Ltd

$

4% Debentures

Current Liabilities

Trade Payables

Taxation

660, 000

24,000

550,000

50,000

88,000

$

145, 000

173,000

1,200,000

336, 000

300,000

1,836 000

445, 000

320, 000

12, 000

209.000 1,074, 000

2.910.000

1,200,000

170,000

246, 000

976, 000

318,000

2.910,000

Barbados Ltd

$

$

100,000

10,000

200 000

40 000

25,000

40,000

7,000

40,000

8,000

38,000

300,000

70,000

90,000 10,000

120,000

30,000

160 000

550 000

112 000

662 000

200,000

30, 000

24, 000

362, 000

Trinidad Ltd

S

46,000

662,000

15,000

8,000

2,000

13.000

15,000

7.000

$

170,000

60,000

90,000

320,000

38,000

358,000

100,000

0

36,000

200,000

22,000

358,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning