Hillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data assembled to assist in preparing the master budget for the first quarter: a. As of December 31 (the end of the prior quarter), the company's general ledger showed the following account balance Cash Accounts receivable Inventory Buildings and equipment (net) Accounts payable Common stock Retained earnings $ 47,000 205,600 58,800 357,000 $ 87,225 500,000 81,175 $ 668,400 $ 668,400 b. Actual sales for December and budgeted sales for the next four months are as follows: December(actual) January February March April $ 257,000 $ 392,000 $ 589,000 $303,000 $ 200,000 C. Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The acco receivable at December 31 are a result of December credit sales. d. The company's gross margin is 40% of sales. (In other words, cost of goods sold is 60% of sales.) e. Monthly expenses are budgeted as follows: salaries and wages, $22,000 per month: advertising, $62,000 per month; ship of sales; other expenses, 3% of sales. Depreciation, including depreciation on new assets acquired during the quarter, will E $43,220 for the quarter. f. Each month's ending inventory should equal 25% of the following month's cost of goods sold. g. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid in the following month. h. During February, the company will purchase a new copy machine for $1,700 cash. During March, other equipment will be pu for cash at a cost of $73,500. d vidondr

Hillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data assembled to assist in preparing the master budget for the first quarter: a. As of December 31 (the end of the prior quarter), the company's general ledger showed the following account balance Cash Accounts receivable Inventory Buildings and equipment (net) Accounts payable Common stock Retained earnings $ 47,000 205,600 58,800 357,000 $ 87,225 500,000 81,175 $ 668,400 $ 668,400 b. Actual sales for December and budgeted sales for the next four months are as follows: December(actual) January February March April $ 257,000 $ 392,000 $ 589,000 $303,000 $ 200,000 C. Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The acco receivable at December 31 are a result of December credit sales. d. The company's gross margin is 40% of sales. (In other words, cost of goods sold is 60% of sales.) e. Monthly expenses are budgeted as follows: salaries and wages, $22,000 per month: advertising, $62,000 per month; ship of sales; other expenses, 3% of sales. Depreciation, including depreciation on new assets acquired during the quarter, will E $43,220 for the quarter. f. Each month's ending inventory should equal 25% of the following month's cost of goods sold. g. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid in the following month. h. During February, the company will purchase a new copy machine for $1,700 cash. During March, other equipment will be pu for cash at a cost of $73,500. d vidondr

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 11CE: Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted...

Related questions

Question

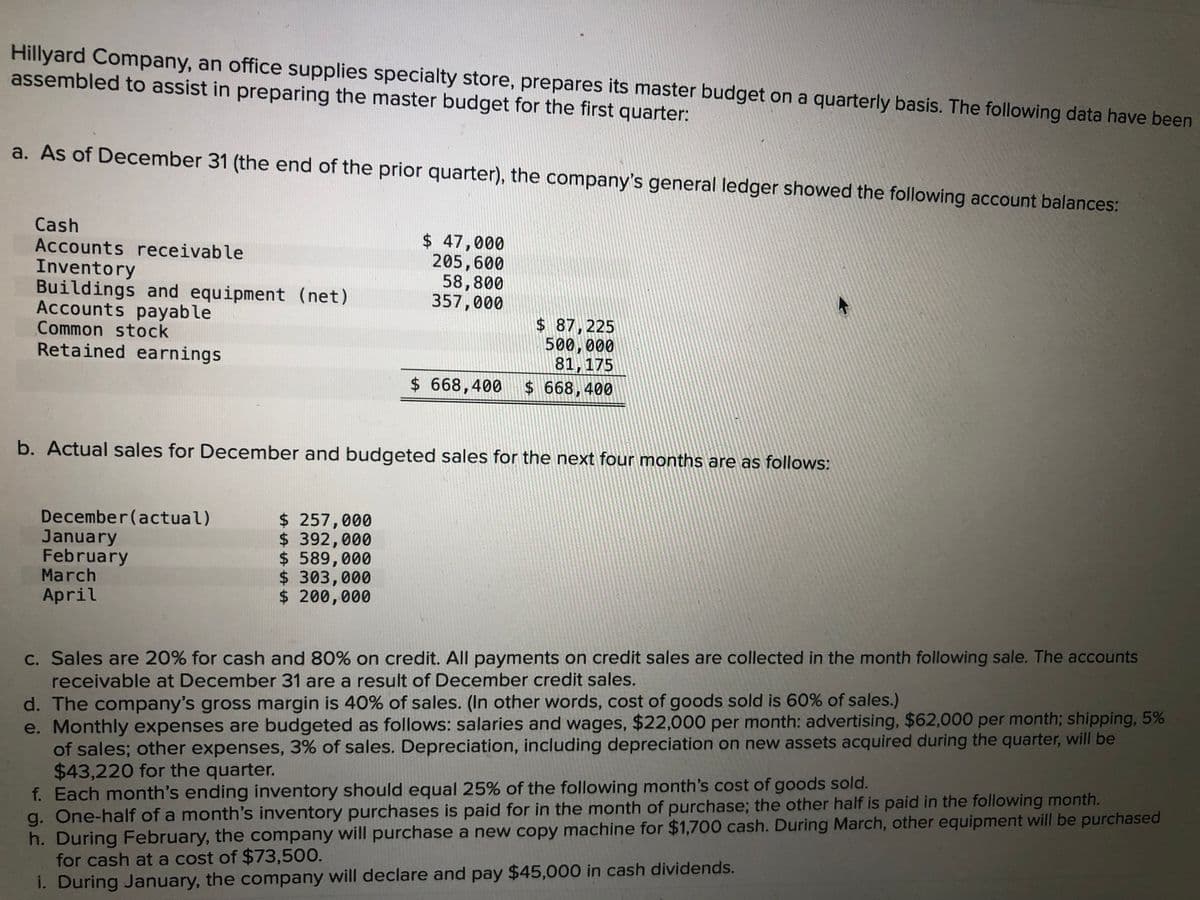

Transcribed Image Text:Hillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data have been

assembled to assist in preparing the master budget for the first quarter:

a. As of December 31 (the end of the prior quarter), the company's general ledger showed the following account balances:

Cash

Accounts receivable

Inventory

Buildings and equipment (net)

Accounts payable

Common stock

Retained earnings

$ 47,000

205,600

58,800

357,000

$ 87,225

500,000

81,175

$ 668,400 $ 668,400

b. Actual sales for December and budgeted sales for the next four months are as follows:

December(actual)

January

February

March

$ 257,000

$ 392,000

$ 589,000

$ 303,000

$ 200,000

April

c. Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The accounts

receivable at December 31 are a result of December credit sales.

d. The company's gross margin is 40% of sales. (In other words, cost of goods sold is 60% of sales.)

e. Monthly expenses are budgeted as follows: salaries and wages, $22,000 per month: advertising, $62,000 per month; shipping, 5%

of sales; other expenses, 3% of sales. Depreciation, including depreciation on new assets acquired during the quarter, will be

$43,220 for the quarter.

f. Each month's ending inventory should equal 25% of the following month's cost of goods sold.

g. One-half of a month's inventory purchases is paid for in the month of purchase; the other half is paid in the following month.

h. During February, the company will purchase a new copy machine for $1,700 cash. During March, other equipment will be purchased

for cash at a cost of $73,500.

i. During January, the company will declare and pay $45,000 in cash dividends.

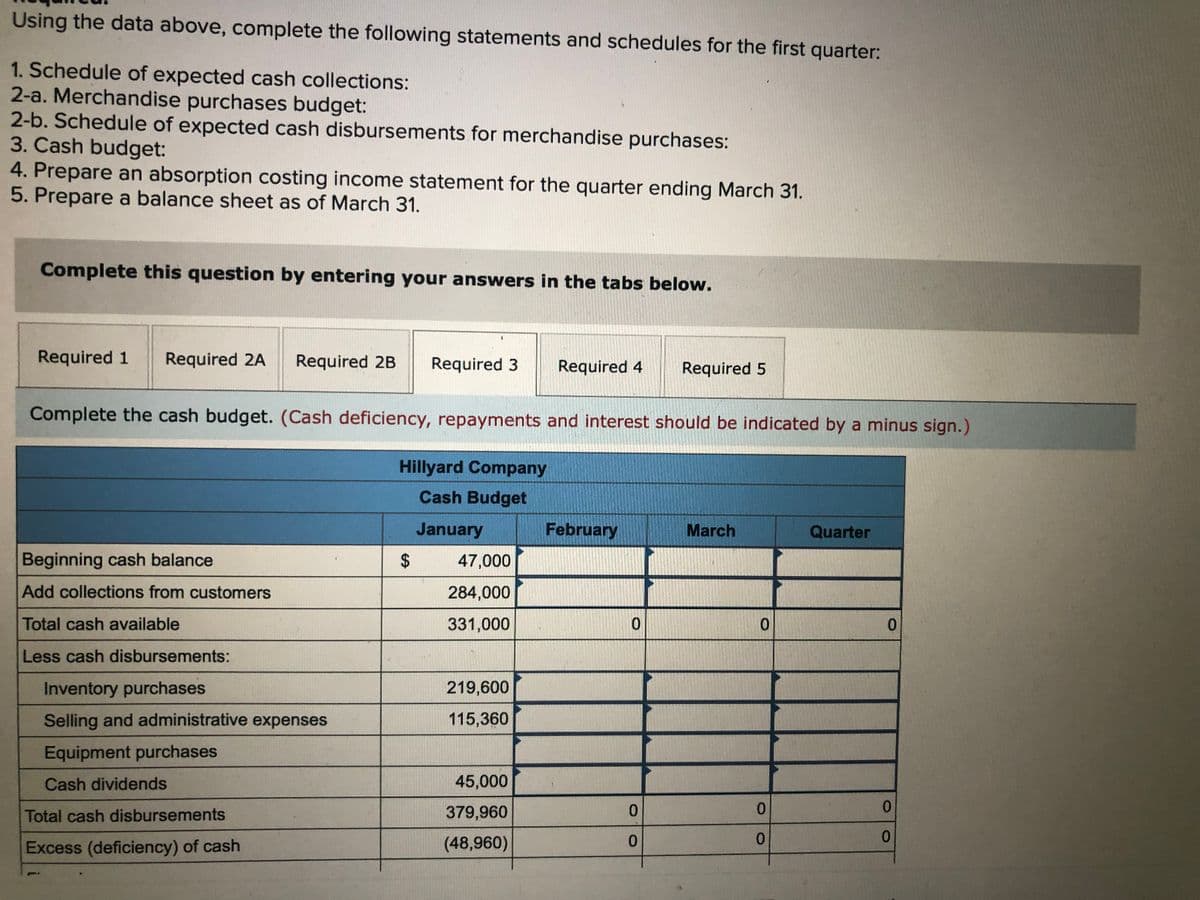

Transcribed Image Text:Using the data above, complete the following statements and schedules for the first quarter:

1. Schedule of expected cash collections:

2-a. Merchandise purchases budget:

2-b. Schedule of expected cash disbursements for merchandise purchases:

3. Cash budget:

4. Prepare an absorption costing income statement for the quarter ending March 31.

5. Prepare a balance sheet as of March 31.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2A

Required 2B

Required 3

Required 4

Required 5

Complete the cash budget. (Cash deficiency, repayments and interest should be indicated by a minus sign.)

Hillyard Company

Cash Budget

January

February

March

Quarter

Beginning cash balance

47,000

Add collections from customers

284,000

Total cash available

331,000

Less cash disbursements:

Inventory purchases

219,600

Selling and administrative expenses

115,360

Equipment purchases

Cash dividends

45,000

Total cash disbursements

379,960

0.

0.

Excess (deficiency) of cash

(48,960)

0.

0.

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning