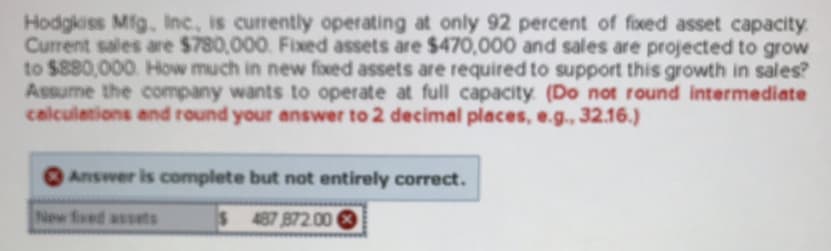

Hodgkiss Mig, Inc, is currently operating at only 92 percent of fixed asset capacity Current sales are $780,000. Fixed assets are $470,000 and sales are projected to grow to $880,000. How much in new foxed assets are required to support this growth in sales? Assume the company wants to operate at full capacity (Do not round intermediate celculetions and round your answer to 2 decimal places,e.g.. 32.16) O Answer is complete but not entirely correct. New fxed assets 487 B72000

Hodgkiss Mig, Inc, is currently operating at only 92 percent of fixed asset capacity Current sales are $780,000. Fixed assets are $470,000 and sales are projected to grow to $880,000. How much in new foxed assets are required to support this growth in sales? Assume the company wants to operate at full capacity (Do not round intermediate celculetions and round your answer to 2 decimal places,e.g.. 32.16) O Answer is complete but not entirely correct. New fxed assets 487 B72000

Chapter12: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:Hodgkiss Mig, Inc, is currently operating at only 92 percent of fixed asset capacity

Current sales are $780,000. Fixed assets are $470,000 and sales are projected to grow

to $880,000. How much in new foxed assets are required to support this growth in sales?

Assume the company wants to operate at full capacity (Do not round intermediate

celculetions and round your answer to 2 decimal places,e.g.. 32.16)

O Answer is complete but not entirely correct.

New fxed assets

487 B72000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning